Embed presentation

Downloaded 11 times

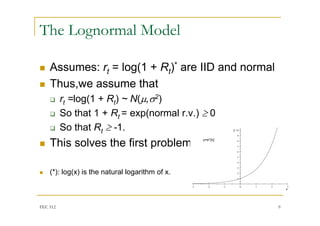

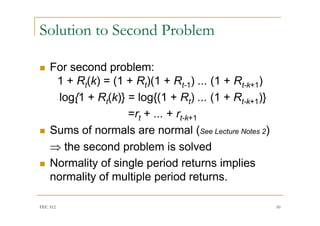

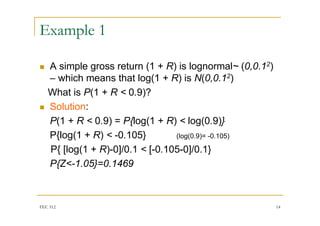

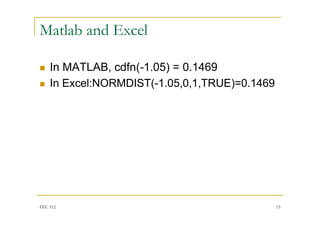

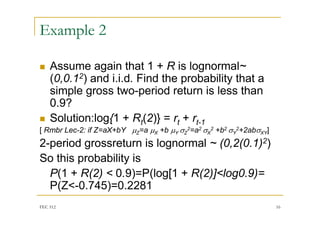

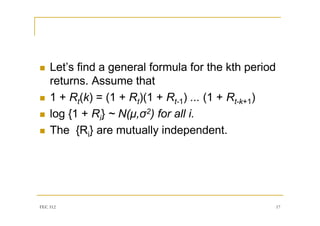

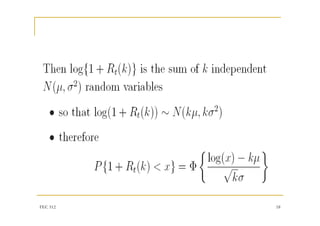

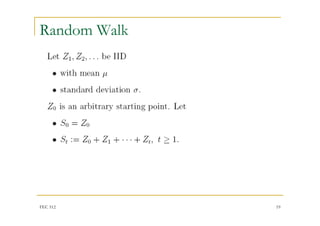

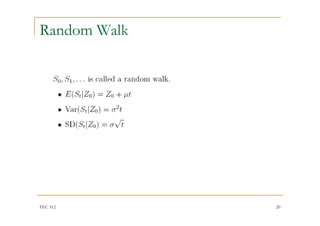

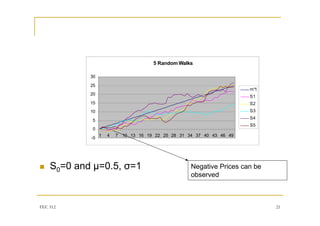

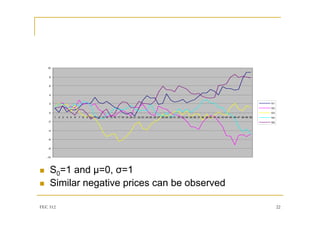

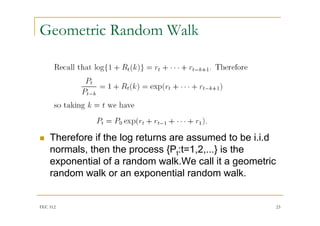

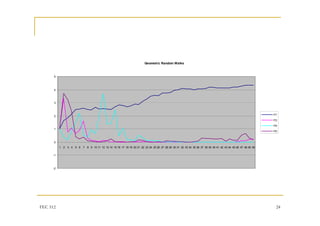

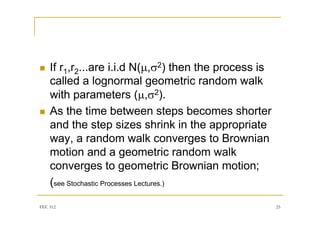

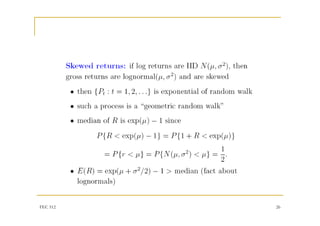

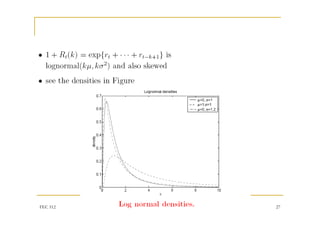

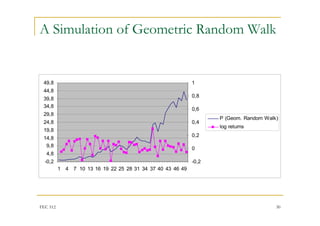

