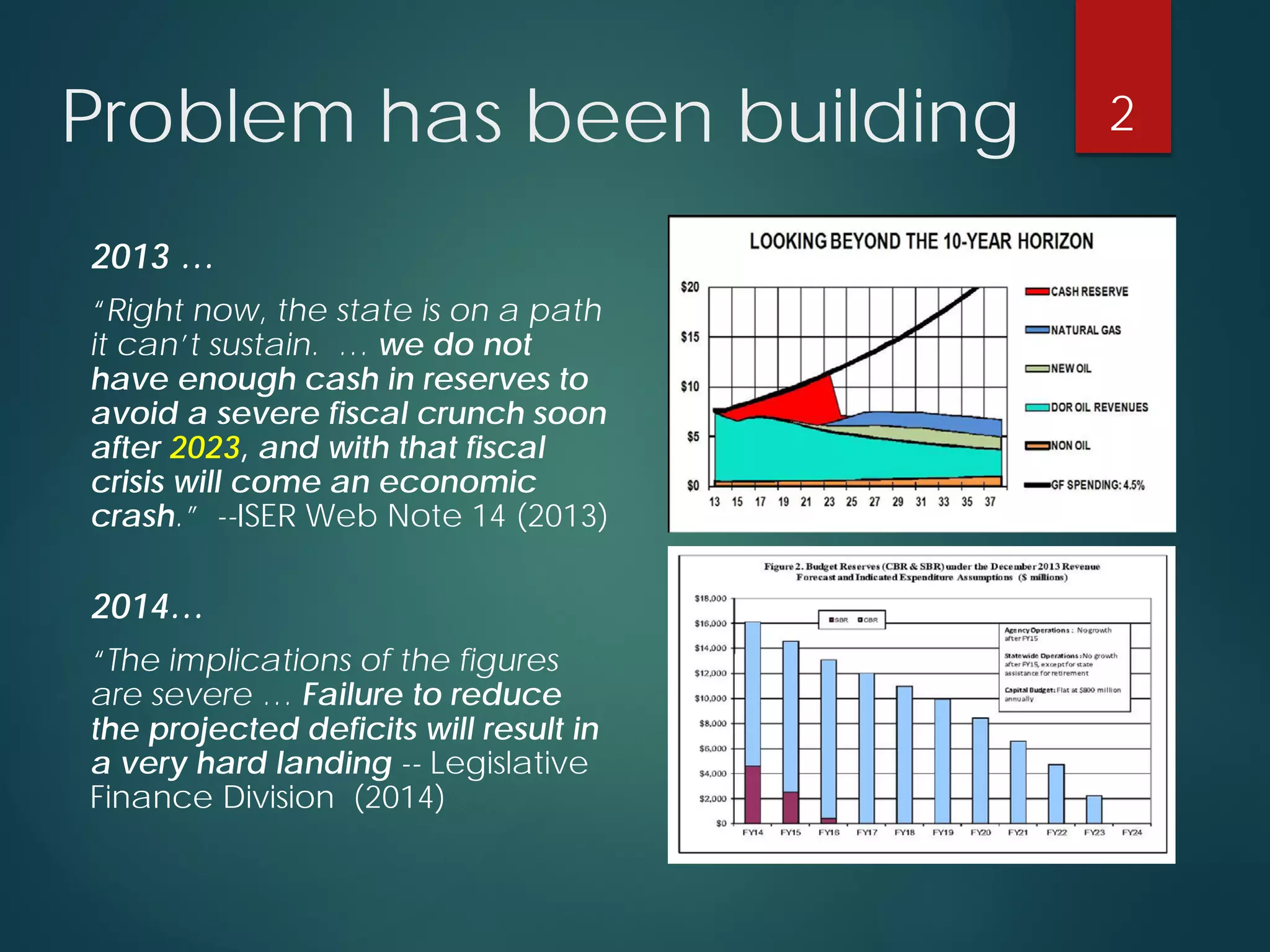

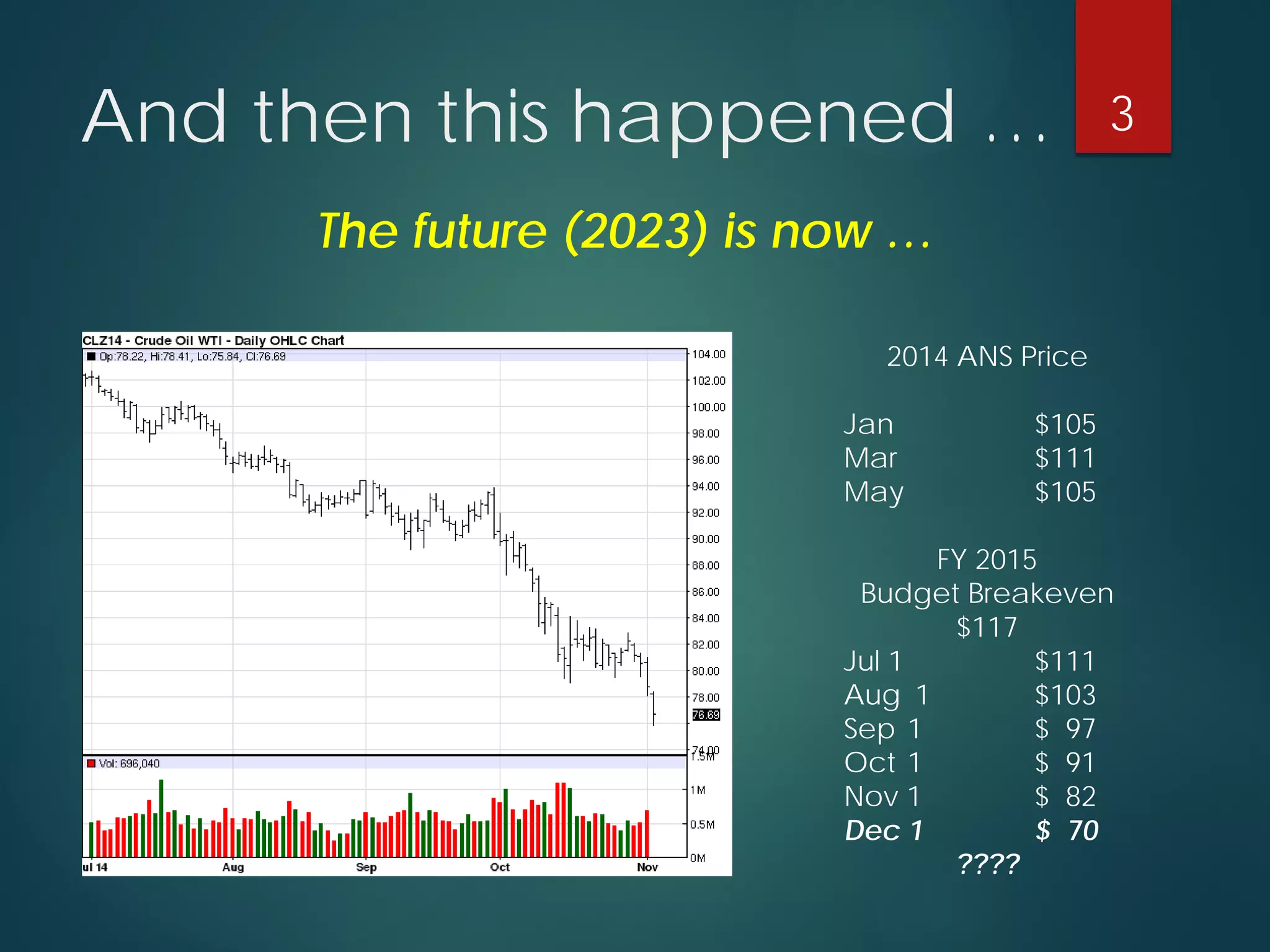

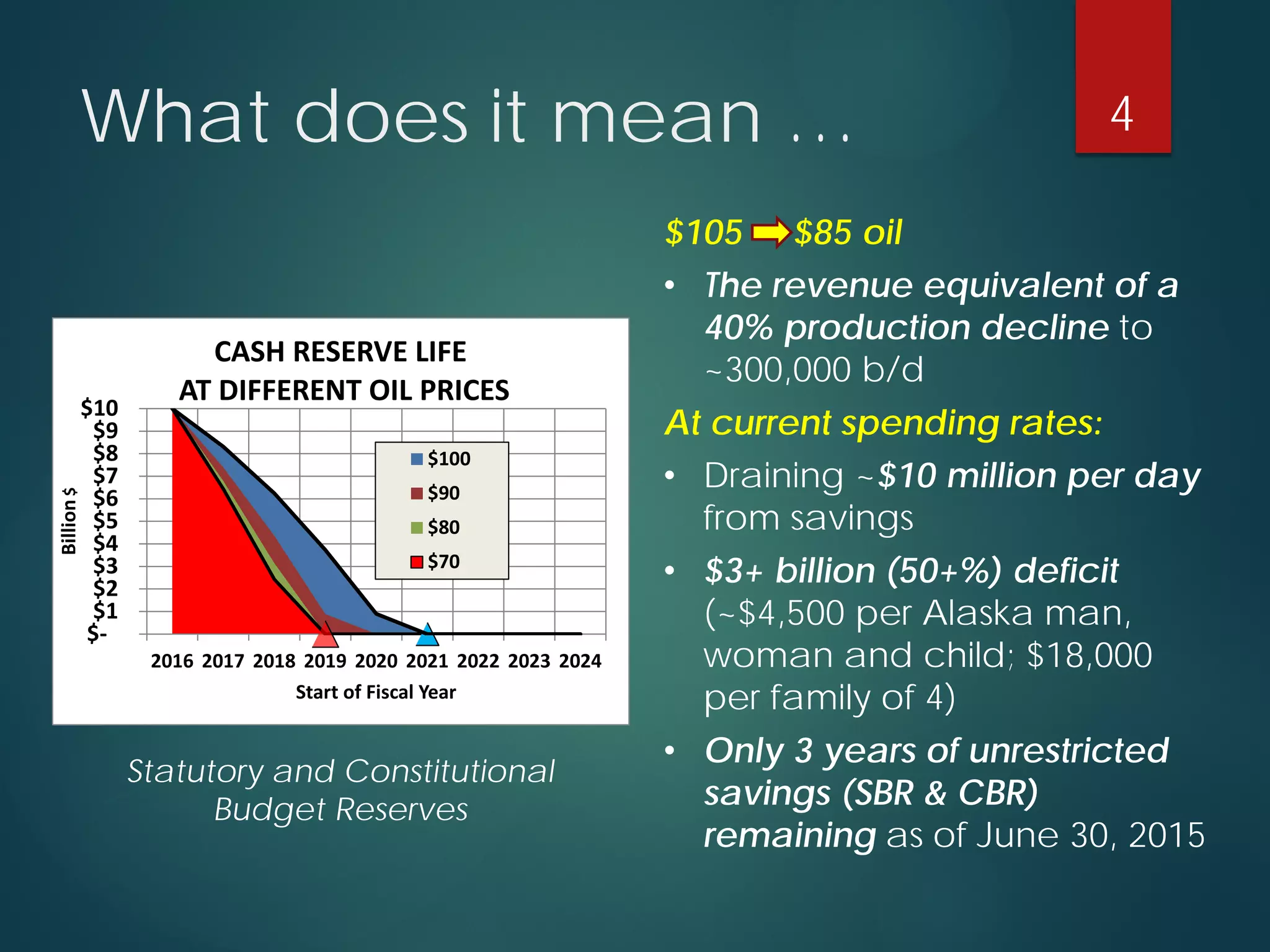

