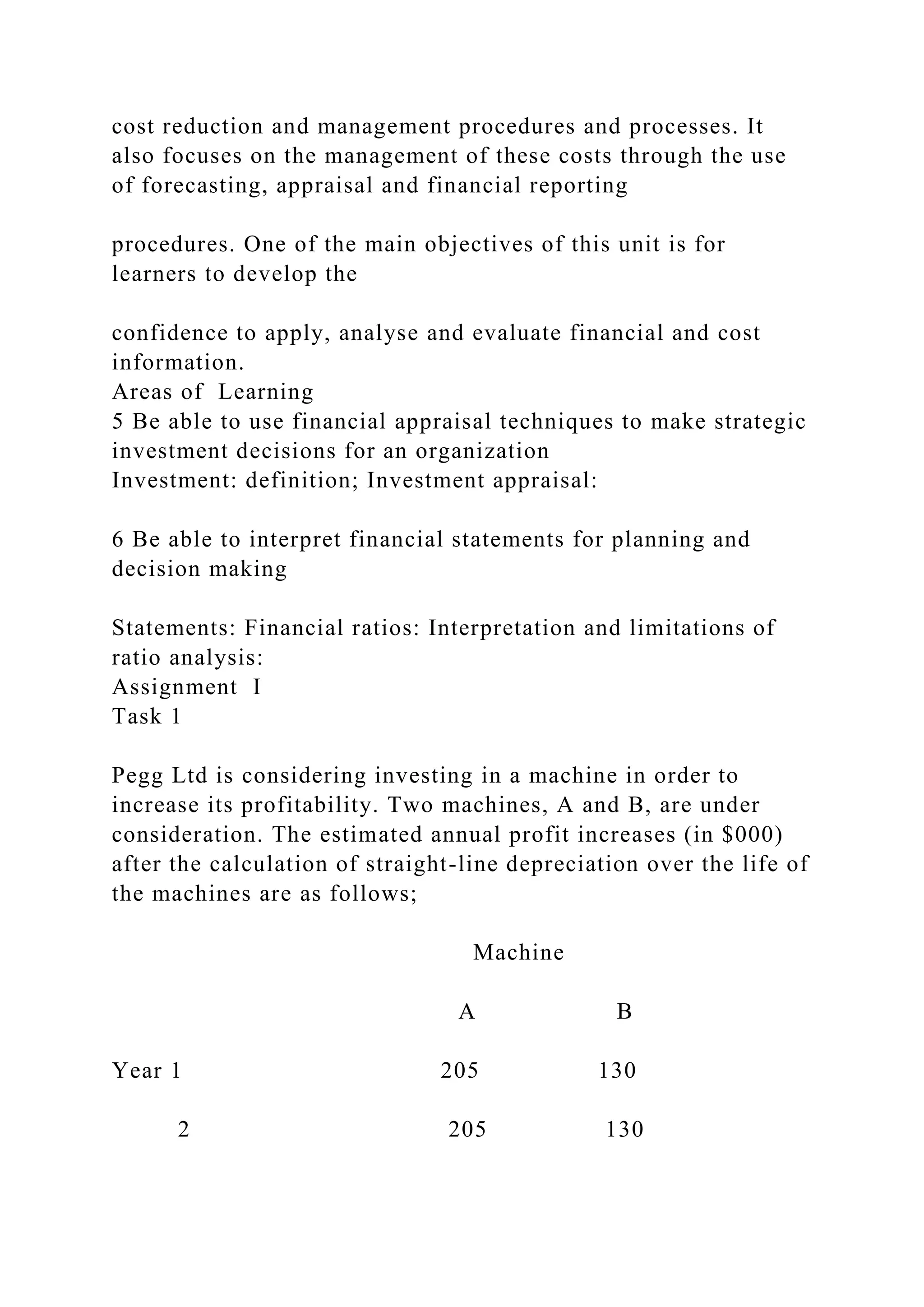

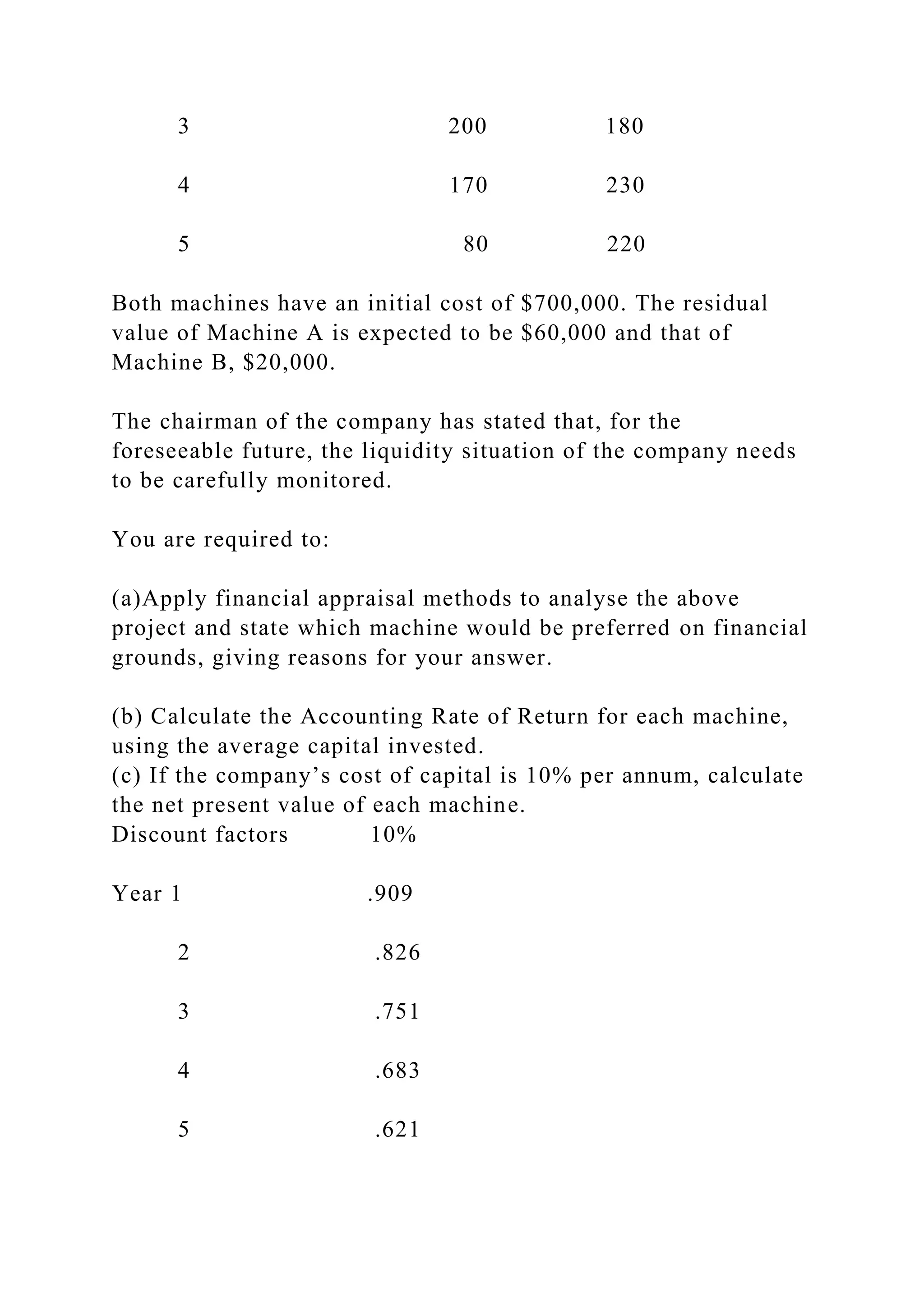

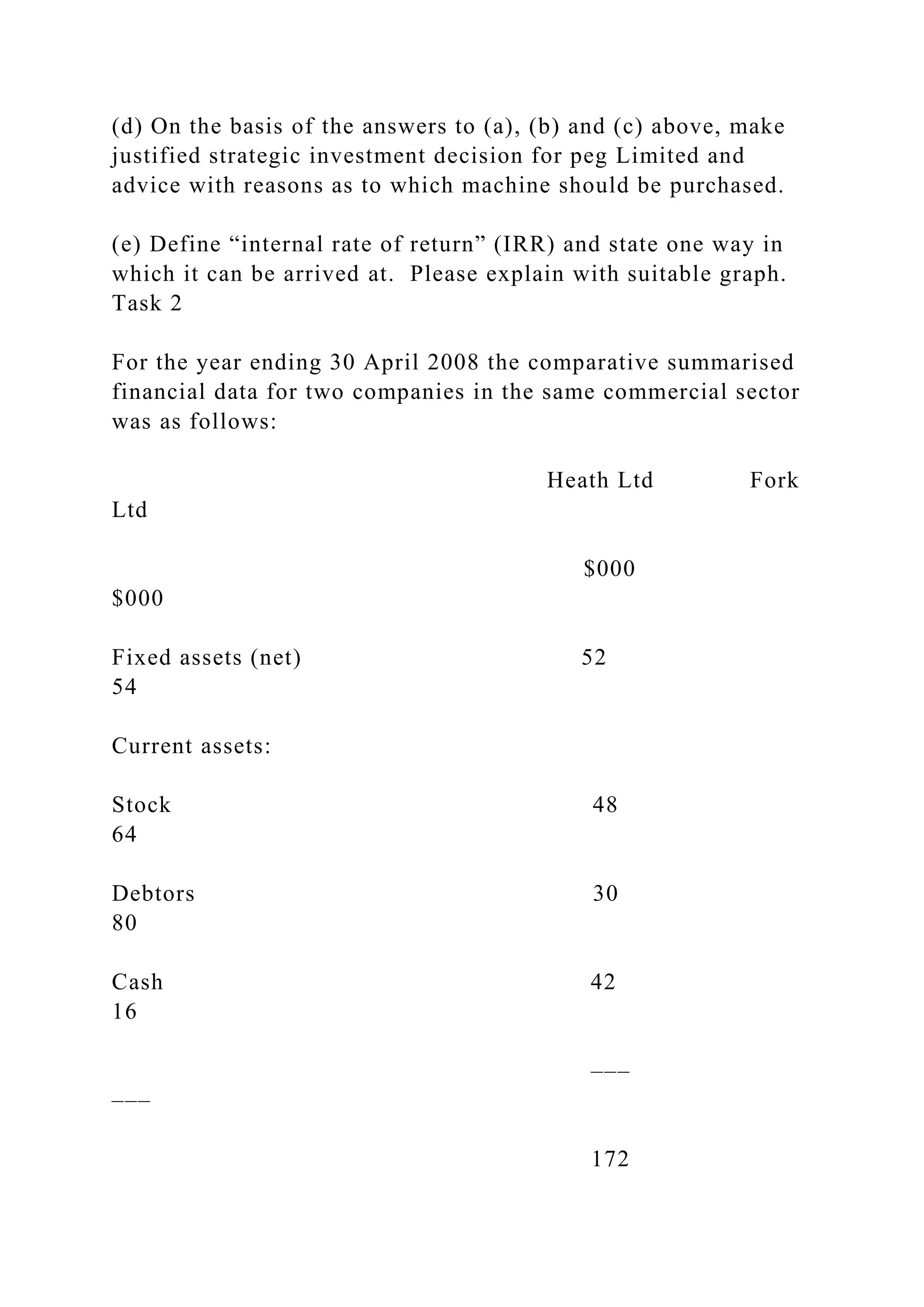

