NSE,BSE,TRADING.pptx

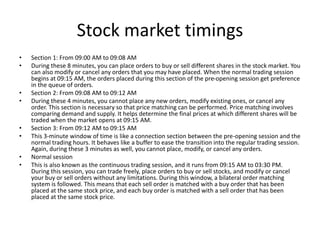

- 1. Stock market timings • Section 1: From 09:00 AM to 09:08 AM • During these 8 minutes, you can place orders to buy or sell different shares in the stock market. You can also modify or cancel any orders that you may have placed. When the normal trading session begins at 09:15 AM, the orders placed during this section of the pre-opening session get preference in the queue of orders. • Section 2: From 09:08 AM to 09:12 AM • During these 4 minutes, you cannot place any new orders, modify existing ones, or cancel any order. This section is necessary so that price matching can be performed. Price matching involves comparing demand and supply. It helps determine the final prices at which different shares will be traded when the market opens at 09:15 AM. • Section 3: From 09:12 AM to 09:15 AM • This 3-minute window of time is like a connection section between the pre-opening session and the normal trading hours. It behaves like a buffer to ease the transition into the regular trading session. Again, during these 3 minutes as well, you cannot place, modify, or cancel any orders. • Normal session • This is also known as the continuous trading session, and it runs from 09:15 AM to 03:30 PM. During this session, you can trade freely, place orders to buy or sell stocks, and modify or cancel your buy or sell orders without any limitations. During this window, a bilateral order matching system is followed. This means that each sell order is matched with a buy order that has been placed at the same stock price, and each buy order is matched with a sell order that has been placed at the same stock price.

- 2. • Post-closing session • This session begins when the regular trading session comes to a close at 03:30 PM. The post-closing session, which runs up to 04:00 PM, consists of two sections. • Section 1: From 03:30 PM to 03:40 PM • In these 10 minutes, the closing prices of stocks are calculated by taking the weighted average of the stock prices traded between 03:00 PM and 03:30 PM. The closing prices of indices like Sensex and Nifty are calculated by considering the weighted average prices of all the securities that are listed in that index. • Section 2: From 03:40 PM to 04:00 PM • In this 20-minute section, you can still place buy and sell orders. But the orders are confirmed only if there are sufficient numbers of buyers and sellers in the market. • Muhurat trading • In India, the stock market typically remains closed on public and national holidays. However, on Diwali each year, the stock market is open for one hour for a Muhurat trading session; this is in place since Diwali is considered to be an auspicious day. The time and the date for this session changes each year. • Conclusion • Being aware of the stock market timings are vital to earn profits, especially if you pursue intraday trading. All you need is an online Demat account and trading account to get started on your journey of trading or investing in the share market. You can open an online Demat and trading account with any one of the many depository participants in India, like IIFL.

- 3. National Stock Exchange 1. Incorporated in 1992 2. Recognized in 1993 3.Operations in june 1994 4.Promoted by IDBI,ICICI,IFCI,INSURANCE,COMMERCIAL BANKS. 5.Recommended by pherwani committee

- 5. NSE Stock exchange The National Stock Exchange is stock exchange located in Mumbai, India. National Stock Exchange was established in the mid 1990s as a demutualised electronic exchange. CEO: ashish kumar Chauhan 14 nov 22 Headquarters: Mumbai, India

- 7. National Stock Exchange:Objectives • Nation wide trading facility • Equal access of information • Efficient and transparent security market • To meet international standards and bench marks. • Enable settlements.

- 8. Ownership and management • Owned by financial institutions, banks, insurance sectors etc. • Managed by professionals. • Board consists of senior executives. • Board prepares policy of stock market. • Executive committees formed under AOA. • Some Executives are traders in market. • Several committees: Trade related, Settlement issues, Regulatory issues. • MD and CEO is the head of professional staff.

- 9. Market segments • Wholesale Debt market-corporate members are admitted.-2crores- fees 30 lakhs • Capital market segment-individuals and firms are eligible – 75 lakh,corporate bodies-100 lakhs. • Timings-9.55am-15.30pm

- 10. Criteria for listing of shares • Companies must and should be listed for trading. • New company: 10 cr of equity capital and market capitalization is not less than 25 cr. • Should be referred by existing company having 3years good past record. • Existing company: it should be listed in any other stock exchange for a minimum of 3 yrs. Net worth capital 50 crs. Dividend is to be paid in 2 out of last 3 financial years. • All the companies should have a minimum paid up capital of 10 crs.

- 11. Settlement mechanism • Periodic settlement cycle • Begins on Wednesday and ends on Tuesday. • Retail debt market is on T+2 rolling basis. • National securities clearing corporation limited is the clearing and settlement agencies all made at NSE.

