Embed presentation

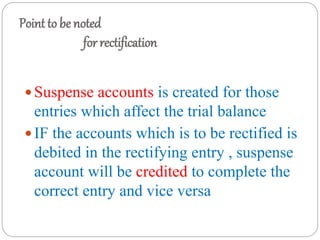

Download to read offline

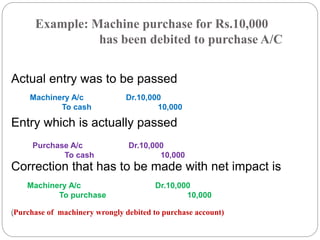

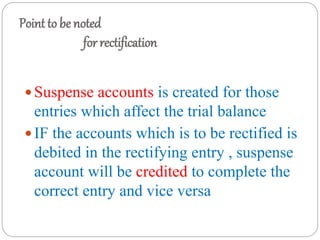

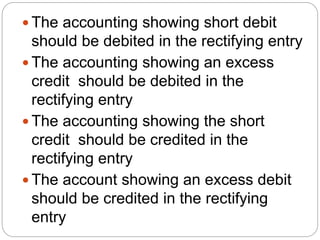

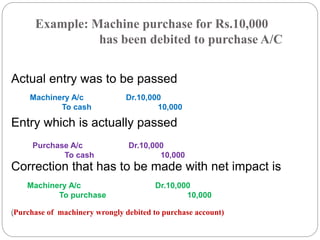

Rectification is the process of correcting accounting mistakes. Errors occur due to ignorance of accounting rules and can be unintentional. To rectify errors, the incorrect entry is reversed and the correct entry is passed. A suspense account is created to balance entries that affect the trial balance. The account showing a short debit or excess credit is debited in the rectifying entry, while the account showing a short credit or excess debit is credited. An example shows machinery purchased for Rs. 10,000 was incorrectly debited to the purchase account instead of the machinery account. The rectifying entry debits machinery and credits purchase to correct the mistake.