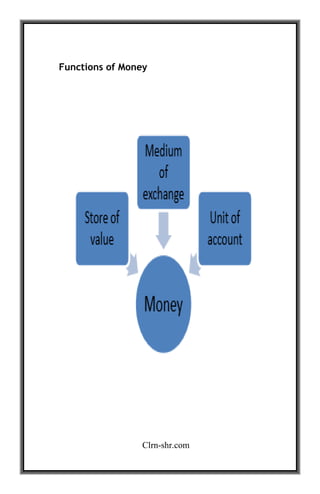

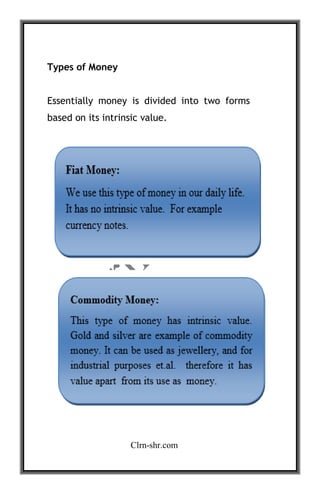

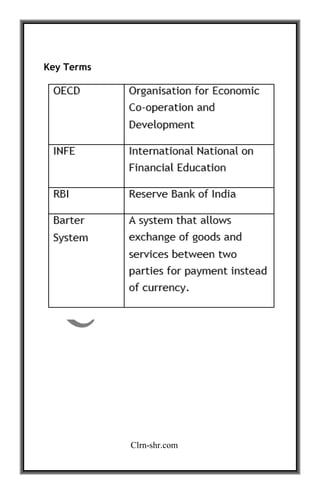

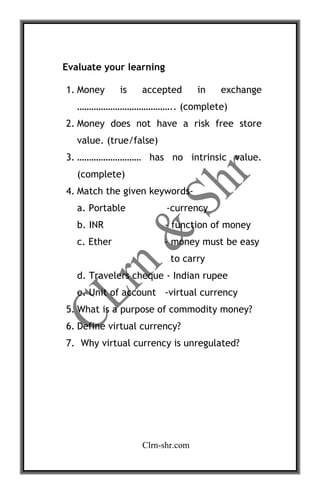

This document discusses financial literacy and provides an overview of a financial literacy module. It defines financial literacy and explains why it is important. The module aims to help learners of all ages understand basic financial concepts like time value of money, risks, and fund management. It covers topics like what money is, the functions and characteristics of money, different types of money including currency, and virtual currency. The module includes practical scenarios and worksheets to help learners assess their knowledge.