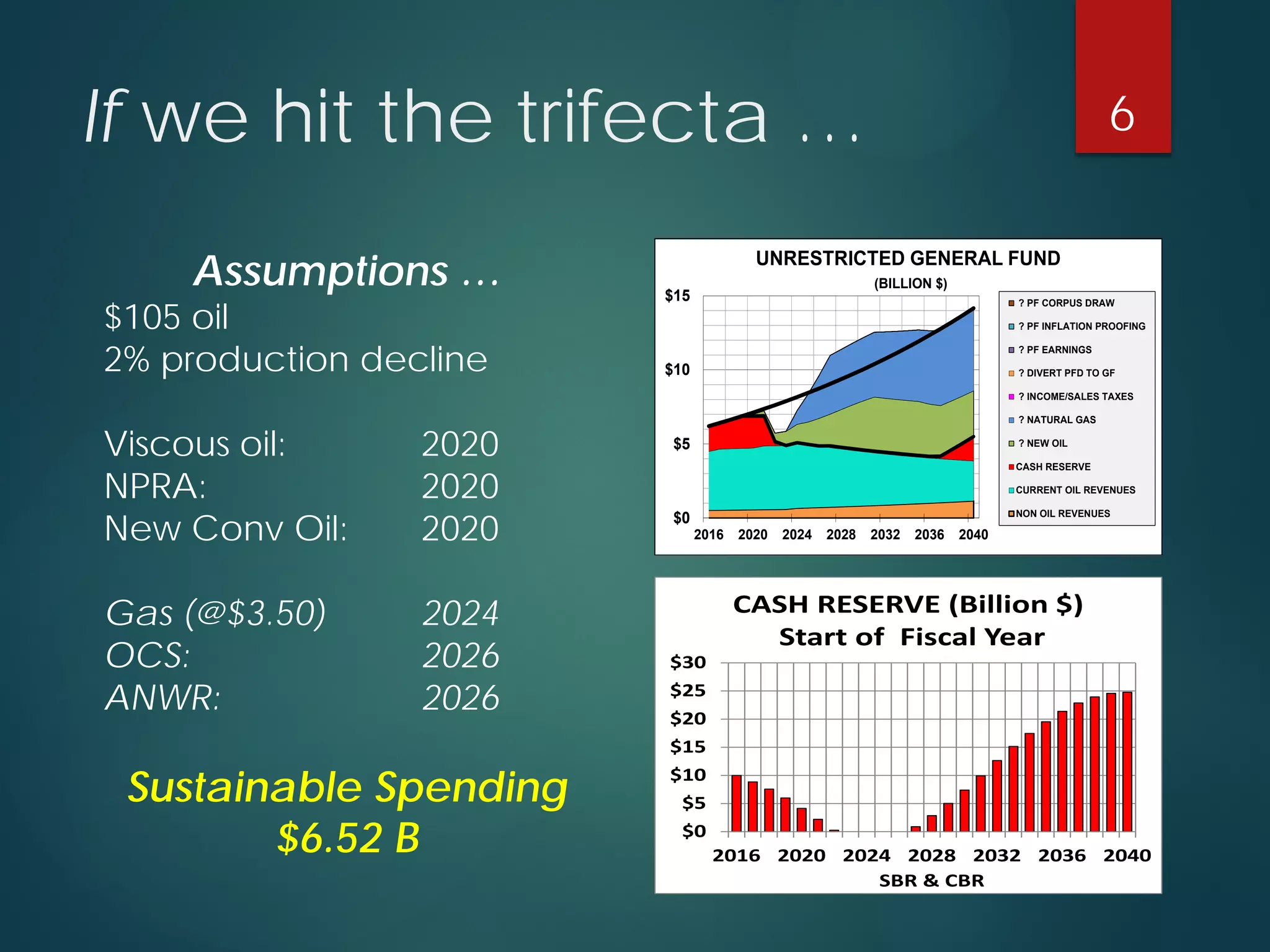

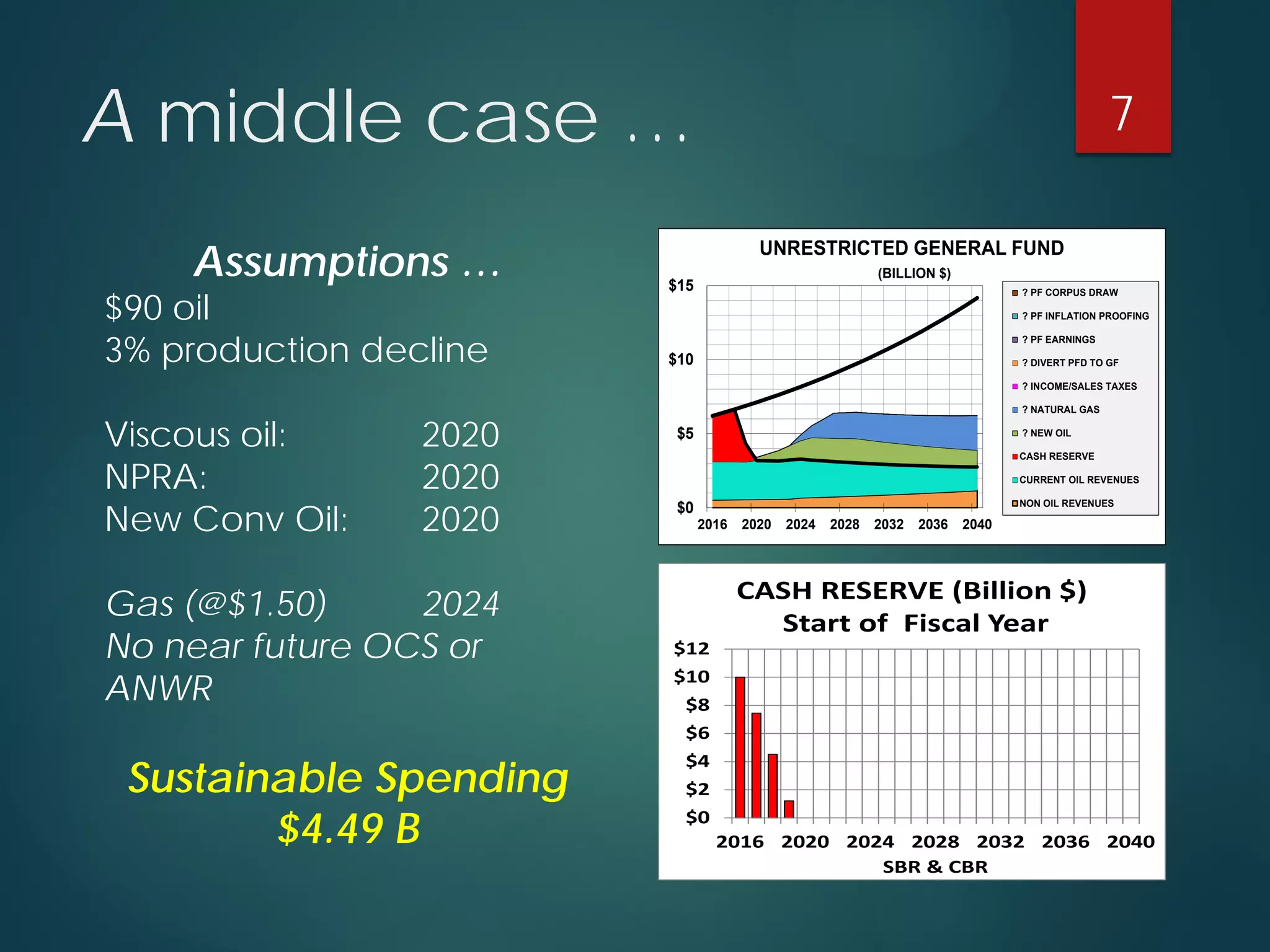

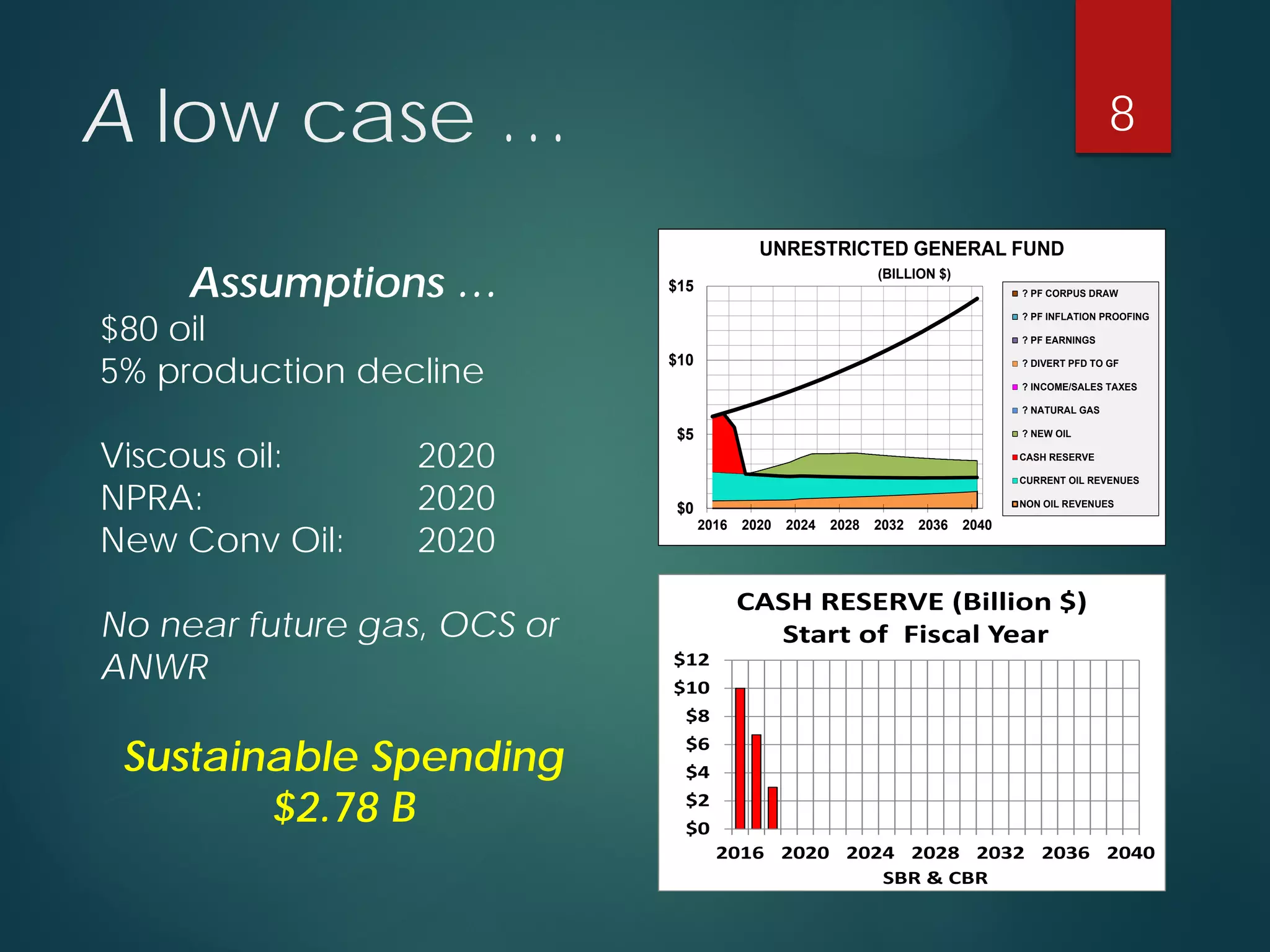