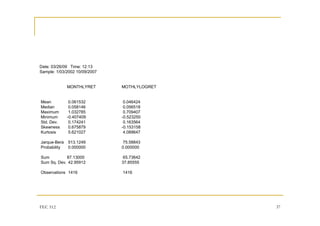

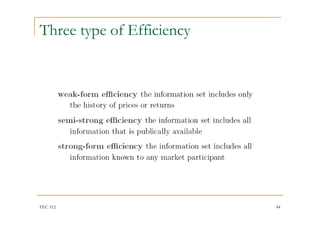

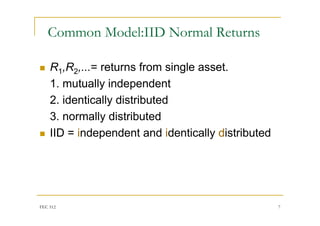

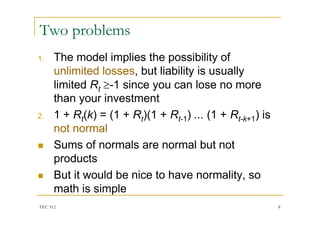

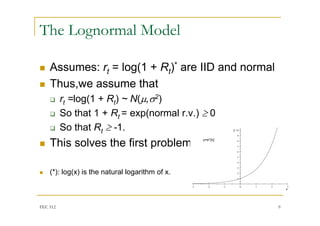

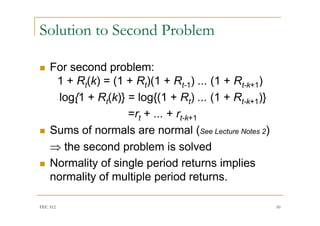

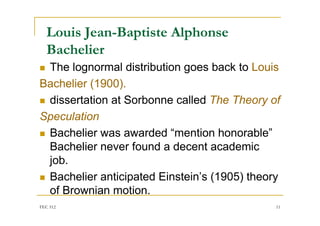

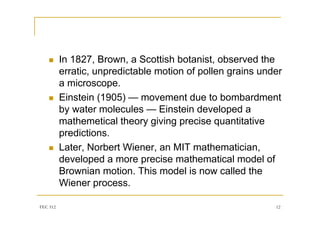

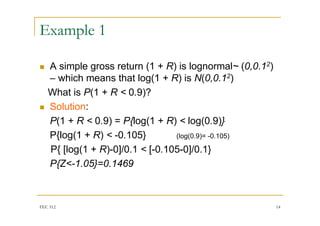

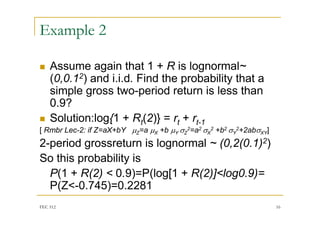

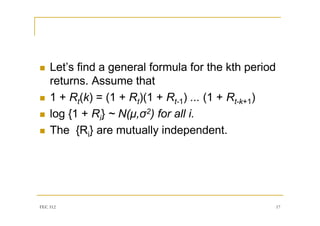

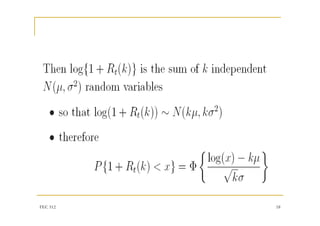

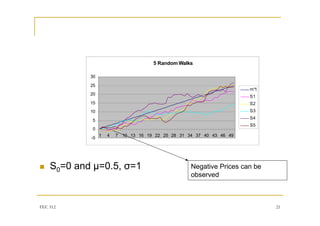

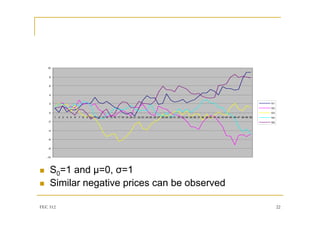

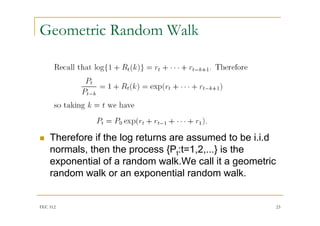

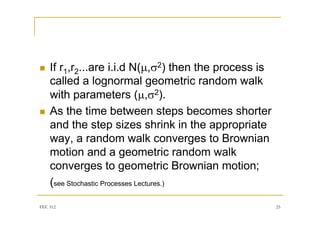

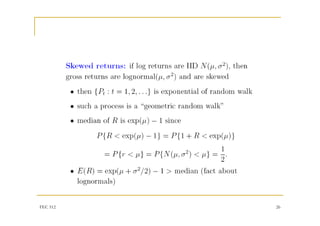

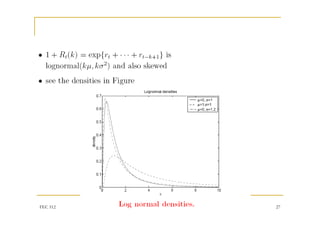

