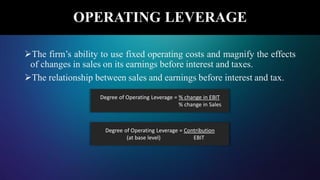

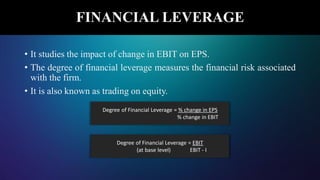

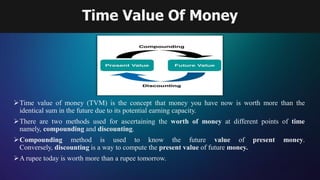

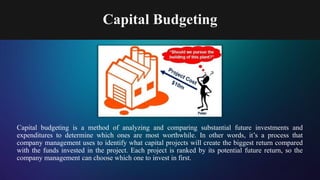

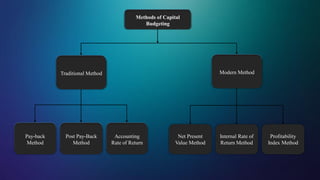

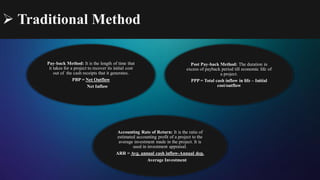

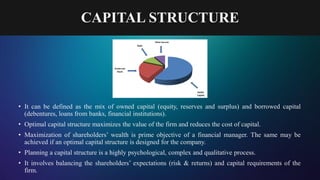

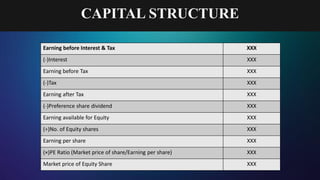

The document discusses various time value of money concepts such as compounding, discounting, and the time value principle that money today is worth more than money in the future. It also provides formulas for calculating future and present value of single and annuity cash flows. The document then discusses capital budgeting methods like payback period, accounting rate of return, net present value, internal rate of return, and profitability index. It also discusses working capital, its estimation using the operating cycle method, and financial leverage analysis.

![Time Value Of Money

Present Value Future Value

Future value of single

present cash flow

FV=PV(1+r)n

Future Value of series

of equal cash flow:

Ordinary Annuity

FVA=A[(1+r)n-1]/r

Future value of series

of equal cash flow:

Annuity Due

FVA= A[(1+r)n-1/r]*

(1+r)

Future Value of series

of unequal cash flow:

Compute it

individually by

compounding each

years annuity

Where;

FV- Future Value

PV- Present Value

A- Annuity

r- Rate of interest

n- time period](https://image.slidesharecdn.com/priyalagrawalfm-201012061626/85/Financial-Management-4-320.jpg)

![Time Value Of Money

Future Value Present Value

Present Value of single

present cash flow:

PV=FV/(1+r)n

Also known as discounting factor

Present Value of series

of equal cash flow:

Ordinary Annuity

Annuity=FVA*r/[(1+r)

n-1]

Present Value of series

of equal cash flow:

Annuity Due

Annuity=

FVA*r/[(1+r)n-1]*(1+r)

Present value of series

of unequal cash flow:

Compute it

individually

considering &

compounding each

year’s interest rate

respectively.

Where;

PV- present

value

A- Annuity

r- Rate of interest

n- time period](https://image.slidesharecdn.com/priyalagrawalfm-201012061626/85/Financial-Management-5-320.jpg)

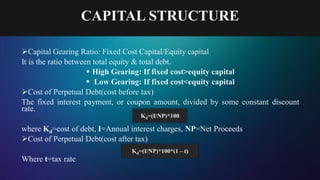

![COST OF CAPITAL

Cost of debt capital: It is an integral part of the discounted valuation

analysis which calculates the present value of a firm by discounting future

cash flows by the expected rate of return to its equity and debt holders.

Cost of Irredeemable debt

Where I=Annual interest charges, NP=Net proceeds, Kd=Cost of debt

Cost of Redeemable debt

Where RV=Redeemable value of debt at the time of maturity, n=No. of

years to maturity

Kd=(I/NP)*100

Kd=[{I+(RV-NP/n)}/{RV+NP/2}]*100](https://image.slidesharecdn.com/priyalagrawalfm-201012061626/85/Financial-Management-16-320.jpg)

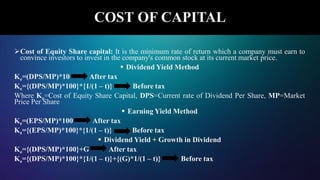

![Cost of Retained Earning: The amount of undistributed profits which is

available for investment is called Retained Earning.

Where Kr=Cost of retained earning, D=Dividend which would be

distributed as an alternative of retained earning, Ti=Income tax rate of

individual shareholder, B=Brokerage payable on investment of dividend

received, Tc=Capital gain tax rate applicable to individual shareholder,

MP=Market price per share

# If the shareholder does not have to pay tax on capital profit & income,

then:

COST OF CAPITAL

Kr=[{D(1-B)}/MP]*100

Kr={D*(1-Ti)*(1-B)}/{MP(1-Tc)}*100](https://image.slidesharecdn.com/priyalagrawalfm-201012061626/85/Financial-Management-19-320.jpg)