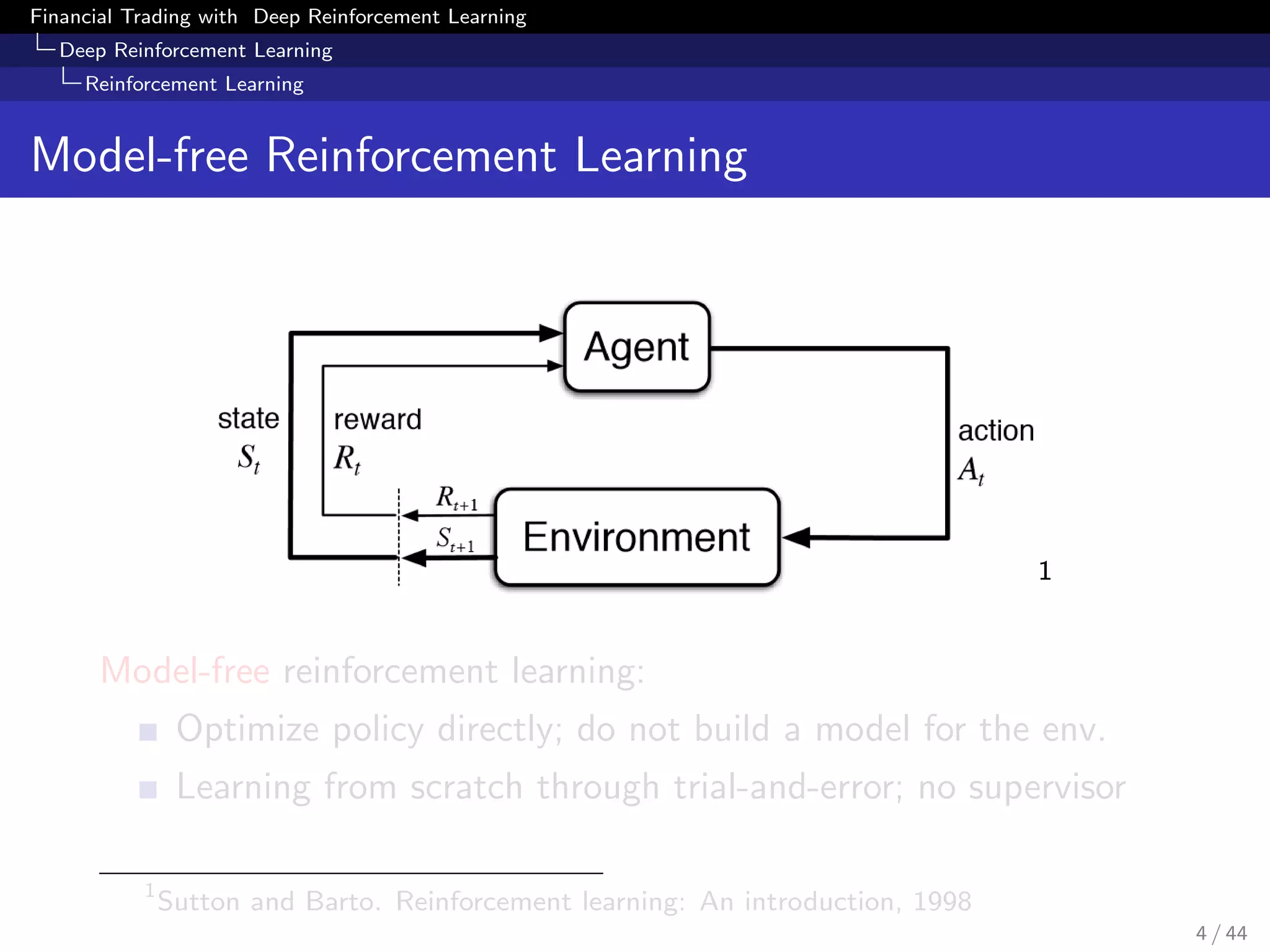

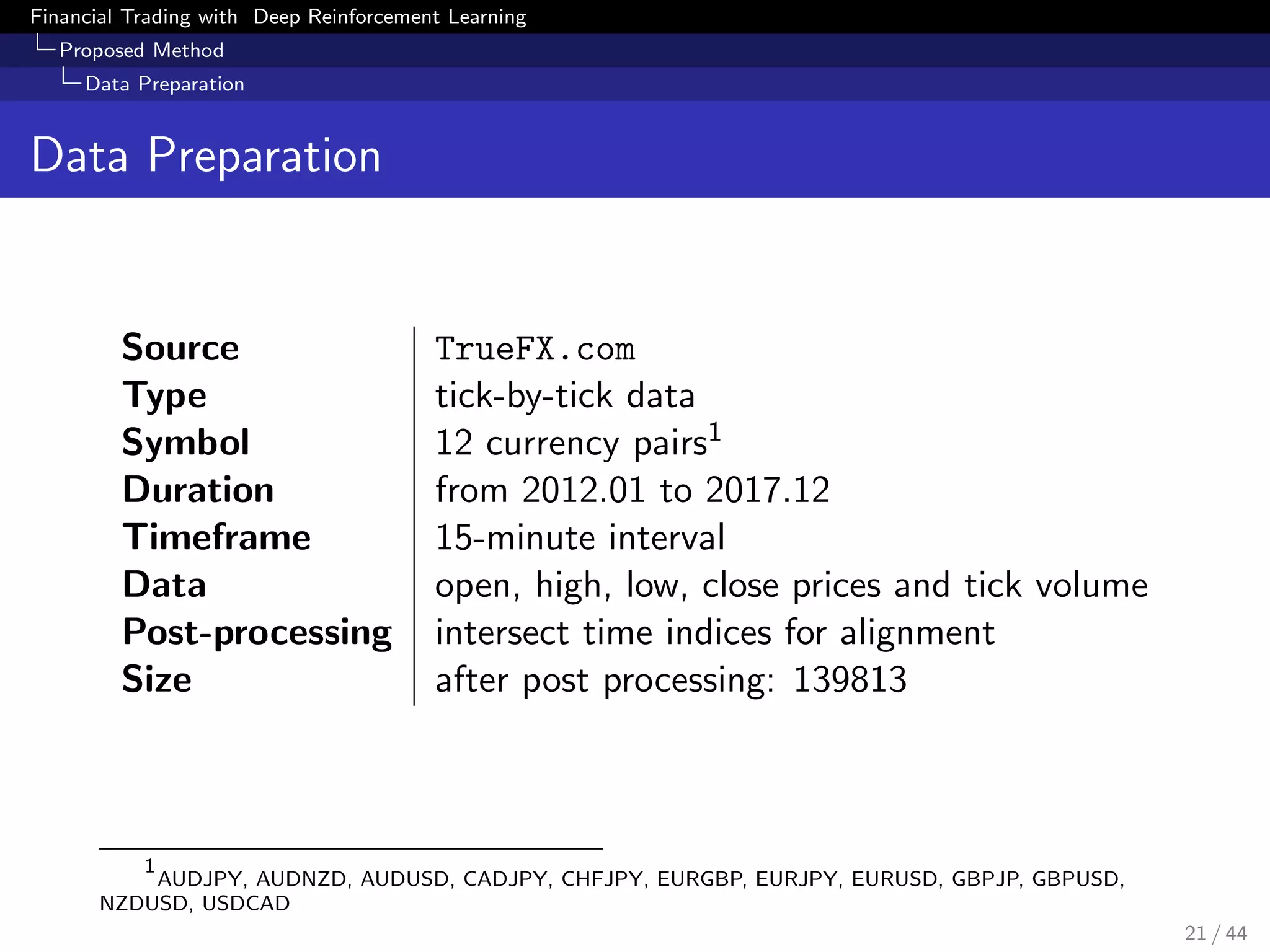

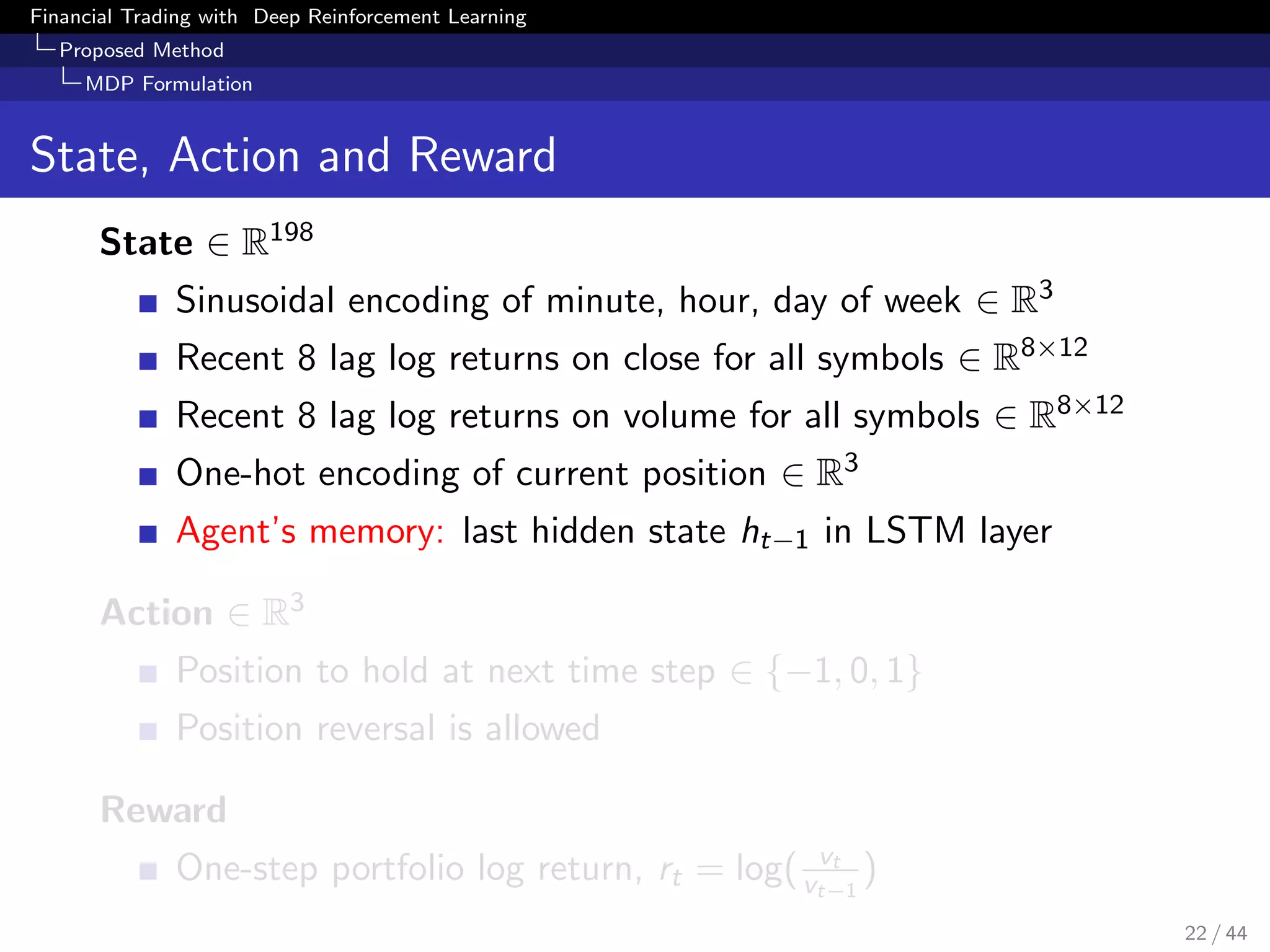

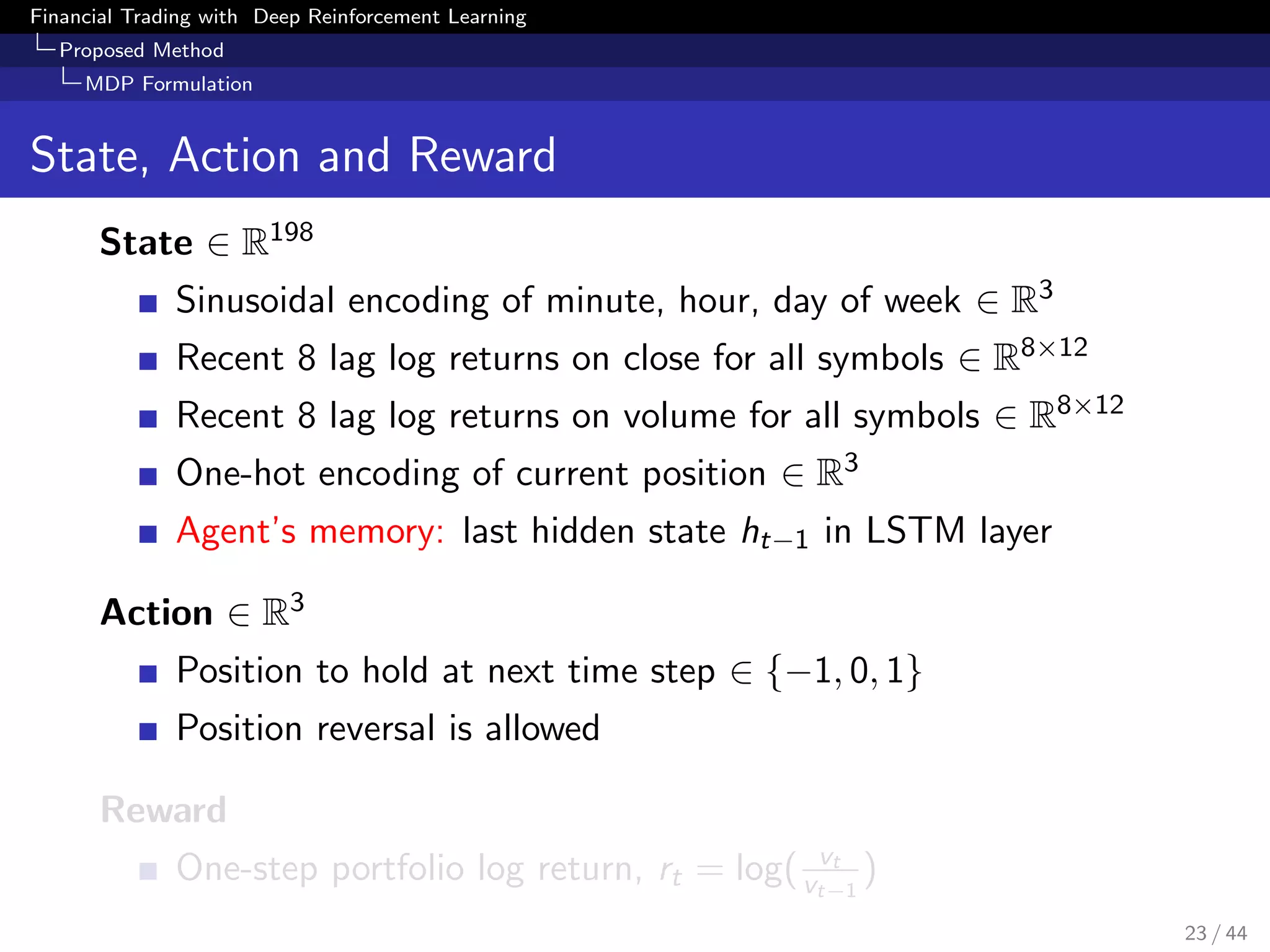

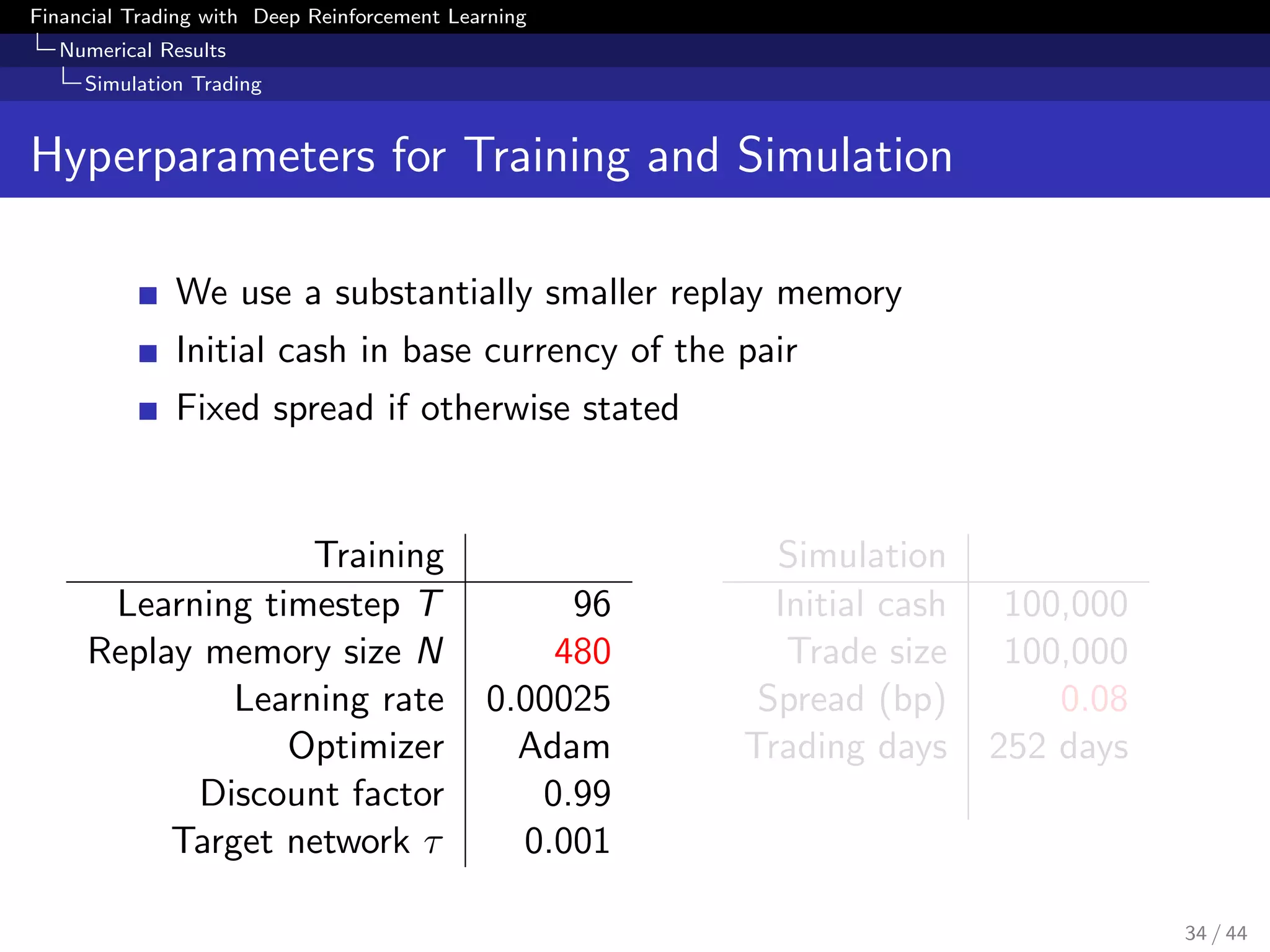

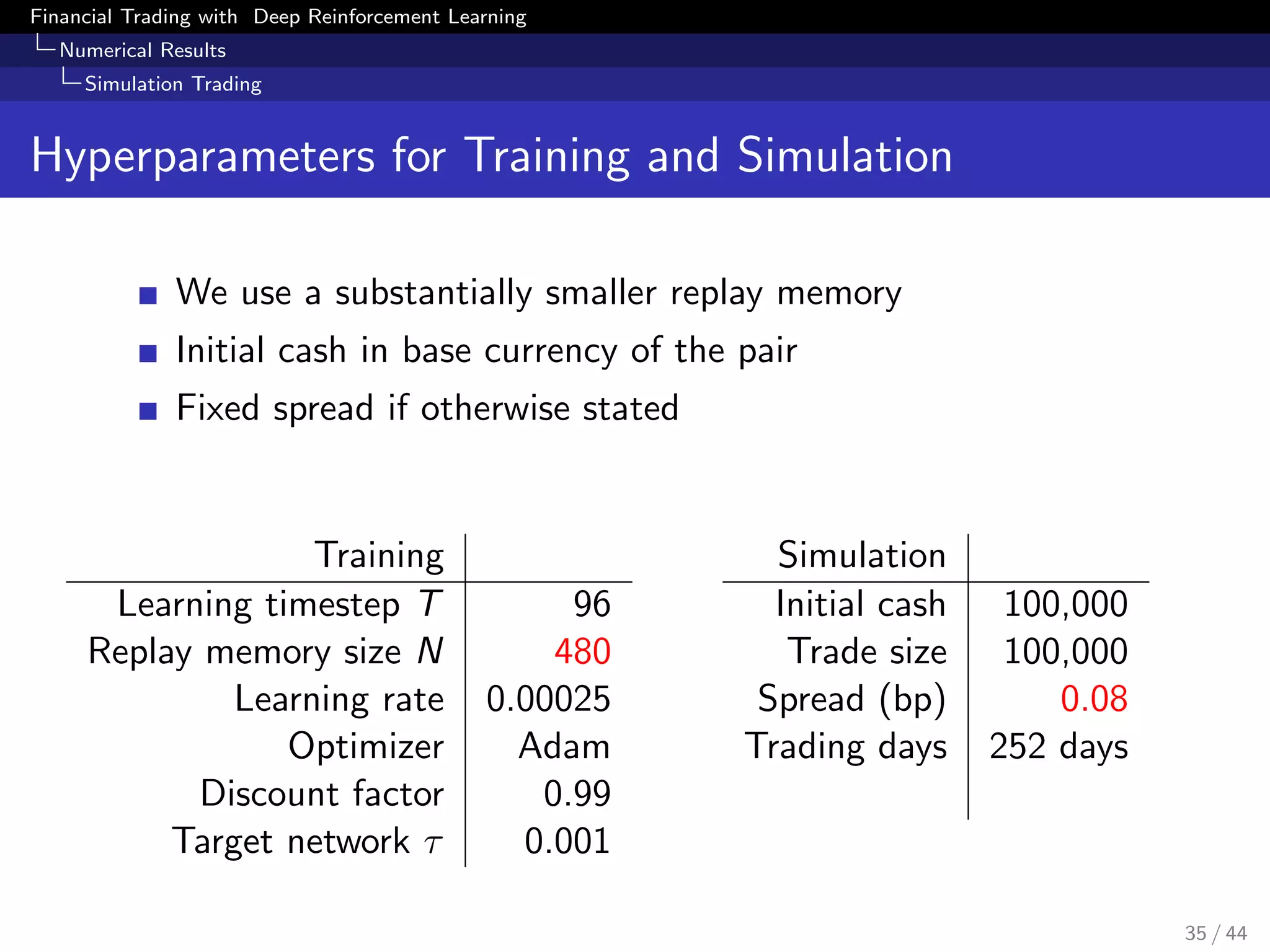

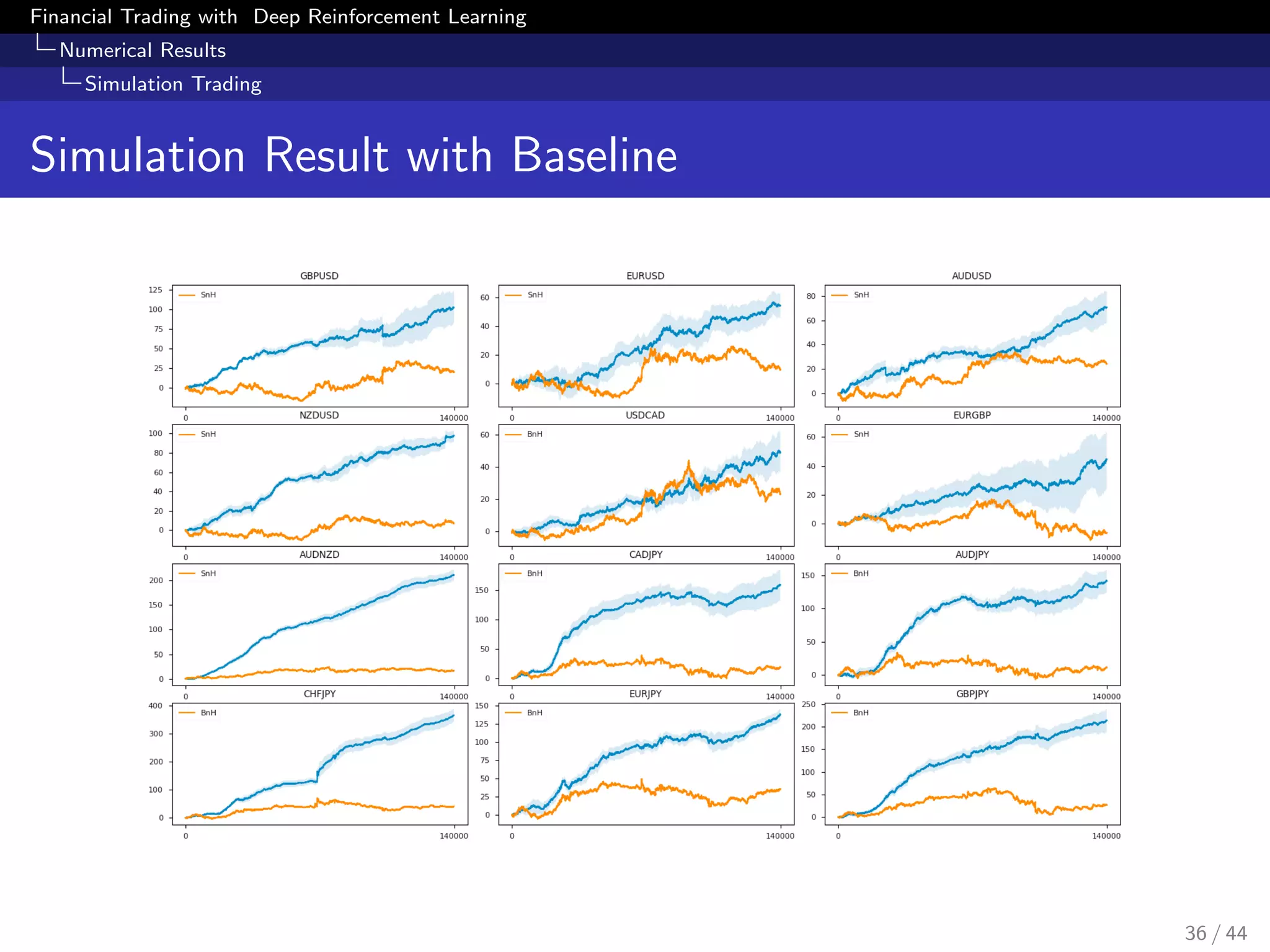

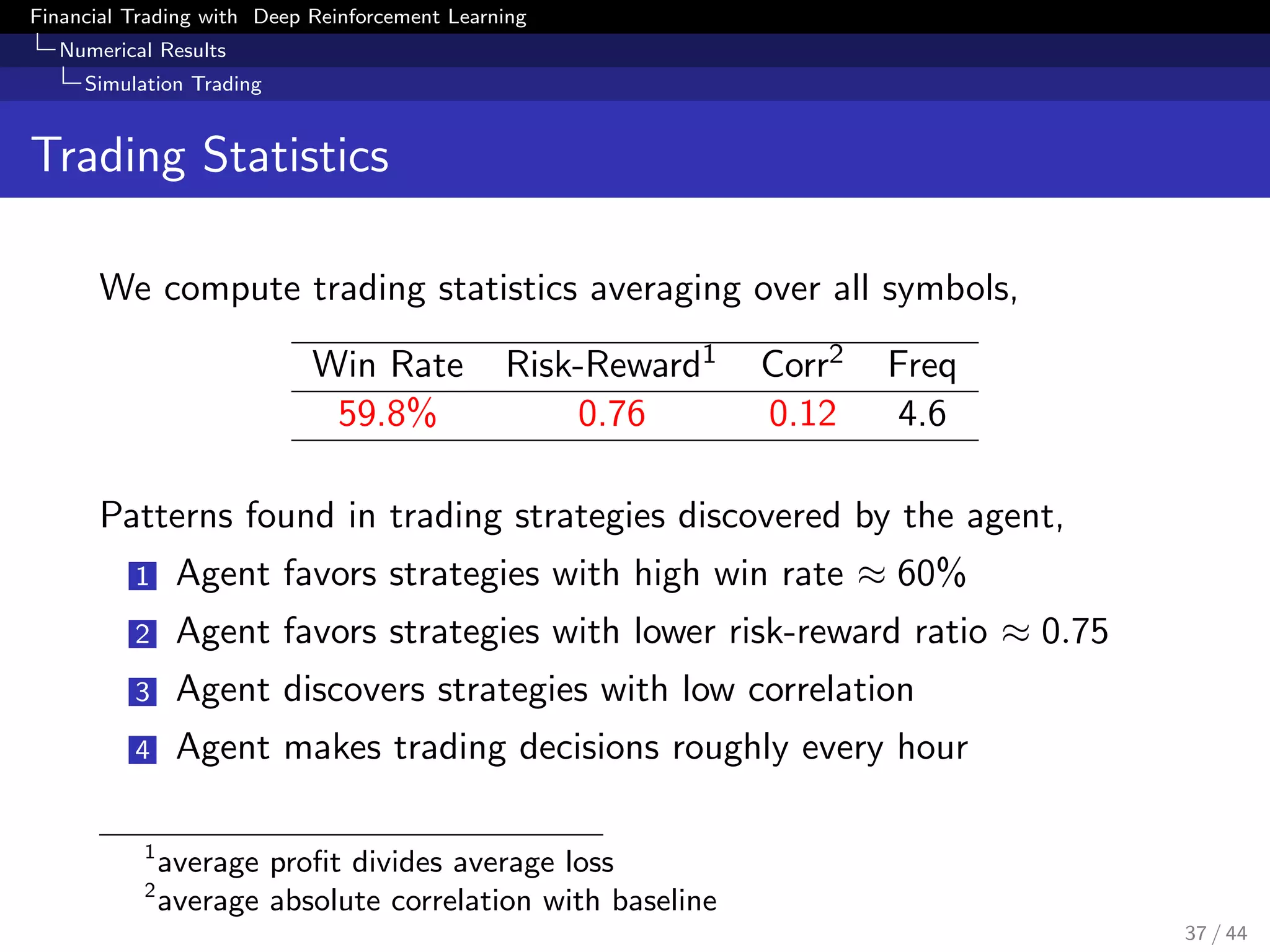

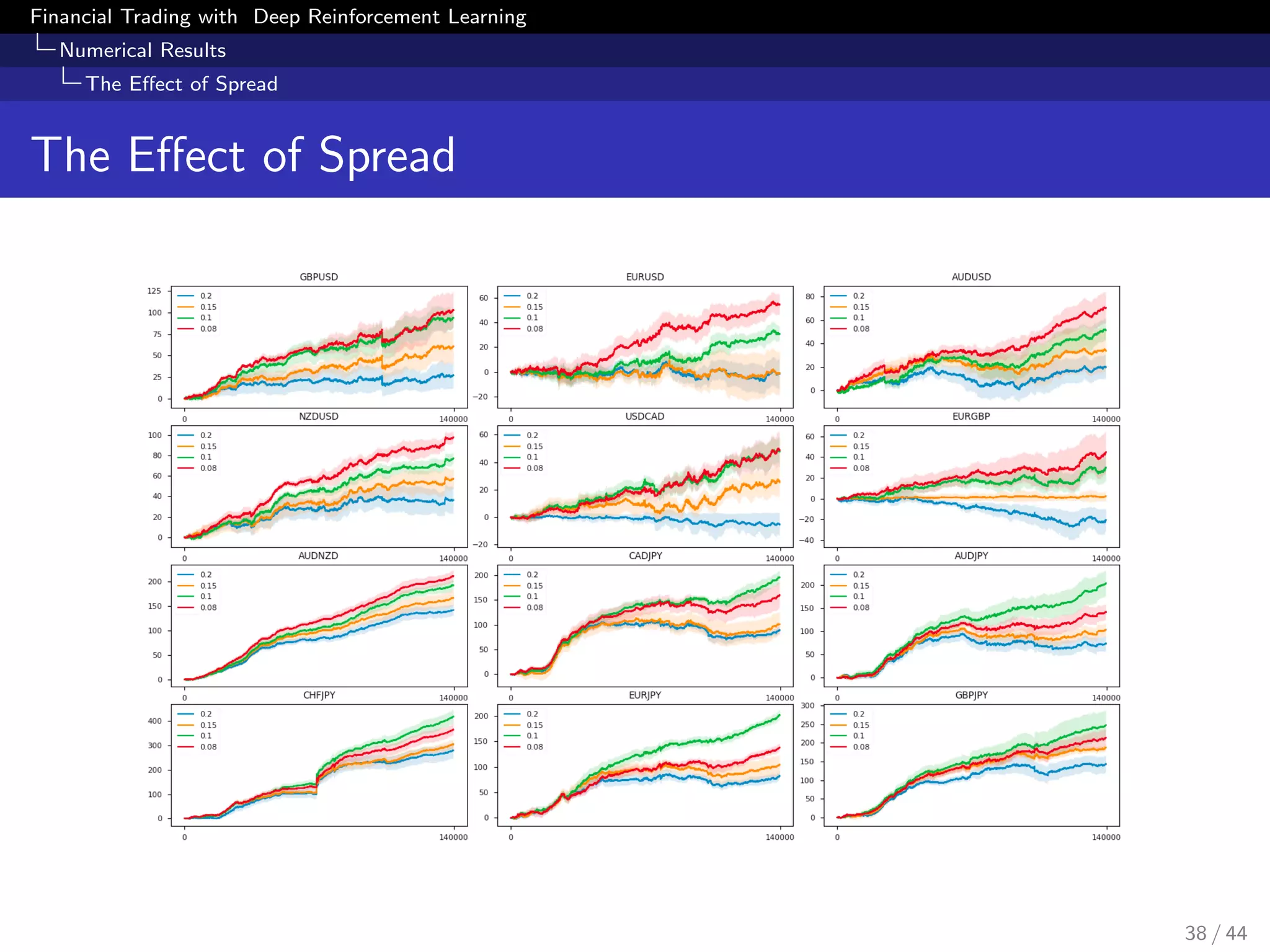

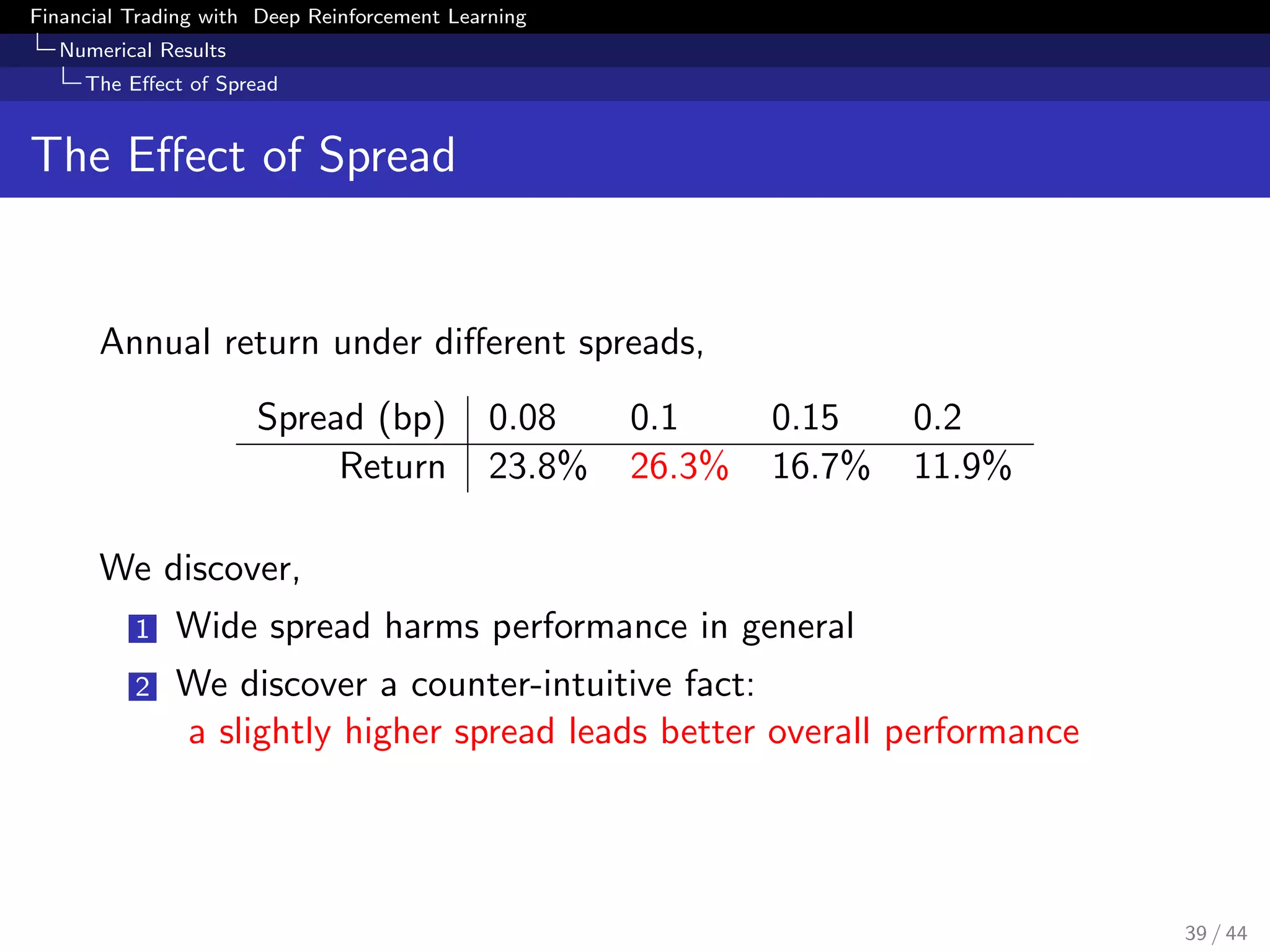

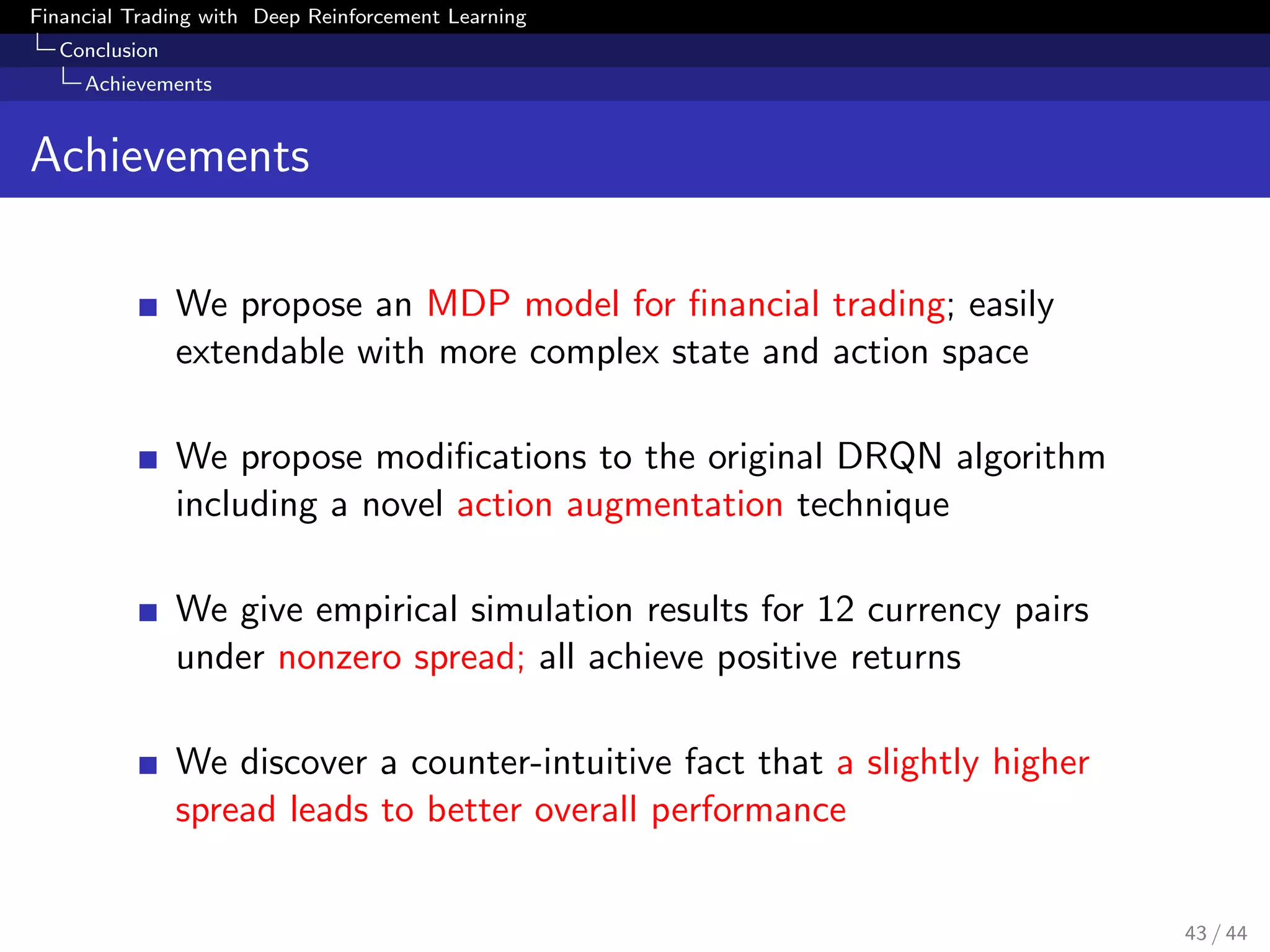

The document discusses financial trading using deep reinforcement learning, detailing methods such as model-free reinforcement learning, Markov decision processes, and the architecture of deep Q-networks. It presents a proposed method that involves data preparation and action augmentation to improve trading strategy, ultimately aiming to determine if a single agent