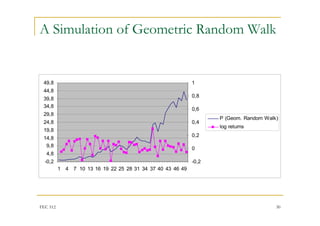

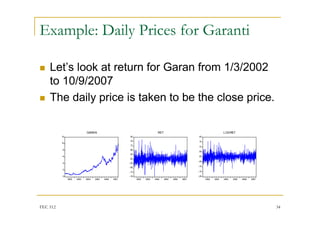

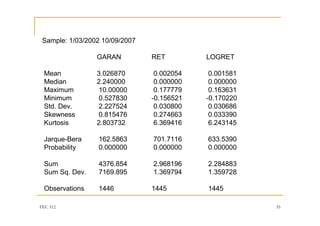

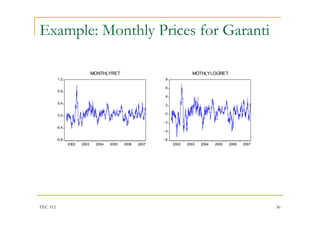

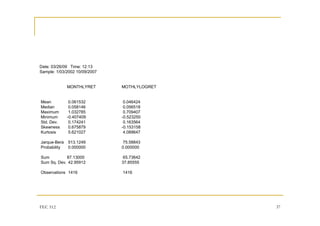

1. Returns on assets cannot be perfectly predicted and are essentially random. Ancient Greeks attributed randomness to gods or fate rather than understanding statistical properties. 2. Probability theory developed from gambling during the Renaissance and distinguishes measurable uncertainty from unmeasurable uncertainty in finance where probabilities are unknown. 3. Models of asset returns typically assume returns are independent and identically distributed over time in a normal or lognormal distribution, though these assumptions have limitations.