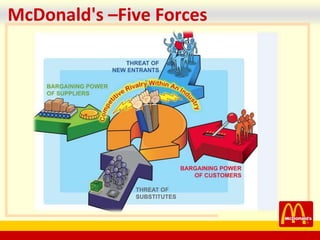

McDonald's is a global fast food chain that was founded in 1940 in California by brothers Dick and Mac McDonald. In 1955, Ray Kroc joined the company and established McDonald's Corporation, growing the small restaurant into the largest restaurant chain worldwide. Currently, McDonald's has over 33,000 restaurants serving around 69 million customers daily in 120 countries. While facing competition and health concerns, McDonald's continues to adapt its menu, locations, and operations to remain successful through strategies like global expansion, branding, targeting various customer segments, and innovation.