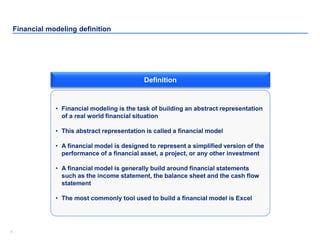

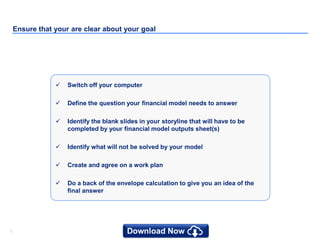

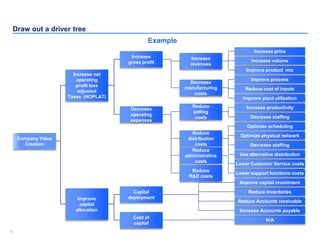

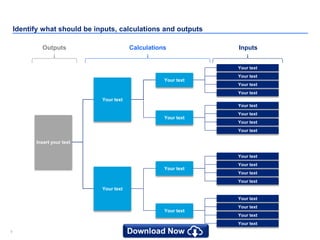

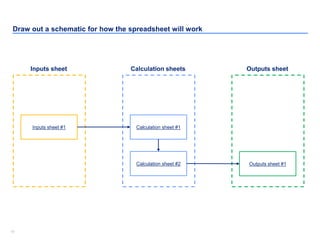

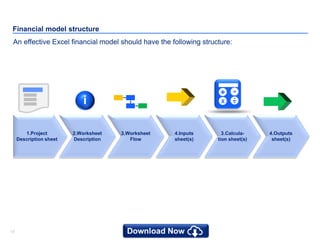

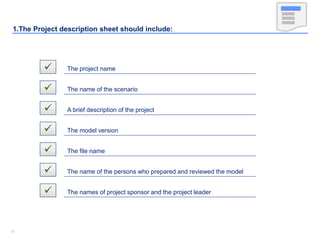

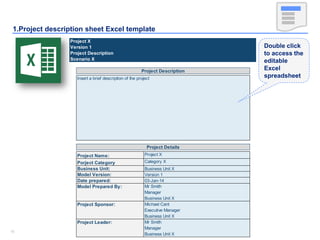

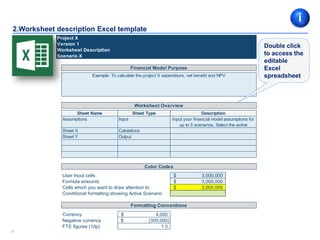

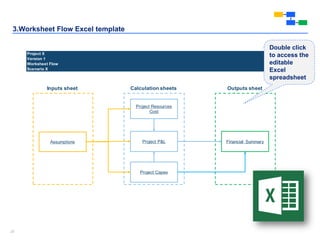

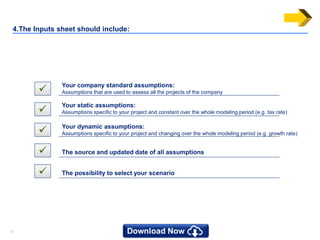

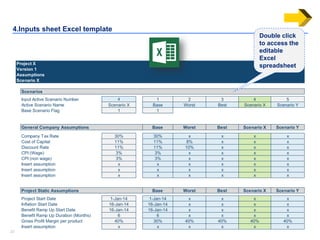

The document provides a comprehensive guide for creating a financial model using Excel, developed by former Deloitte management consultants. It includes objectives, detailed instructions on planning and designing a financial model, key formulas, and templates for various components such as inputs, calculations, and outputs. Additionally, it emphasizes the importance of having a clear goal and structure for effective financial modeling.