Fintech Project Diary

•

0 likes•71 views

The document provides an overview of a fintech capstone project aimed at developing a personal financial management solution. It discusses: 1. The initial project phases focused on product discovery and defining deliverables like an MVP and business model canvas. 2. The proposed product is a digital assistant that helps optimize users' financial planning and behavior for long-term financial security. It aims to provide personalized recommendations and eliminate the need for financial advisors. 3. Next steps include validating the business model canvas, studying differentiation from competitors, and moving to the validation phase of the project.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Präsentiert am 17. Key Note Anlass von Bosshard & Partner am 08. April 2015 in Zürich.Digitization Strategies in Corporate Banking von Brigitte Ross

Digitization Strategies in Corporate Banking von Brigitte RossBosshard & Partner Unternehmensberatung

In the Case Management space, one critical area for helping improve efficiencies of case workers is that of analytics and reporting.Whitepaper: Data Visualization & Reporting for Case Management - Happiest Minds

Whitepaper: Data Visualization & Reporting for Case Management - Happiest MindsHappiest Minds Technologies

More Related Content

What's hot

Präsentiert am 17. Key Note Anlass von Bosshard & Partner am 08. April 2015 in Zürich.Digitization Strategies in Corporate Banking von Brigitte Ross

Digitization Strategies in Corporate Banking von Brigitte RossBosshard & Partner Unternehmensberatung

What's hot (20)

P2P lending –a “financial intermediary in social democracy” – indian scenario

P2P lending –a “financial intermediary in social democracy” – indian scenario

Take It To The Bank: Sam's Club Whitepaper Helps Small Business Navigate Loan...

Take It To The Bank: Sam's Club Whitepaper Helps Small Business Navigate Loan...

Digitization Strategies in Corporate Banking von Brigitte Ross

Digitization Strategies in Corporate Banking von Brigitte Ross

Ten Types of Business Financing You May Not Have Tried

Ten Types of Business Financing You May Not Have Tried

Suresh - Mobile Banking (Corporate Banking Stream)

Suresh - Mobile Banking (Corporate Banking Stream)

Similar to Fintech Project Diary

In the Case Management space, one critical area for helping improve efficiencies of case workers is that of analytics and reporting.Whitepaper: Data Visualization & Reporting for Case Management - Happiest Minds

Whitepaper: Data Visualization & Reporting for Case Management - Happiest MindsHappiest Minds Technologies

Similar to Fintech Project Diary (20)

Whitepaper: Data Visualization & Reporting for Case Management - Happiest Minds

Whitepaper: Data Visualization & Reporting for Case Management - Happiest Minds

Enhancing Customer Experience through Loan Origination System (1).pdf

Enhancing Customer Experience through Loan Origination System (1).pdf

Valuation Demystified How to Evaluate a Fintech Startup’s Worth

Valuation Demystified How to Evaluate a Fintech Startup’s Worth

Organisational Growth and Financial Management Education.pdf

Organisational Growth and Financial Management Education.pdf

An Introduction to Digital Credit: Resources to Plan a Deployment

An Introduction to Digital Credit: Resources to Plan a Deployment

Solving Financial Constraints with Innovative Funding Solution

Solving Financial Constraints with Innovative Funding Solution

Digital and Big data disruption in financial services

Digital and Big data disruption in financial services

More from Ayushi Mona

More from Ayushi Mona (20)

Competition Analysis for the Home Furniture Market

Competition Analysis for the Home Furniture Market

Bu#4 dysphoria-chronical dissatisfaction-compressed

Bu#4 dysphoria-chronical dissatisfaction-compressed

Recently uploaded

Media Wall Street is a premier Branding and Marketing Agency in Chandigarh, India. We offer brand strategy, digital marketing, content creation, and web development. We start by understanding your business goals to create tailored strategies. Our digital marketing services include SEO, SEM, social media marketing, email marketing, influencer marketing, video marketing, mobile marketing, and media buying. We excel in graphic design, video production, copywriting, and content writing. Our web development services feature responsive design, UI/UX design, custom websites, landing pages, CMS websites, cloud deployment, and web analytics. At Media Wall Street, we are committed to delivering professional and premium services to help your brand succeed.Media Wall Street | Best Branding And Marketing Agency In Chandigarh

Media Wall Street | Best Branding And Marketing Agency In ChandigarhMedia Wall Street Best Branding and Marketing Agency in Chandigarh

Promoção comercial dos ditos substitutos do leite materno:

Implementação do Código Internacional -

relatório de situação mundial em 2024

Esta publicação fornece informações atualizadas sobre o estado de implementação do Código Internacional de Comercialização de Substitutos do Leite Materno (de 1981) e subsequentes resoluções da Assembleia Mundial da Saúde (relacionadas com o “Código”) por países. Apresenta o estatuto jurídico do Código, incluindo até que ponto as disposições de recomendação foram incorporadas nas legislações nacionais.