- 12. Nation Wide trading • NSE provides service at same price at any stock exchange • Uses automated trade system for exchange • NSE operates on NEAT • Price data will be broadcasted by press trust of india • NCH gives information about the owner of scrips and no. of scrips by a specific person INDEX • 50 companies shares representing 25 sectors of the economy • Uses weighted average method

- 13. Developments in NSE • Launched internet trading services in 2000 • Future derivate tradings • 2001 trading in index options, futures • 2002 launched exchanged traded funds and NSE govt. securities index • Own wharton infosys business transformation award in wide transformation category • 2003 started in trading in retail debt market • 2004 trading in interest rate futures • 2005 it instituted the futures and options bank NIFTY index • Ranks amongst the largest stock market in the world

- 14. • Ashish Chauhan • Business person • Ashish Kumar Chauhan is an Indian business executive and administrator. He is the current Managing Director & Chief Executive Officer of the national Stock Exchange. • Education: Indian Institute of Management Calcutta

- 16. BSE • BSE • Stock exchange • Bombay Stock Exchange, is a stock exchange located on Dalal Street, Mumbai, Maharashtra, India. It is the 8th largest stock exchange in the world by market capitalisation of 276.713 lakh crore as of 31 December 2022. • CEO: Ashish Chauhan • Founder: Premchand Roychand • Founded: 1875 • Headquarters: Mumbai, India

- 17. • Ashish Chauhan • Business person • Ashish Kumar Chauhan is an Indian business executive and administrator. He is the current Managing Director & Chief Executive Officer of the Bombay Stock Exchange. • Education: Indian Institute of Management Calcutta

- 18. BOMBAY STOCK EXCHANGE • Established in 1875 in dalal street, Mumbai • Native share and stock brokers association • First stock market in india • Screen based trading system- 1955 • Permanent recognition from govt. of india under the securities contract act 1956 INDEX • BSE sensex- introduced in 1986 • Most popular weighted index • 30 companies in Apr 1979 • Sensex are about one-fifth of market capitalization of BSE • Some other indices used in BSE are BSE100 and BSE500 Sensex = Aggregate Market value of 30 companies/ Index divisor

- 19. Significance • First stock market to introduce equity derivatives • It was the first option to obtain ISO certification for surveillance, Clearing and settlement • It launched nation wide investor awareness campaign and passes information through print and electronic media. BOLT • started in march 1995 to bring about transparency and liquidity. It eliminates mismatches and settlement risks Investor protection fund • To help the investors against defaulting members. • Managed by trustees appointed by the stock exchange, members contribute to it • Fees 2.5% is collected from listing members • SM also credits the interest on security deposites by making a public issue • Exchange releases 5% of its surplus to this fund • Maximum amount payable to an investor from this fund incase of default is 10lacs • Defaulter committee finds out the geniuses of the claim and releases the fund

- 20. Investor education and training • Provides financial assistance up to one crore rupees to recognize investor association • Investor assistance centre in many cities . • Center provide redressal of investor grievances and information. • BSE has given training to 20,000 investors in BSE training institute. • It brings out many publications providing information to investors. • Arranged seminars and lectures for creating awareness. • It is associated with professional bodies. • Initiated many research projects. • Website bscindia.com provides information on capital markets. • BSE collaborated with ZEE interactive learning systems to provide knowledge, information and awareness.

- 21. The Basics of buying shares online in India • In the present digital age, you can purchase shares online with just a few clicks. Here are the steps required to buy shares online: • 1. Getting a PAN card • 2.d mat account • You can open a Demat Account with a Depository Participant (DP). A DP can either be registered with National Securities Depository Limited (NSDL) or Central Securities Depositories Limited (CSDL), or both. • 3. Open a Trading Account • The next step is to open a Trading Account. A trading account is used to purchase and sell shares in the stock market. Once you have a Demat Account to hold the shares virtually, you need a Trading Account to complete the buy and sell transaction. While purchasing shares online, you have to quote your unique Trading Account number. • 4. Register with a Broker/Brokerage Platform • 5. The need for a Bank Account • 6. Get your Unique Identification Number (UIN) • To create a database of all Market Participants and investors, SEBI has made it compulsory for investors to get a UIN. You can get a UIN through Point of Service (POS) agents appointed by NSDL. • You must, however, note that a UIN is only required when you are trading with a capital of Rs 1 lakh or more.

- 22. Trading mechanism • Knowledge about securities market. • Marketing of securities can be done only through members of stock exchange. • Members are either individuals or institutions. • The member is registered under stock exchange. • Trading can also be done by brokers on listed securities. • The brokers receive commission. • The transactions to buy and sell securities is also called trade. • This is to be done through selection of a broker.

- 23. securities • Three kinds of securities are traded in Mumbai stock exchange. • Specified securities: Share should be listed on the stock exchange for at least 3 years. Issued capital should not be less than 75 crores. It should have a market capitalization of 2 or 3 times. 2000 share holders are on dividend receiving list. Growth company with shares of 4.5 crs with face value. • Non specifies securities: The securities which do not follow above conditions are non specified securities. • Odd lots: Includes odd lots of shares and debentures. Example: 3, 5, 7, 25, 29 etc.