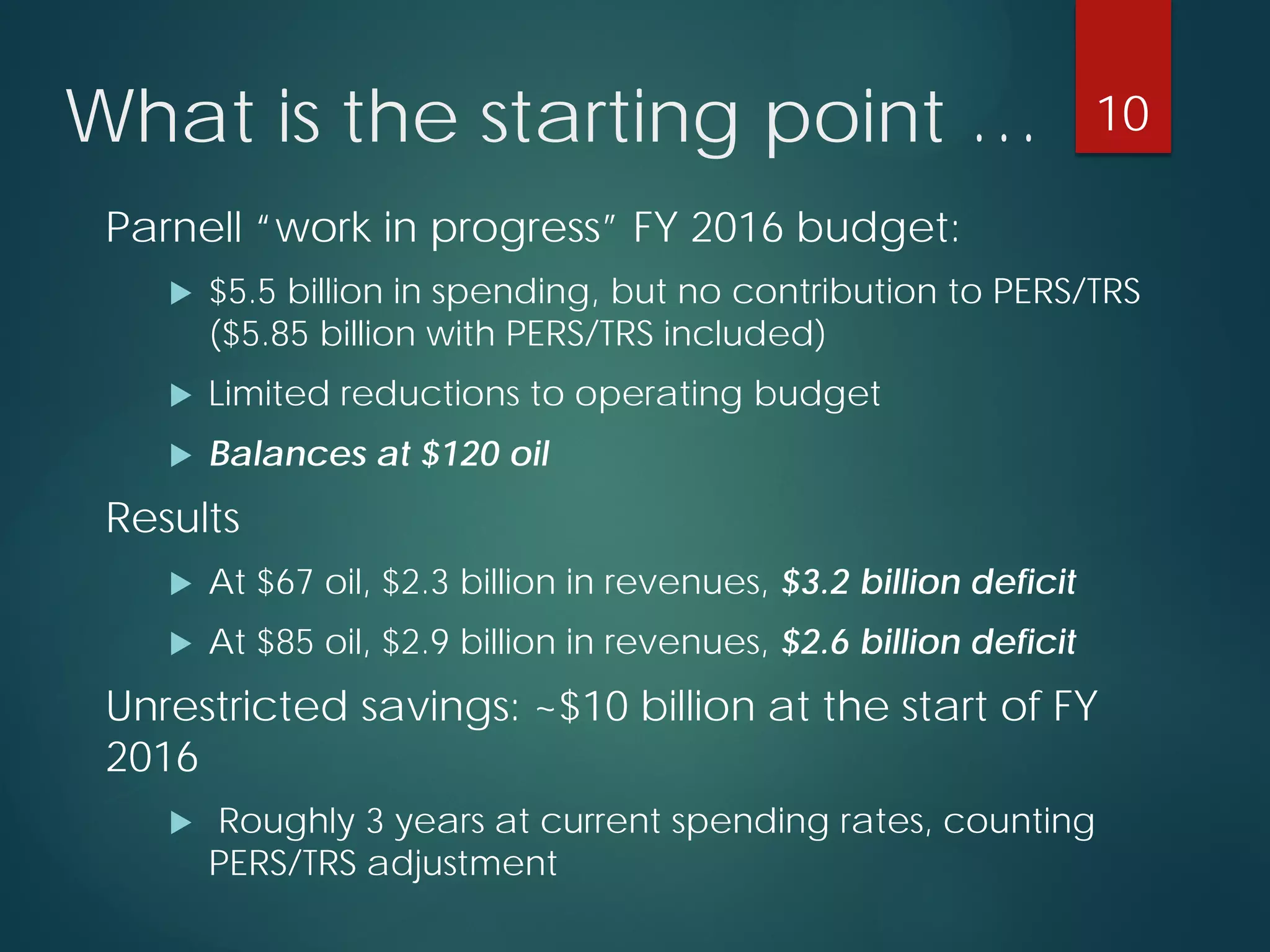

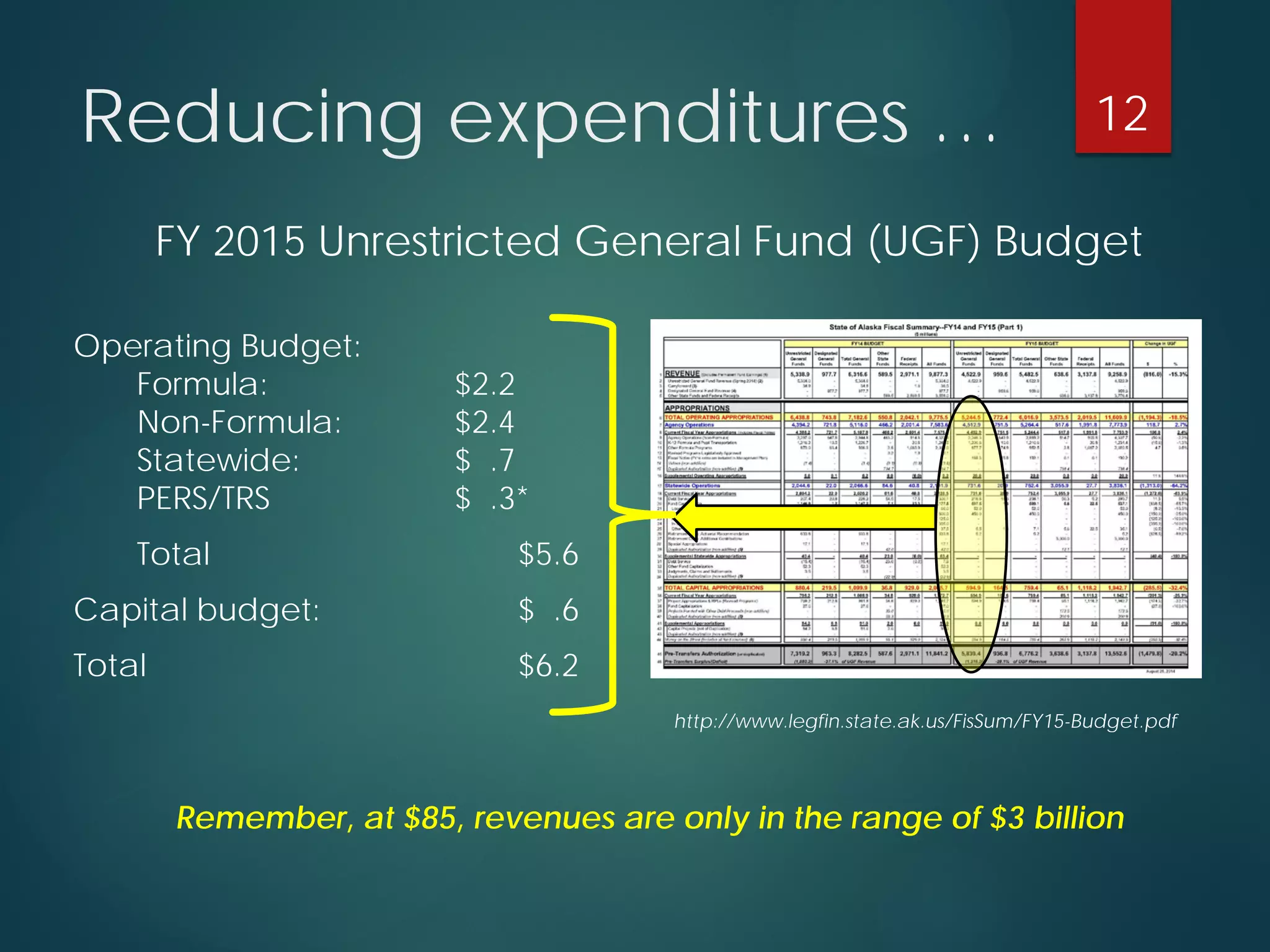

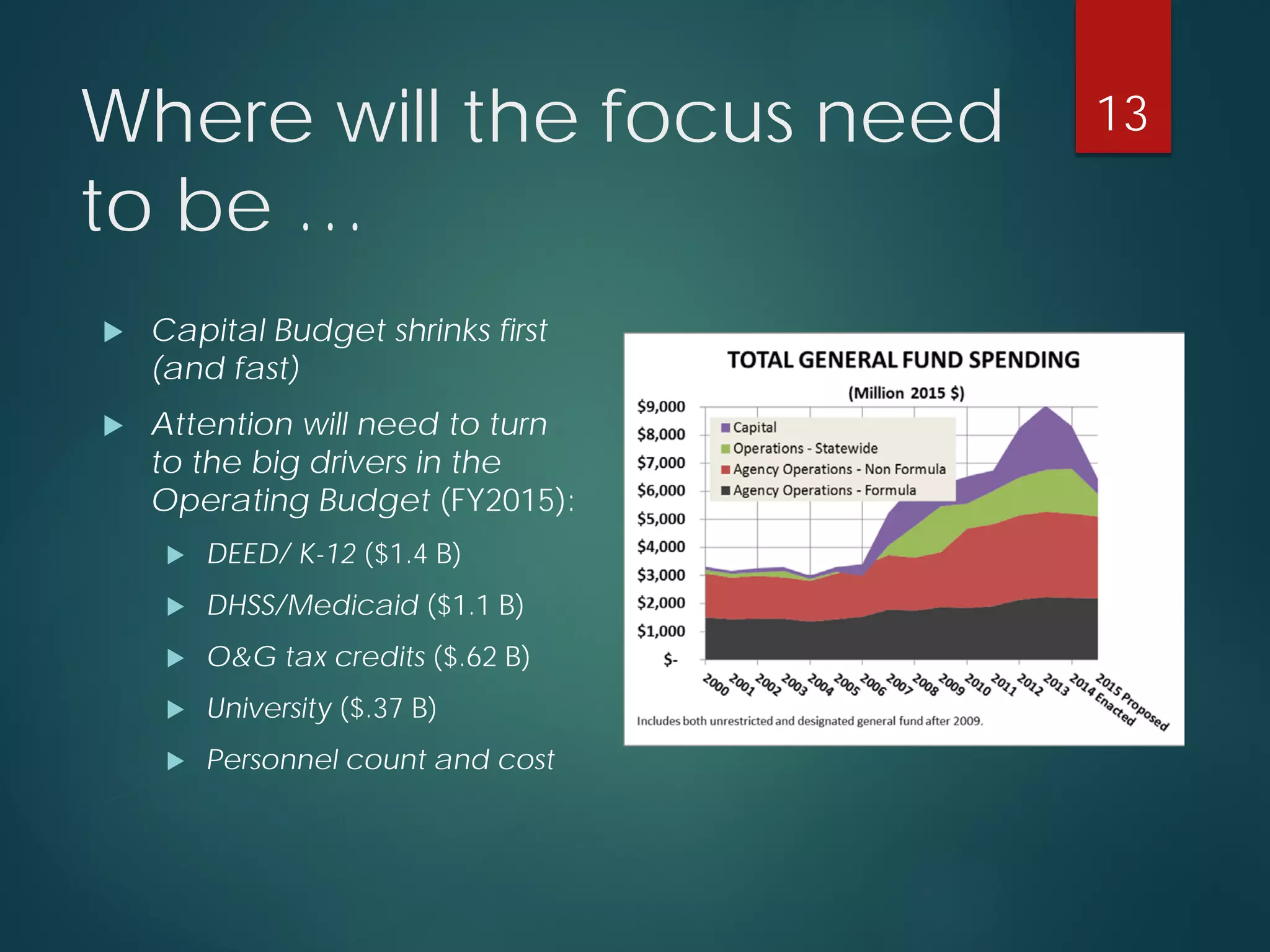

