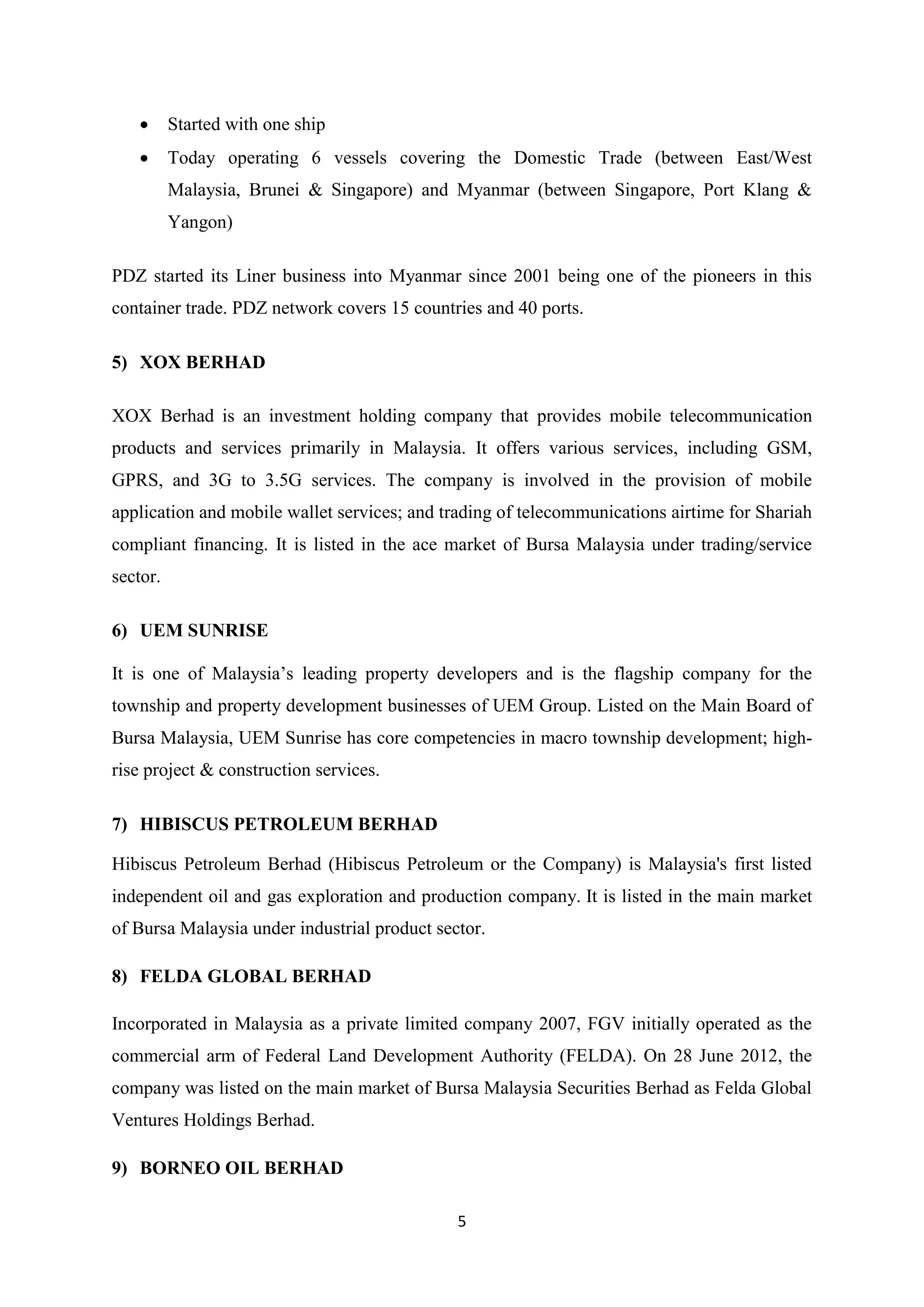

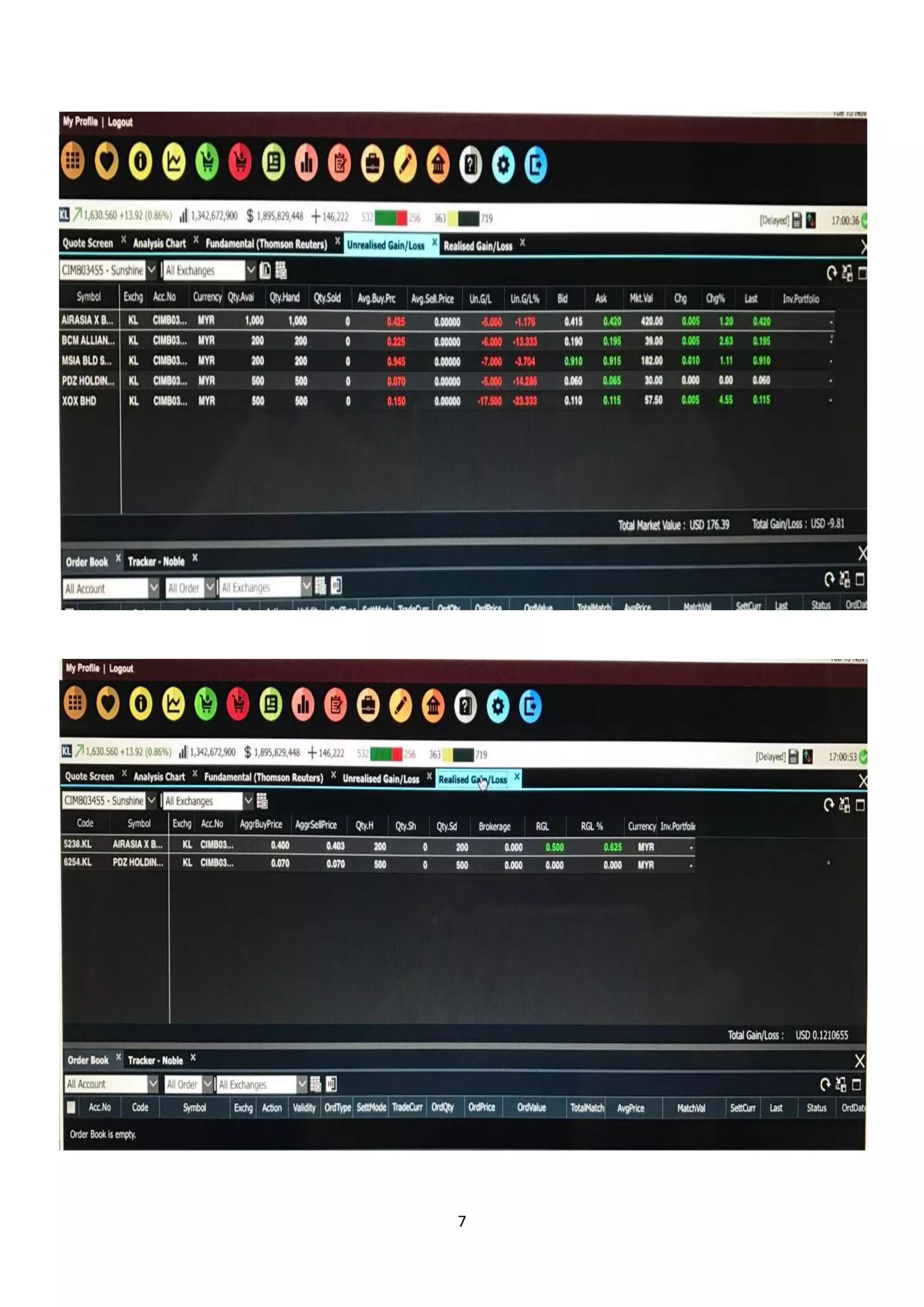

The document outlines a project report on the CIMB ASEAN Stock Challenge 2016, where a group of university students participated in a simulated stock trading competition with a virtual capital of $80,000. The report details the team's stock portfolio, their investment in nine stocks listed on Bursa Malaysia, and factors influencing their buying decisions. Overall, while they experienced minimal gains and some losses during the competition, the challenge provided a valuable learning experience in stock trading for first-time participants.