O relatório centra-se na forma como as medidas legais delineiam processos de monitorização e aplicação para garantir a eficácia das disposições incluídas.

Também destaca exemplos importantes de interferência de fabricantes e distribuidores de substitutos do leite materno nos esforços para enfraquecer e atrasar a implementação de proteções contra o marketing antiético.

O Brasil aparece classificado como “substancialmente alinhado com o Código” devido à NBCAL – Norma Brasileira de Comercialização de Alimentos para Lactentes e Crianças de Primeira Infância, Bicos, Chupetas e Mamadeiras, que está em constante atualização desde sua primeira versão de 1988.

Esse status no traz esperança de continuar avançando, principalmente contra o marketing digital perpetrado pelas redes sociais e pelas ditas “influenciadoras”.

Prof. Marcus Renato de Carvalho

www.agostodourado.com

Relatório da OMS / Unicef / IBFAN sobre a situação do Código Internacional de...

Relatório da OMS / Unicef / IBFAN sobre a situação do Código Internacional de...Prof. Marcus Renato de Carvalho

Recently uploaded (20)

All Over Conclusion Digital Marketing / Digital Marketing Benefits

All Over Conclusion Digital Marketing / Digital Marketing Benefits

SAUDI ARABIA MARKET OVERVIEW-PARTICLE BOARD.docx.pdf

SAUDI ARABIA MARKET OVERVIEW-PARTICLE BOARD.docx.pdf

BLOOM_May2024. Balmer Lawrie Online Monthly Bulletin

BLOOM_May2024. Balmer Lawrie Online Monthly Bulletin

The Wealth of a Homeonwers association is analogous to the wealth of a Nation

The Wealth of a Homeonwers association is analogous to the wealth of a Nation

Digital Commerce Lecture for Advanced Digital & Social Media Strategy at UCLA...

Digital Commerce Lecture for Advanced Digital & Social Media Strategy at UCLA...

Media Wall Street | Best Branding And Marketing Agency In Chandigarh

Media Wall Street | Best Branding And Marketing Agency In Chandigarh

20221005110010_633d63baa84f6_learn___week_3_ch._5.pdf

20221005110010_633d63baa84f6_learn___week_3_ch._5.pdf

Relatório da OMS / Unicef / IBFAN sobre a situação do Código Internacional de...

Relatório da OMS / Unicef / IBFAN sobre a situação do Código Internacional de...

What is Digital Marketing? Advantages and Disadvantages

What is Digital Marketing? Advantages and Disadvantages

Blue and Yellow Illustrative Digital Education Presentation (1).pptx

Blue and Yellow Illustrative Digital Education Presentation (1).pptx

The_Canvas_of_Creative_Mastery_Newsletter_May_2024_Version

The_Canvas_of_Creative_Mastery_Newsletter_May_2024_Version

Top 3 Ways to Align Sales and Marketing Teams for Rapid Growth

Top 3 Ways to Align Sales and Marketing Teams for Rapid Growth

Awesome Free Global Opportunity Online Mining Crypto Currency On Your Mobile...

Awesome Free Global Opportunity Online Mining Crypto Currency On Your Mobile...

Search Engine Marketing - Competitor and Keyword research

Search Engine Marketing - Competitor and Keyword research

How to Run Landing Page Tests On and Off Paid Social Platforms

How to Run Landing Page Tests On and Off Paid Social Platforms

Mastering Multi-Touchpoint Content Strategy: Navigate Fragmented User Journeys

Mastering Multi-Touchpoint Content Strategy: Navigate Fragmented User Journeys

Fintech Project Diary

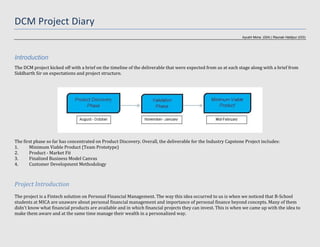

- 1. DCM Project Diary Ayushi Mona (024) | Raunak Haldipur (033) Introduction The DCM project kicked off with a brief on the timeline of the deliverable that were expected from us at each stage along with a brief from Siddharth Sir on expectations and project structure. The first phase so far has concentrated on Product Discovery. Overall, the deliverable for the Industry Capstone Project includes: 1. Minimum Viable Product (Team Prototype) 2. Product - Market Fit 3. Finalized Business Model Canvas 4. Customer Development Methodology Project Introduction The project is a Fintech solution on Personal Financial Management. The way this idea occurred to us is when we noticed that B-School students at MICA are unaware about personal financial management and importance of personal finance beyond concepts. Many of them didn't know what financial products are available and in which financial projects they can invest. This is when we came up with the idea to make them aware and at the same time manage their wealth in a personalized way.