can learn to trade multiple currency pairs. Numerical results are provided to support the effectiveness of the proposed deep reinforcement learning approach in financial trading scenarios.

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Markov Decision Process

Markov Decision Process

Definition

A Markov Decision Process is a tuple (S, A, p, r, γ) where

S is a finite set of states

A is a finite set of actions

p is a transition probability distribution,

p(s | s, a) = P [St+1 = s | St = s, At = a]

r is a reward function, r(s, a) = E [Rt+1 | St = s, At = a]

γ ∈ (0, 1) is a discount factor

In real applications of model-free RL, we only define the state

space, action space and reward function

Reward function should reflect the ultimate goal

6 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-6-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Markov Decision Process

Markov Decision Process

Definition

A Markov Decision Process is a tuple (S, A, p, r, γ) where

S is a finite set of states

A is a finite set of actions

p is a transition probability distribution,

p(s | s, a) = P [St+1 = s | St = s, At = a]

r is a reward function, r(s, a) = E [Rt+1 | St = s, At = a]

γ ∈ (0, 1) is a discount factor

In real applications of model-free RL, we only define the state

space, action space and reward function

Reward function should reflect the ultimate goal

7 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-7-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Markov Decision Process

Markov Decision Process

Definition

A Markov Decision Process is a tuple (S, A, p, r, γ) where

S is a finite set of states

