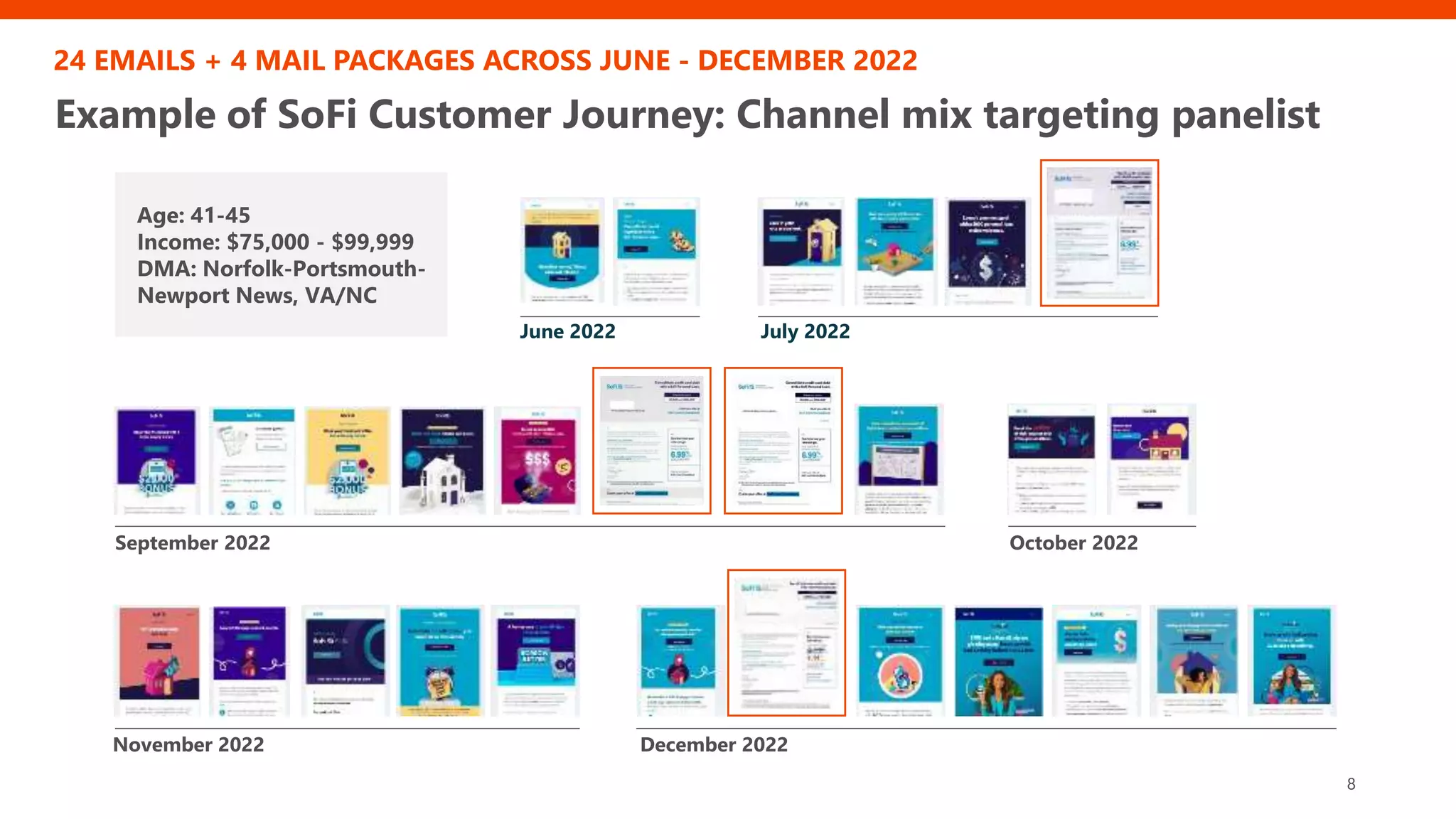

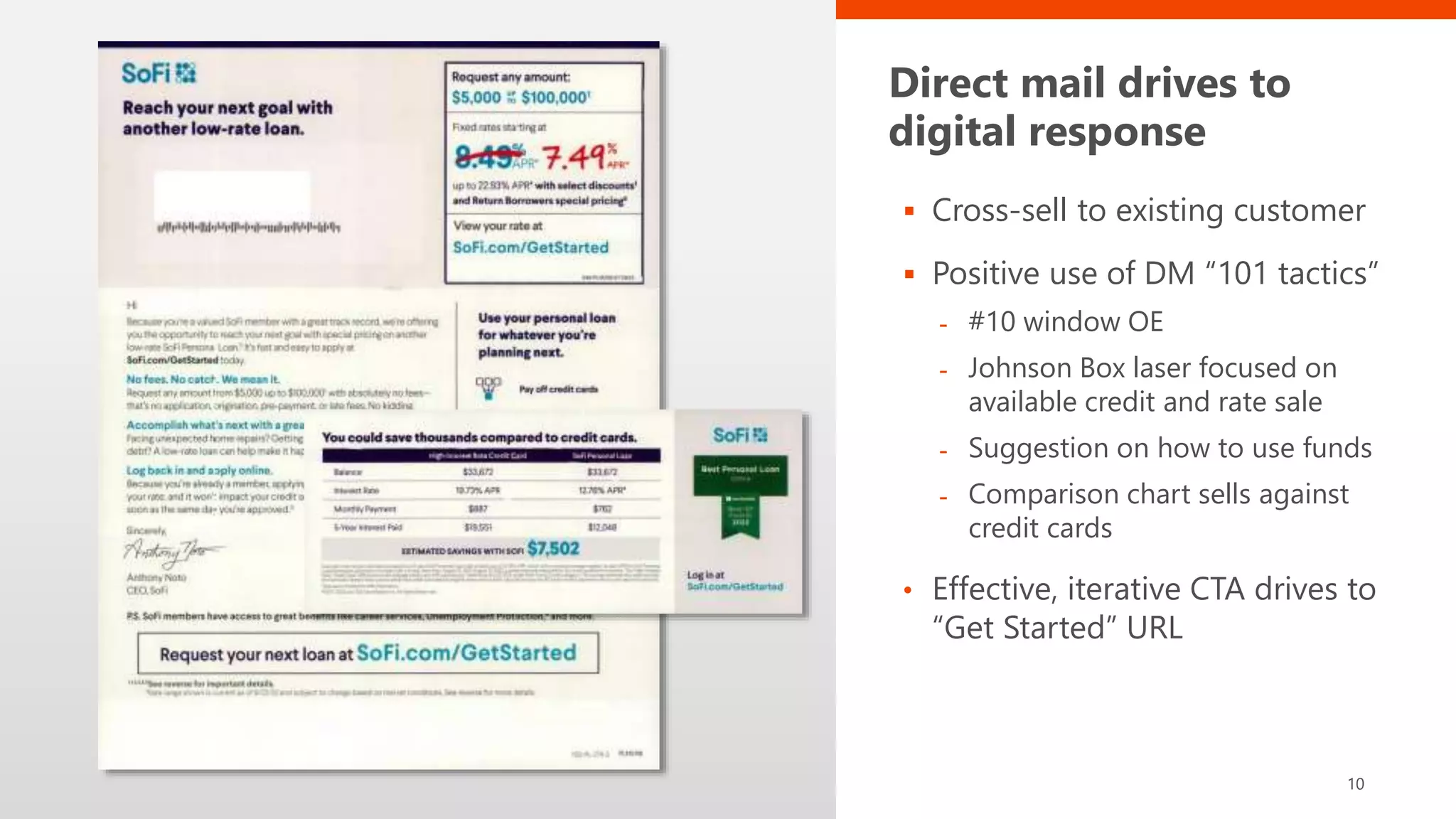

The fintech marketing landscape is increasingly leveraging direct mail (DM) for customer acquisition, especially targeting the subprime audience with personal loan offers. Trends indicate that DM is effective in building trust, delivering high ROI, and engaging consumers, with omni-channel strategies outperforming single-channel approaches. Fintech brands are employing best practices in DM, including personalized messaging and digital response integration, to enhance engagement and brand credibility.