- 2. We also realized that unlike financial management - personal financial management is affected heavily by individual traits and psychological habits. Most major Fintech players are crowded in the digital payments space. There are at least 20 leading payment app brands in India. From telecom operators to cab aggregators to banks to VC funded independent startups all have a payment solution and they all are an app. However, beyond the mesh of wallet solutions in the market, nobody is paying specific interest to personal banking on a digital platform though there is a lot of manpower investment in the form of relationship and financial service managers otherwise. When we started out the Project, both the partners were working on different lines – one was working on a digital passbook which would just integrate all financial touchpoints together so as to present a composite view of all wallets, accounts, and financial products together; while the other team mate’s focus was on driving digital payments into the unorganized sector. Post subsequent discussions, we decided to work together on a personal finance product which would merge the transactional aspect of the latter with a collated personal financial charter from the former. Hence, if we were to summarize at this stage – our product is a Digital Assistant that helps people twerk their financial planning behavior in order to optimize for a safe financial future. The differentiation is that: 1. There is no actual sale of a financial product so that the customer does not feel that there is an underlying motive to earn a commission. 2. Looks beyond obvious things like interest rates and possibility of return to include aspects of financial planning that aren’t given enough importance – nominees, sway in rates, tracking changes in own financial objectives, charges, best date to close EMI and credit card payments. Essentially, a Jeeves that panders to all your financial whims and caters to even those problems that you don’t realize are important until much later. Four Action Framework Reduce The objective is to reduce confusion around building, and, sustaining a financial plan. While most people are aware of surface level details such as the extent of risk/return or recovery of an investment option – people do not dive deeper, especially with respect to charges, margins, nominees, account updates and all such details that are as material as the financial decision that someone is making to invest or take a new liability or purchase an asset.

- 3. Create Personalized financial product based on income level and liabilities taken up by the user. This will give the user an optimized investment proposal based on his propensity to keep aside money for investment. This will be improved over time by studying the income and expense patterns of the user. The user will also be given suggestions on what expense should be incurred when and whether he can claim any tax benefits from it based on his business or profession. Eliminate Eliminate the need for financial advisors. Currently financial advisors are entirely unorganized. A lot of people believe they do not need official financial advisory services and those who do often feel shortchanged due to mis-selling or really high margins that eat into their hard – earned money. A large section of middle class households feel that formal financial management services can only be availed with an expert at hand, this is an apprehension we want to do away with. Raise The accuracy of the return on investment of a particular financial product. The transparency of the financial product must be raised. The user must know what exactly he/she is investing in. We also aim to raise the general level of financial awareness of the users. This way, no one should be able to take a particular investor for a ride.

- 4. The Business Model Canvas Key Partners Insurance Companies Payment Banks/ Options For payment of credit bill, various payment options like Credit/Debit Card, Net banking, Digital wallets like Paytm etc. Key Activities Identifying investments Calculating Income and Expenditure Value Proposition Hassle-free investments No need to do extensive research or pay a portfolio manager for making investments Dynamic- Learns your risk appetite over time Mobile application (Android and iOS) ____________________ Revenue Streams Subscription Fees Commission on Investment Transactions Customer Relationships Credit to everyone Customers can choose from a plethora of retailers Merchants reach customers they could never reach before by onboarding the Simpl app Merchants will do away with record maintenance Customer Segments Customers who do not have financial knowledge and want to invest their money Customers who don’t have the time to research investment product by themselves Tech savvy millennials Tech averse audience ____________________ Cost Structure Application Development cost Marketing Spends (Online and Offline) Customer Acquisition cost Web Infrastructure cost Employee Salaries Key Resources Technological competence Customer Service support Sales team UX/UI designers Web hosting infrastructure CRM tool Channels Offline: Aggressive merchant acquisition though bank branches. Tie-up with Banks for the same. Online: Email, Facebook, LinkedIn, Instagram, SEO, SEM for online merchant acquisition

- 5. Next steps Besides working on the preliminary business canvas for our idea and the 4 action framework, we also took out some time to study what was happening in the space of digital payments and Fintech. We kept ourselves abreast with a lot of developments happening in this space and are now looking at the Validation phase next. We also need to figure the defense moat around our idea and ensure that differentiation we have provided is maintained.