- 24. Rules for stock exchange • Market capitalization should not be too high or too low. • Brokers are given only a fixed rate of commission • 75 % of daily transactions should be in cash. This system is called “thin track” system. • The brokers have right to purchase and sell of shares of ¼ total shares. • Uniformity in rules and regulations should be there for opening and closing of stock exchange. • The stock exchanged is managed by a committee called a governing body consists of brokers, directors, government, SEBI and public representatives.

- 25. broker • The person who involve in the exchange of securities for the sake of investors is called broker. • Selection of broker depends on kinds of services rendered by him. • Responsibilities: Provide information. Availability of investment literature. He should be registered in stock exchange. Appoint competent representatives.

- 26. Types of brokers 1. Commission broker:-agent-commission-independent dealer-deal with broker or another jobber. 2. Jobber:-professional speculator,profit called turn 3. Floor broker:-sell and buy shares for busy brokers- commission 4. Taraniwalla:-jobber-auction-localised dealer-small differences in prices. 5. Odd lot dealer:- 6. Budliwalla:-financier—contago-fee for credit facilities- loan for 2 or 3 week-prevaling rate of interest 7. Arbitrageur:-deal with different stock exchanges at same time-profit on price differences. 8. Security dealers:-sale and buy of govt securities.

- 27. Opening an account with dealer 1. Agreement: • Broker Open an account in the name of investor in his books • Margin money as advance • Opening an account with the broker is optional • Broker ask for bank reference and 2 or 3 credit references from the investor • Enquires his customer weather he is interested in stability of principal, dividend income, growth issues. • Knowledge of type of securities the customer is seeking will help the broker in knowing the customers requirements in stock markets. • After satisfying all requirements broker and investor come to an agreement. • The next step for the investor is to place an order on the broker

- 28. 2. Order: Terms: • Long– buy • Short– sell • Spot delivery– delivery and payment on the same day as the date of contract • Hand delivery– delivery and payment with in the time of contract or not more than 14 days Investor can have his own orders • Orders are of two types: Market order – prevailing price in the market. Limit order– buy lower price and sell higher price. Limit orders are generally placed away from the market. Special orders– which may be used by the investors to protect their profits or limit their losses. • Stop order or stop loss order • Stop limit order • Day order • Week order • Month order • Open order • Kill orders

- 29. 3.settlement • Trading in stock exchanges is carried out in two phases. • 1st phase Order submitted by the clients takes place between brokers acting on behalf of the clients. Buy orders are matched with sell orders Trading is carried out in an anonymous environment. Orders are matched by computer system. Buyers handover the money and receive the security Seller handover the security and receive money • 2nd phase Settlement is carried by separate agency known as clearing house Member brokers have to submit securities to the clearing house and receive cash from clearing house incase of selling securities and vice versa. Compulsory rolling system mandated by SEBI— Trades executed on a particular day settled after a specified number of business days. Initially T+5 Later T+3 Currently T+2 settlement cycle On T+1 exchange generates delivery and receive order for transactions done by member brokers Payments or receipts of monies by the member brokers is also prepared by the exchange. On T+2 paying instructions to the depositories for transfer of securities to clearing house in case of DMAT securities.

- 30. SPECULATION • Long term securities • Short term securities • Speculator • High return with in a short span of time • Price fluctuations • Long buy Under priced securities Long position Not taking delivery • Short sale over priced Short position High amount of risk Either profit or loss

- 31. Types of speculators • Bull : expects rise in price Long position Good rumours about company Bull campaign Market is said to be in a bullish phase • Bear: Expects a decline in price Short position Unfavorable rumours Bear raid Suffers losses Prices of securities rise The market is said to be bearish • Lame duck: Lame duck is a bear who has made a sort sale but is unable to meet his commitment to deliver the securities sold by him on account of rising prices Struggles like a lame duck • Stag: Is a trader for shares in the new issue market just like a genuine investor Optimist like a bull and expects a rise in price Quote premium to share He is also called premium hunter Suffers loss if there is no price rise.

- 32. Margin trading • Borrowing money from the bank or the broker for purchasing securities is known as margin trading. • Part of the value is paid by investor • Remaining is provided by the broker or the banker. • In margin trading the investor has to pay interest on the money barrowed to finance a security transaction.

- 33. depositories • Equity shares, bonds, debentures– share certificates– name of the holder– face value of the security • Stock exchange clearing house • Issuing company enters name in the certificate • Securities are issued and transferred in D-Mat mode • Depository • Depository participants • Investors has to open a D-Mat account • Two depositories in India NSDL, CDSL • SEBI made it compulsory for trades in almost all securities to be settled in D-Mat mode • Dematerialization: • Rematerialization:

- 34. Stock market quotations and indices • BSE—SENSEX , BSE100, BSE 500,MID CAP. • NSE NIFTY, S&P CNX NIFTY, CNX NIFTY JUNIOR, S&P CNX 500, CNX MIDCAP 200, S&P CNX DEFTY