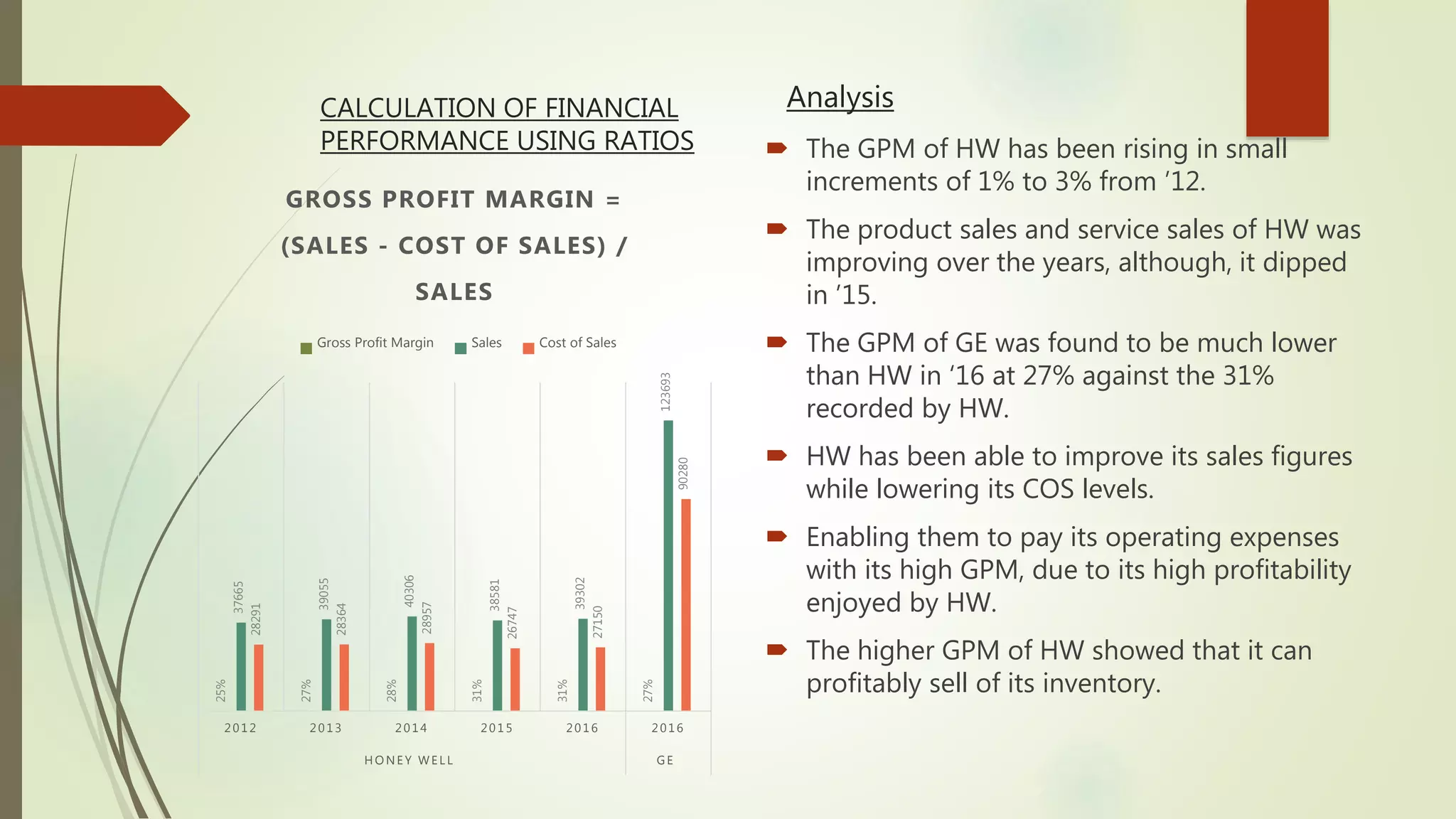

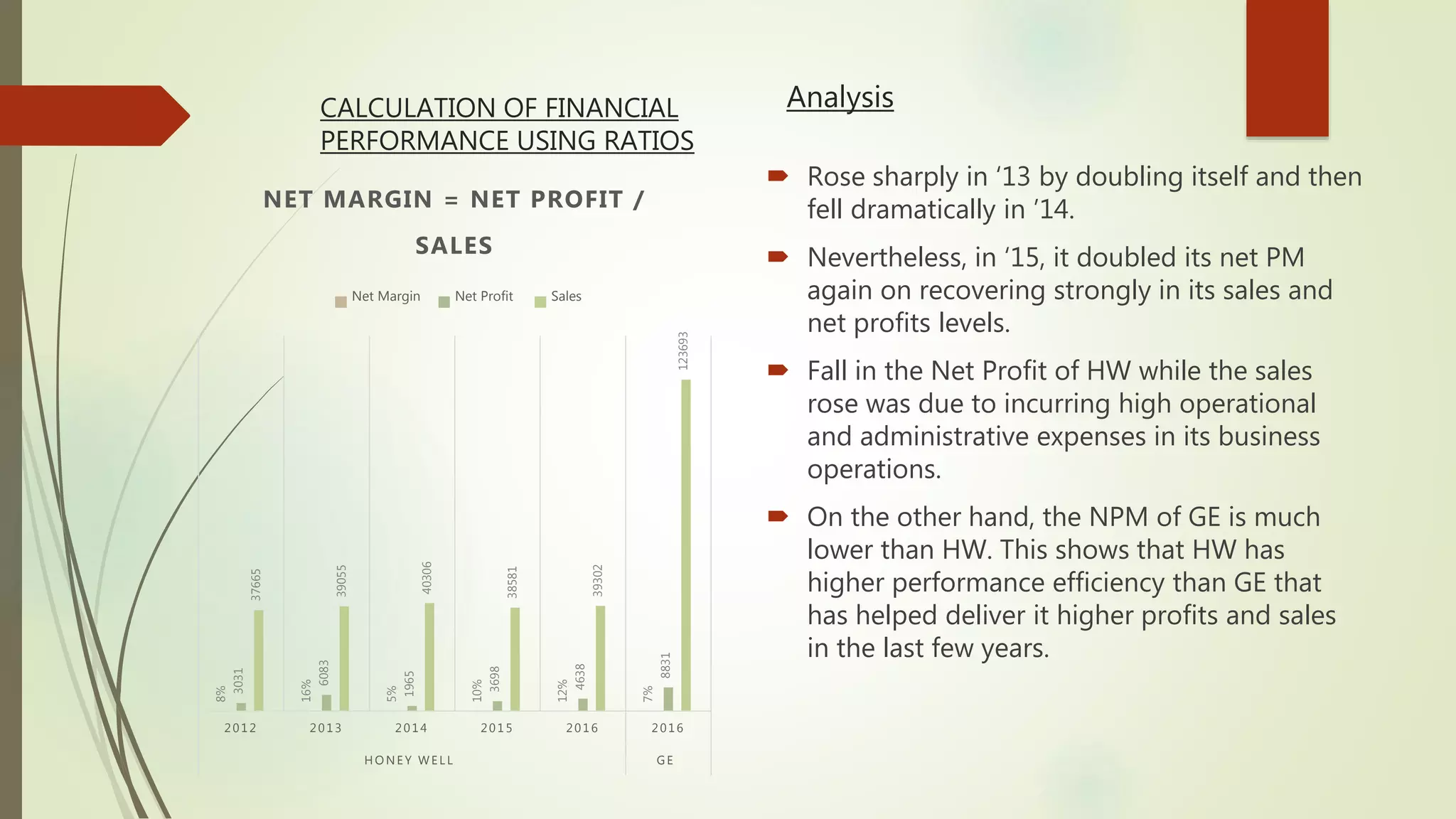

The document analyzes the financial performance of Honeywell from 2012 to 2016 using various ratios, highlighting strengths in profitability and efficiency despite a decline in 2015. Projections for 2017 suggest continued solid performance and potential for shareholder returns. Recommendations include managing currency risks and diversifying product portfolios while considering the competitive landscape of the aircraft market.