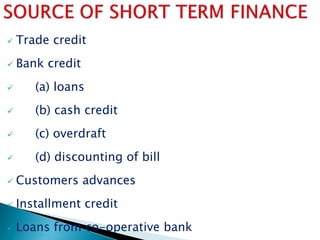

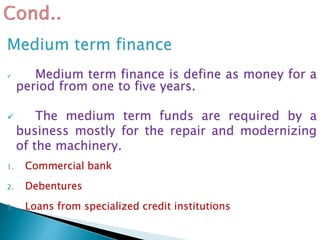

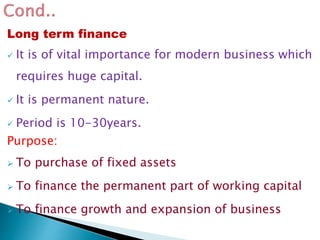

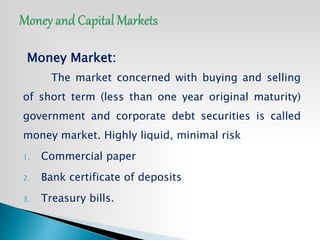

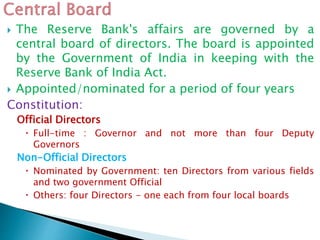

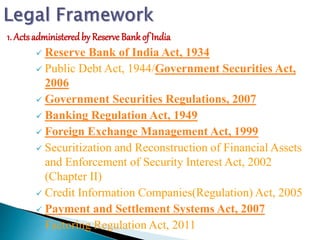

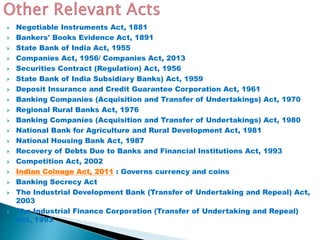

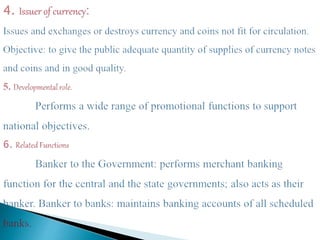

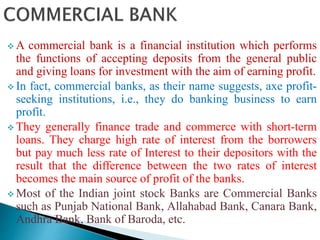

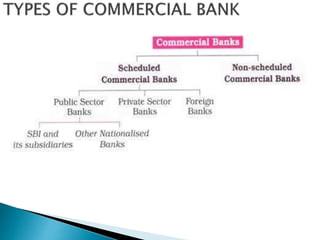

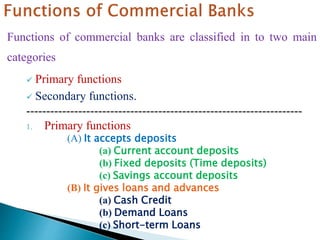

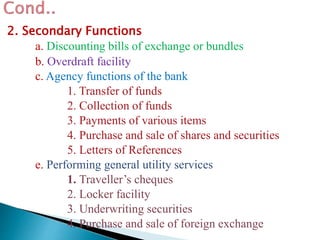

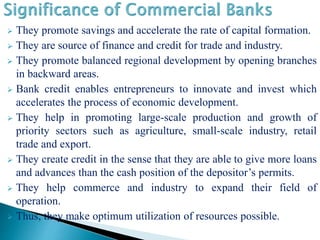

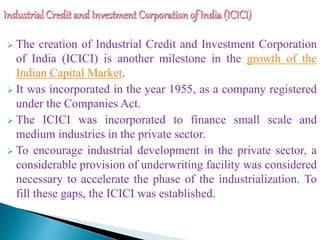

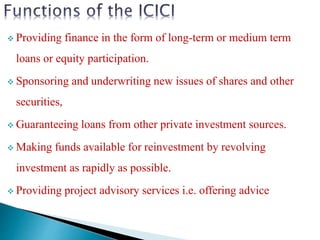

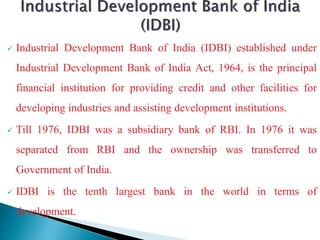

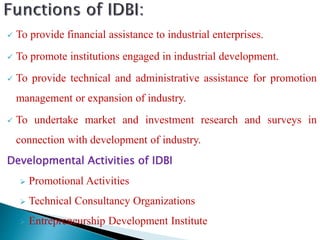

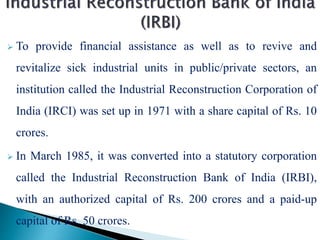

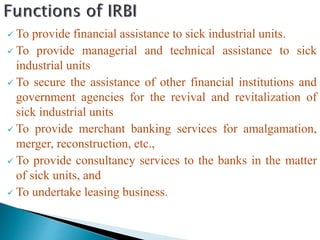

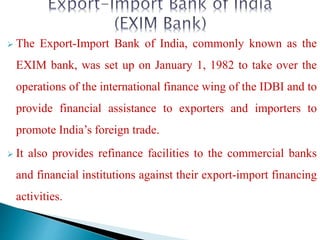

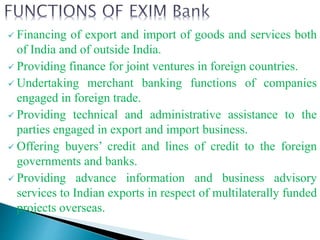

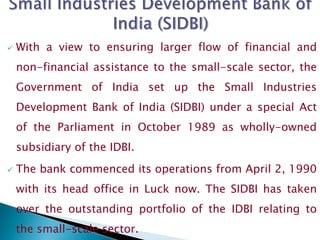

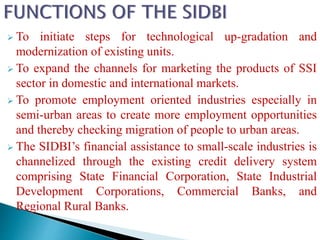

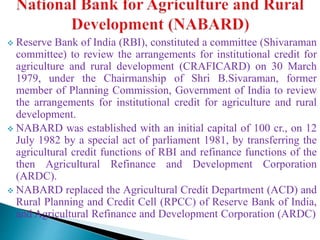

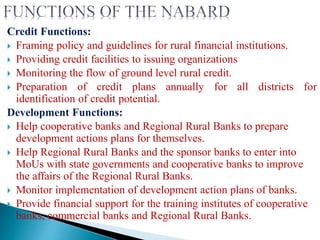

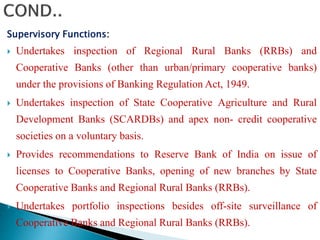

The document provides information on India's financial environment and financial institutions. It discusses key components of the financial environment including financial managers, markets, and investors. It then describes various types of short, medium, and long term financing. Finally, it outlines several important financial institutions in India and their roles, including the Reserve Bank of India, commercial banks, ICICI, IDBI, EXIM Bank, SIDBI, and NABARD.