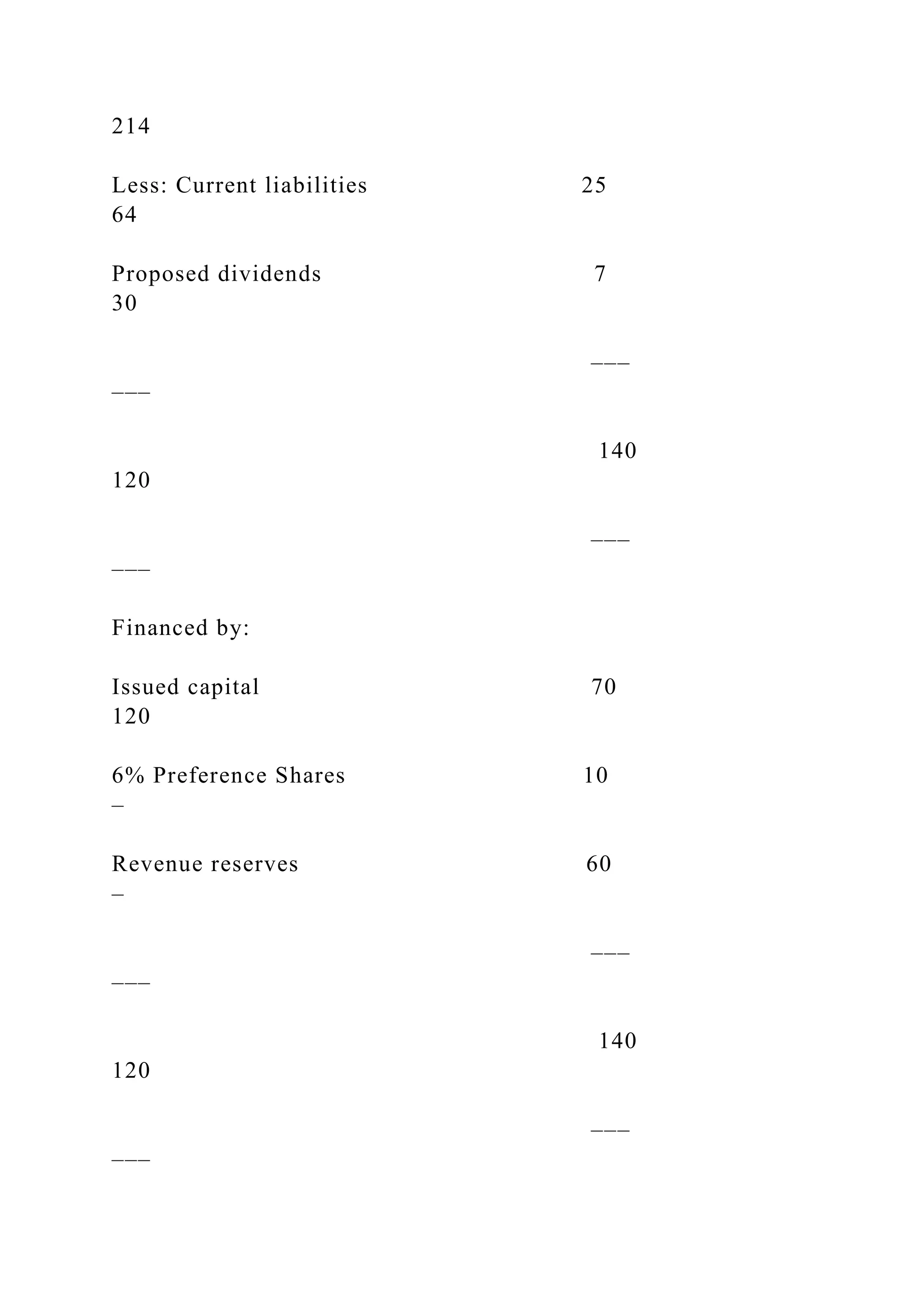

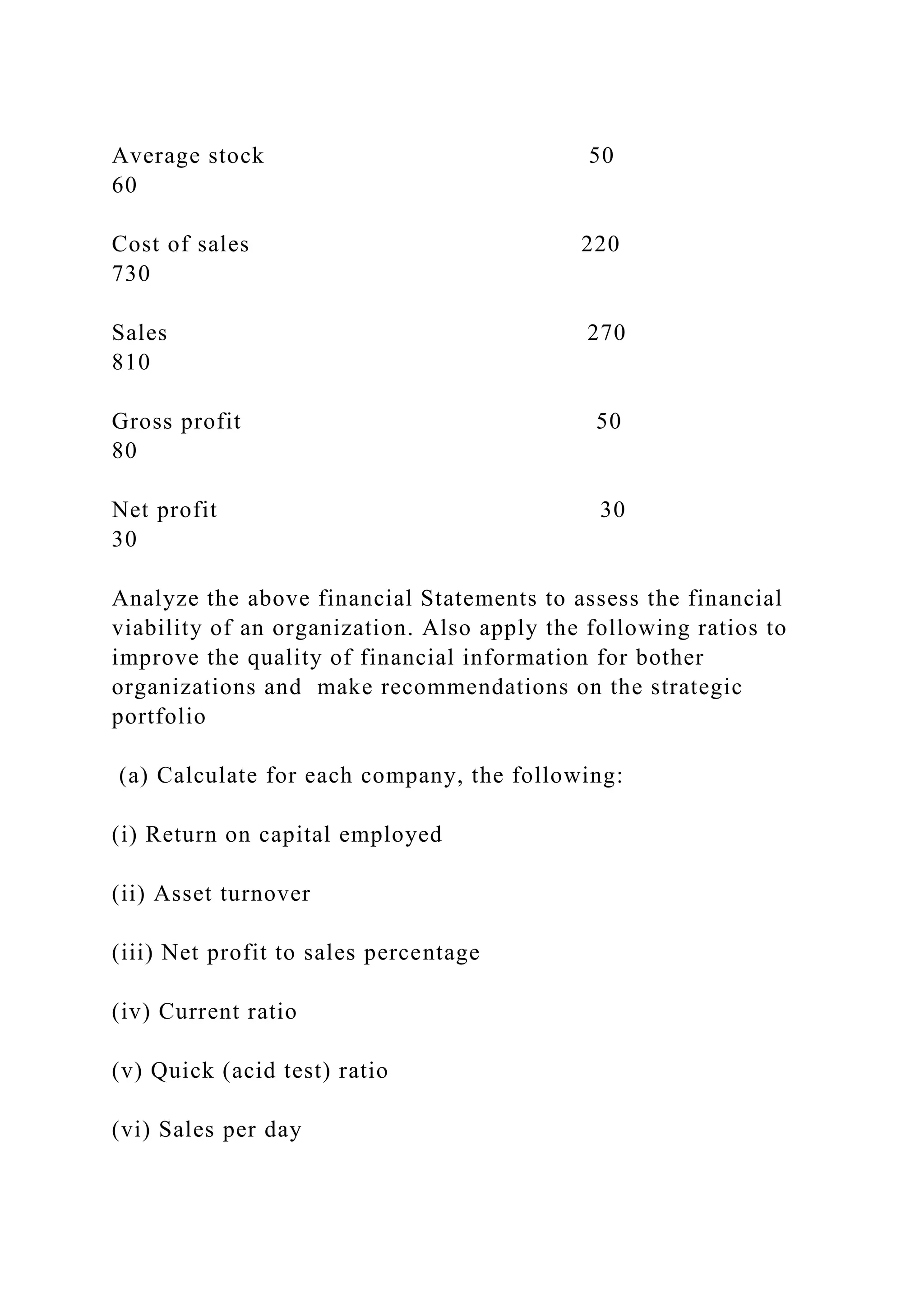

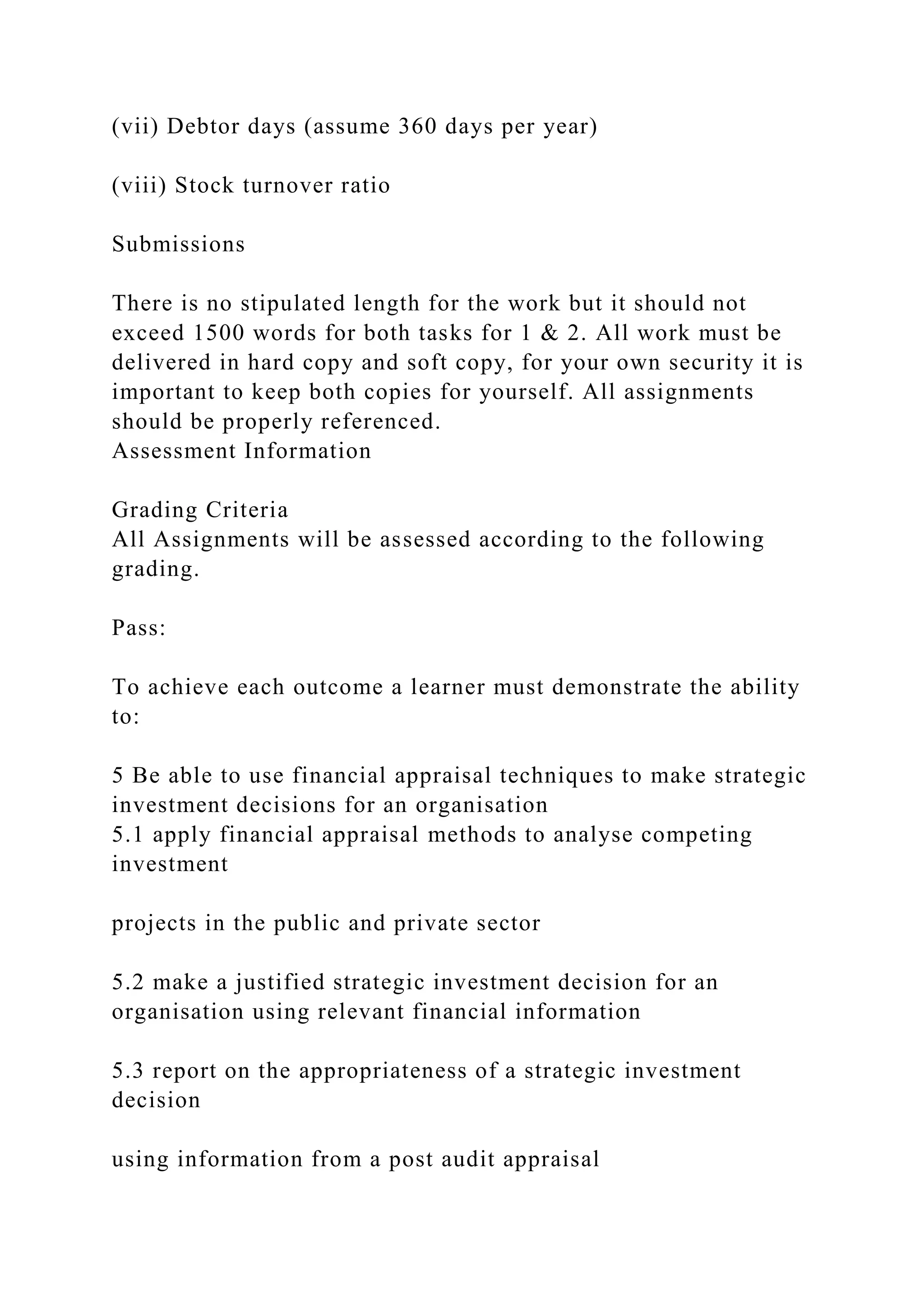

This assignment focuses on the interpretation of financial statements and investment appraisal, emphasizing the analysis and evaluation of financial information to make strategic decisions. It includes tasks such as assessing the viability of investment in machines by analyzing projected profits and computing financial metrics like accounting rate of return and net present value. Additionally, students are required to evaluate comparative financial data of two companies and apply various financial ratios to inform decision-making.