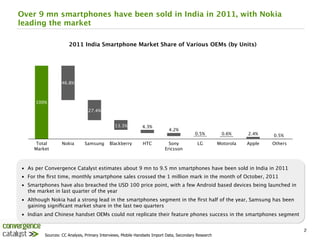

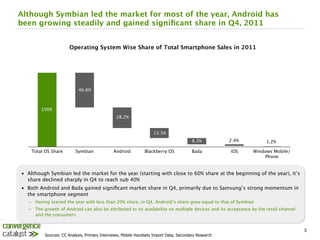

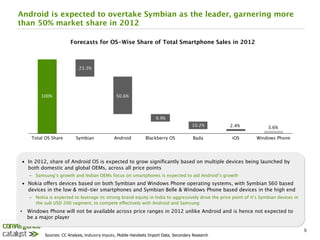

India's smartphone market grew significantly in 2011, with sales reaching 9-9.5 million units. Nokia led the market but Android gained share, especially in Q4. In 2012, smartphone sales are expected to grow 100% to 18-20 million units as prices decrease. Android is forecasted to surpass Symbian and capture over 50% of the market due to many new affordable devices. Dual-SIM smartphones and experiments with carrier contracts will be key trends. Global brands like Nokia and Blackberry aim to leverage their strength in India.