A is a finite set of actions

p is a transition probability distribution,

p(s | s, a) = P [St+1 = s | St = s, At = a]

r is a reward function, r(s, a) = E [Rt+1 | St = s, At = a]

γ ∈ (0, 1) is a discount factor

In real applications of model-free RL, we only define the state

space, action space and reward function

Reward function should reflect the ultimate goal

8 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-8-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Return and Policy

Definition

The return Gt is the total sum of discounted rewards from time

step t,

Gt = Rt+1 + γRt+2 + γ2

Rt+3 + · · · =

∞

k=0

γk

Rt+k+1

Definition

A policy π is a distribution over actions given states,

π(a|s) = P[At = a | St = s]

9 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-9-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Return and Policy

Definition

The return Gt is the total sum of discounted rewards from time

step t,

Gt = Rt+1 + γRt+2 + γ2

Rt+3 + · · · =

∞

k=0

γk

Rt+k+1

Definition

A policy π is a distribution over actions given states,

π(a|s) = P[At = a | St = s]

10 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-10-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Value Function

Definition

The action-value function Qπ(s, a) of an MDP is the expected

return starting from state s, taking action a and then following

policy π,

Qπ

(s, a) = Eπ[Gt | St = s, At = a]

Definition

The optimal action-value function Q∗(s, a) is the maximum value

function over all policies

Q∗

(s, a) = max

π

Qπ

(s, a)

11 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-11-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Value Function

