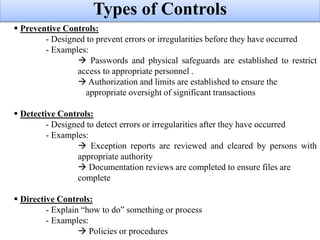

The document discusses internal controls and risk assessment. It provides information on key components of management's assessment of internal control, the nature of risk, types of internal risks, factors that affect risk, types of controls, and how internal controls can promote reliable financial reporting, safeguard assets, and help achieve targets and compliance. Some of the 10 reasons for fraud occurring are also listed.