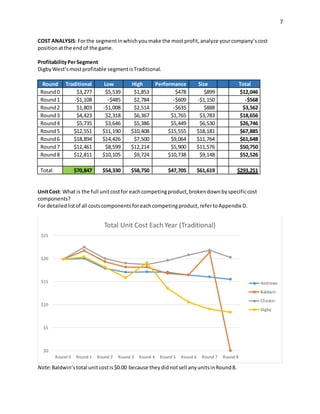

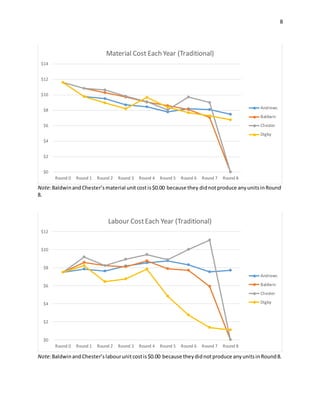

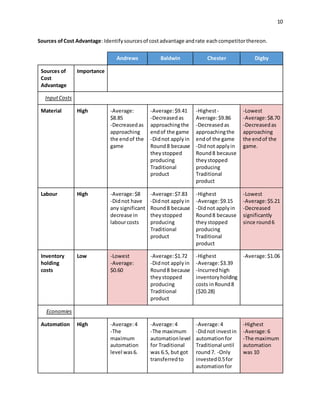

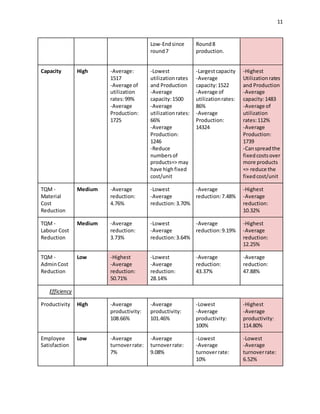

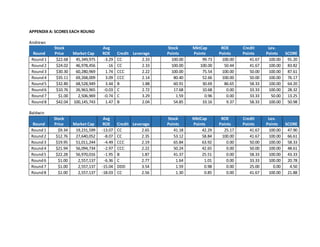

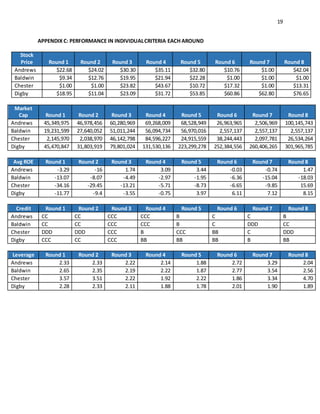

This document analyzes Team Digby West's performance over 8 rounds of simulation. Digby West performed best in the Traditional segment, with profits of $70.8 million. At the end of the game, Digby West had the lowest unit costs in the Traditional segment, with average material costs of $8.70 and labor costs of $5.21. Digby West had several sources of cost advantage, including the highest automation levels, largest production capacity, and greatest productivity increases. While Digby West's initial strategy remained largely the same, investments in R&D, marketing, production, and TQM allowed it to maintain leadership in key segments and optimize performance over the 8 rounds.