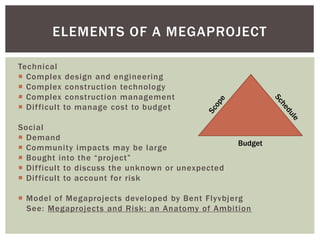

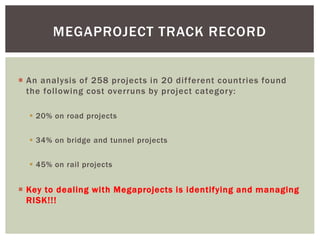

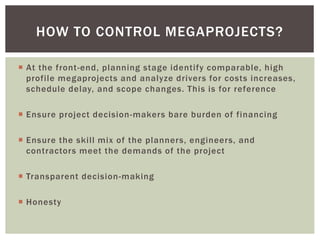

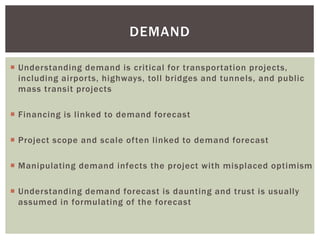

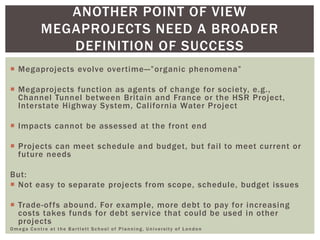

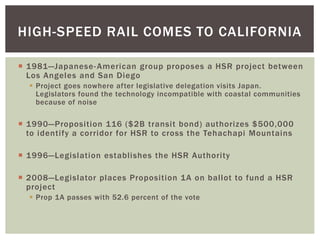

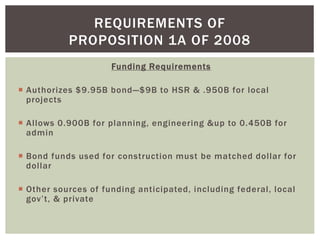

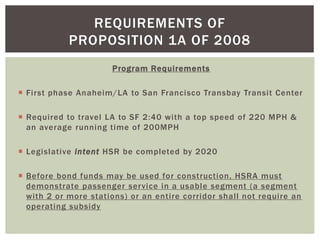

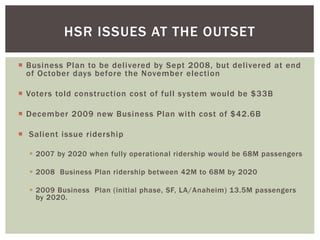

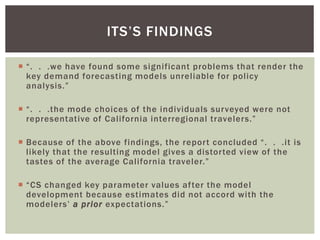

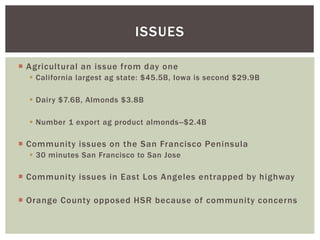

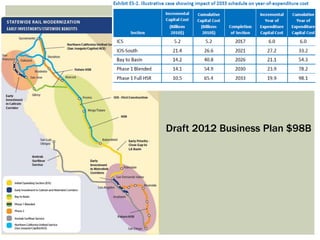

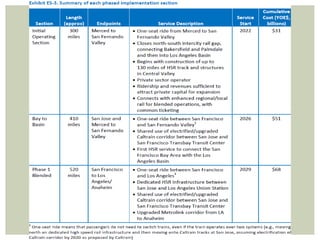

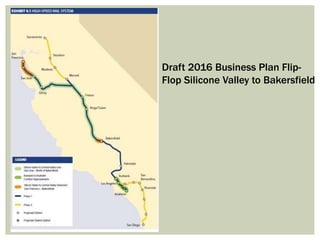

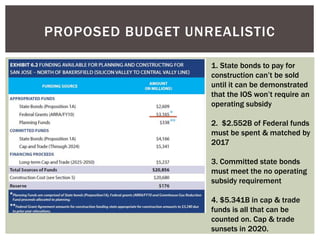

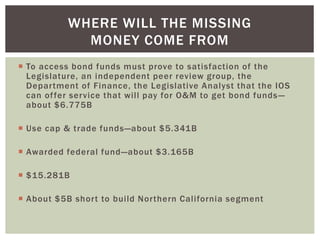

This document summarizes a presentation about megaprojects and the California high-speed rail project. It defines megaprojects as projects costing $1 billion or more that face challenges in development, planning, management, and risks. The presentation focuses on the California high-speed rail project, discussing elements of megaprojects like technical complexity, social impacts, and budget issues. It also outlines the history and ongoing challenges of the rail project, including cost increases, routing conflicts, and securing sufficient funding.