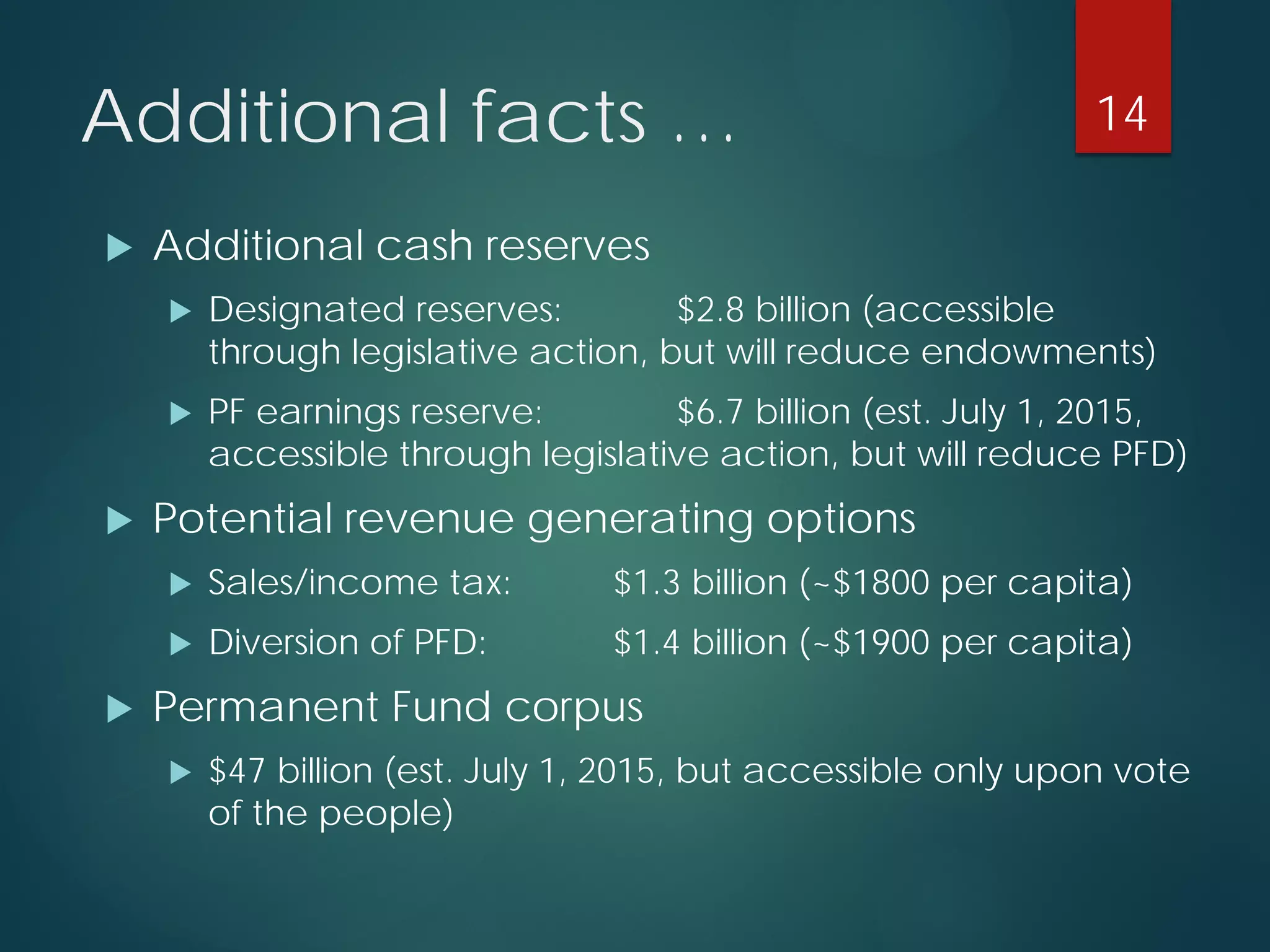

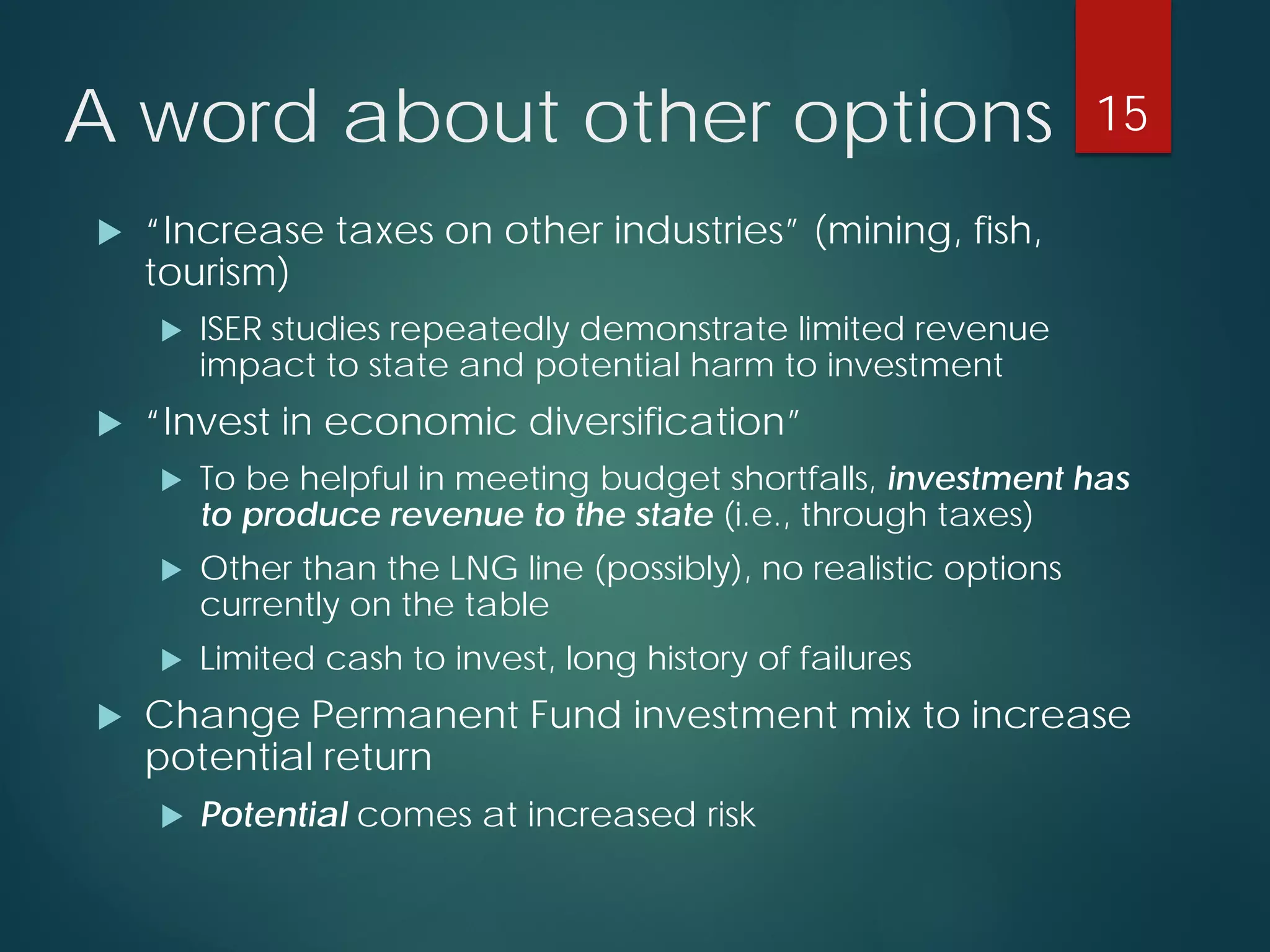

Alaska is facing a severe fiscal crisis due to unsustainable spending and declining oil revenues, with projections indicating significant deficits after 2023. The state's budget relies heavily on oil prices and reserves, and without substantial changes, it may lead to drastic budget cuts or the need for new taxes. Key areas of focus for reducing expenditures include education, healthcare, and oil tax credits, while additional revenue options such as sales or income taxes have also been discussed.