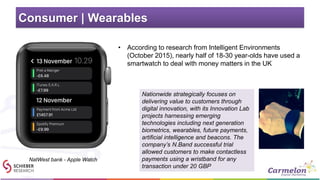

The document presents a comprehensive analysis of digital disruption trends in financial services, highlighting consumer demand, market trends, and innovation adoption. Key themes include the rise of mobile banking, fintech innovations, and the impact of social media on new financial solutions. The report emphasizes the need for personalization and convenience in financial services to adapt to evolving consumer expectations and market dynamics.