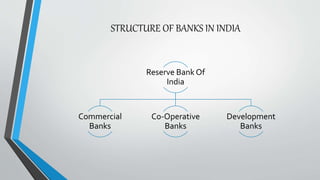

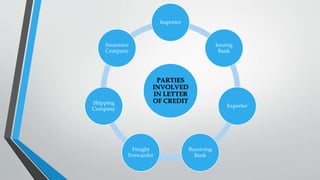

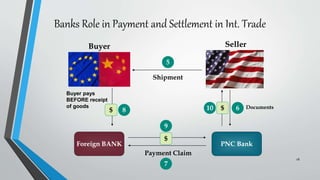

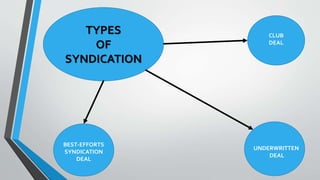

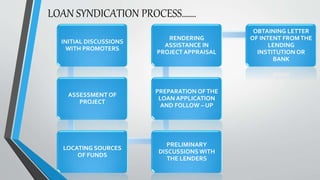

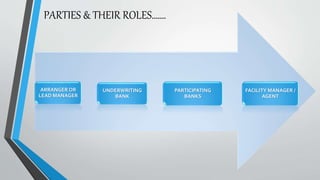

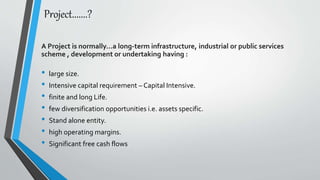

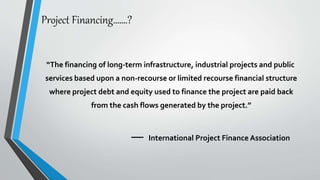

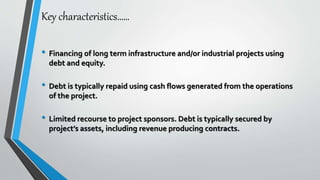

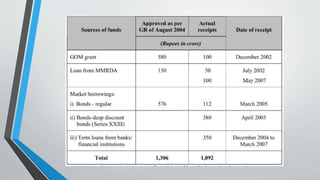

This document provides an overview of various financial services including banking, loan syndication, project finance, and wealth management in India. It discusses the structure of banks in India including commercial banks like SBI and private banks, co-operative banks, and development banks. It also summarizes how banks facilitate international trade through letters of credit and payments. Loan syndication and its types are defined. Project financing is described as financing long-term infrastructure projects based on cash flows. Sources of project financing include equity, debt, and subsidies. Finally, wealth management is summarized as a professional service combining financial advice, tax services, and planning to meet objectives like risk management and lifestyle enhancement.