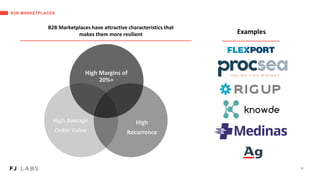

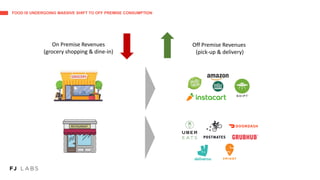

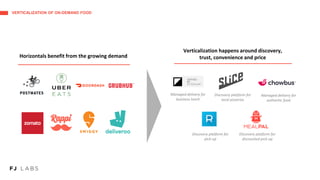

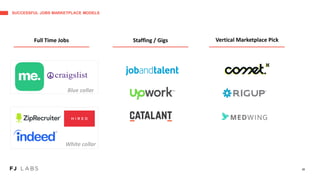

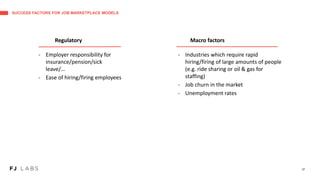

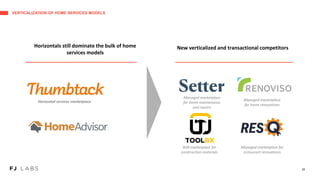

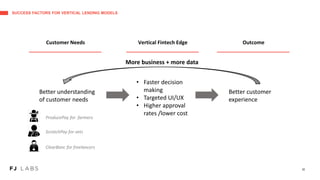

The document outlines the investment strategies and market insights of Fj Labs, focusing on venture capital in marketplaces, food models, real estate, and job marketplaces. It emphasizes the importance of verticalization, attractive unit economics, and the resilience of B2B marketplaces amidst evolving consumer behaviors. Additionally, it highlights successful investment themes, heuristics for evaluating opportunities, and specific growth drivers in various sectors.