Definition

The action-value function Qπ(s, a) of an MDP is the expected

return starting from state s, taking action a and then following

policy π,

Qπ

(s, a) = Eπ[Gt | St = s, At = a]

Definition

The optimal action-value function Q∗(s, a) is the maximum value

function over all policies

Q∗

(s, a) = max

π

Qπ

(s, a)

12 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-12-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Bellman Equation

Theorem

Optimal value function satisfies Bellman Optimality Equation,

Q∗

(s, a) = E[Rt+1 + γ max

a

Q∗

(St+1, a ) | St = s, At = a]

1 Once we have Q∗, we can act optimally,

π∗

(s) = arg max

a

Q∗

(s, a)

2 Cannot compute expectation without environment dynamics

3 Sample the Bellman equation through interaction with env

13 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-13-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Bellman Equation

Theorem

Optimal value function satisfies Bellman Optimality Equation,

Q∗

(s, a) = E[Rt+1 + γ max

a

Q∗

(St+1, a ) | St = s, At = a]

1 Once we have Q∗, we can act optimally,

π∗

(s) = arg max

a

Q∗

(s, a)

2 Cannot compute expectation without environment dynamics

3 Sample the Bellman equation through interaction with env

14 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-14-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Deep Reinforcement Learning

Definition and Theorem

Bellman Equation

Theorem

Optimal value function satisfies Bellman Optimality Equation,

Q∗

(s, a) = E[Rt+1 + γ max

a

Q∗

(St+1, a ) | St = s, At = a]

1 Once we have Q∗, we can act optimally,

π∗

(s) = arg max

a

Q∗

(s, a)

2 Cannot compute expectation without environment dynamics

3 Sample the Bellman equation through interaction with env

15 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-15-2048.jpg)

![Financial Trading with Deep Reinforcement Learning

Conclusion

Future Directions

Future Directions

Expand state and action space,

Macro data, NLP data...

Adjustable position size, limit orders...

Different financial trading setting, e.g. high frequency trading

Different input state and action space

Different reward function

Distributional reinforcement learning:

Q(s, a)

D

= R(s, a) + γQ(S , A )

Pick action with Sharpe ratio

a = arg max

a∈A

E[Q]

Var[Q]

44 / 44](https://image.slidesharecdn.com/finale-180708100547/75/Financial-Trading-as-a-Game-A-Deep-Reinforcement-Learning-Approach-44-2048.jpg)