Embed presentation

Download to read offline

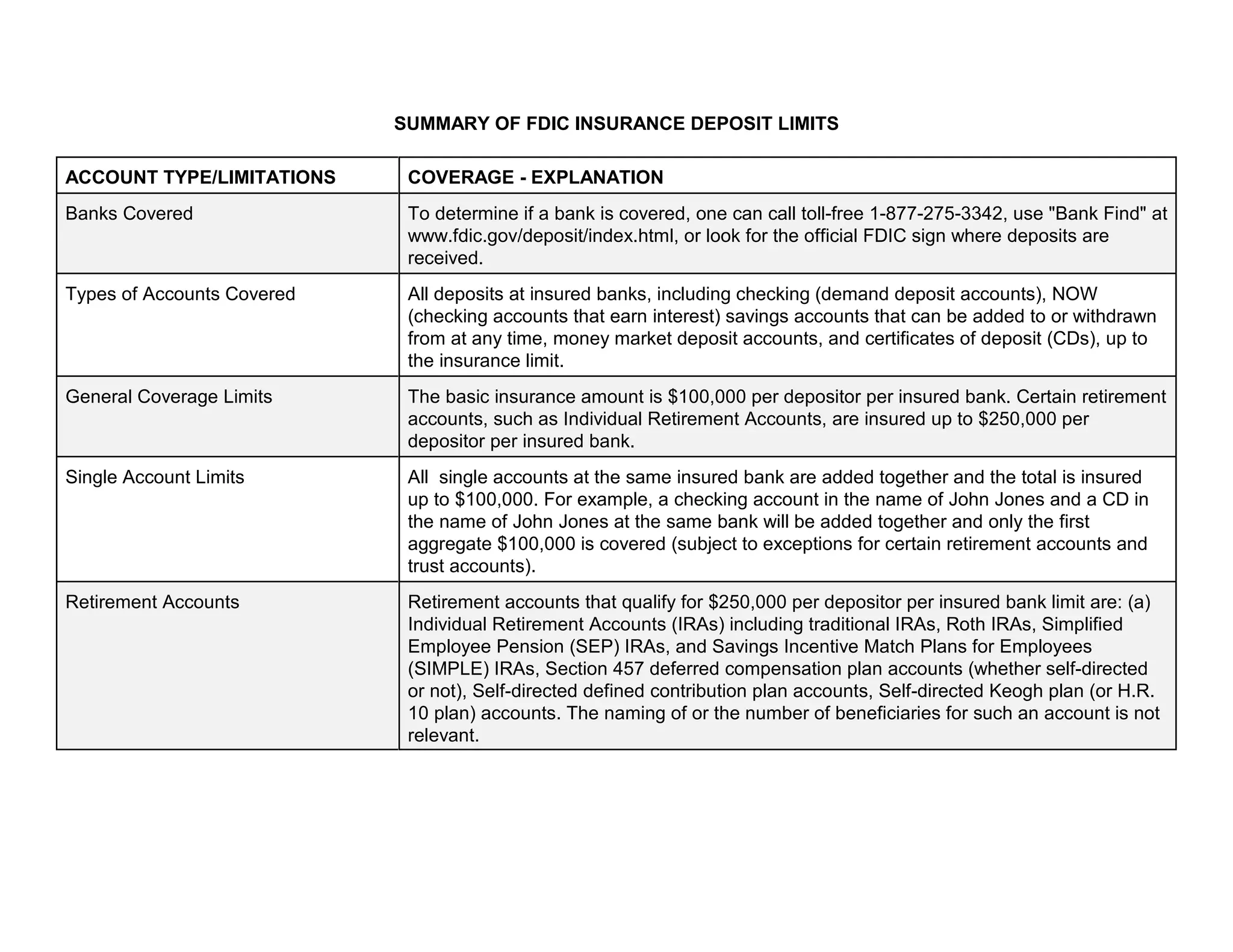

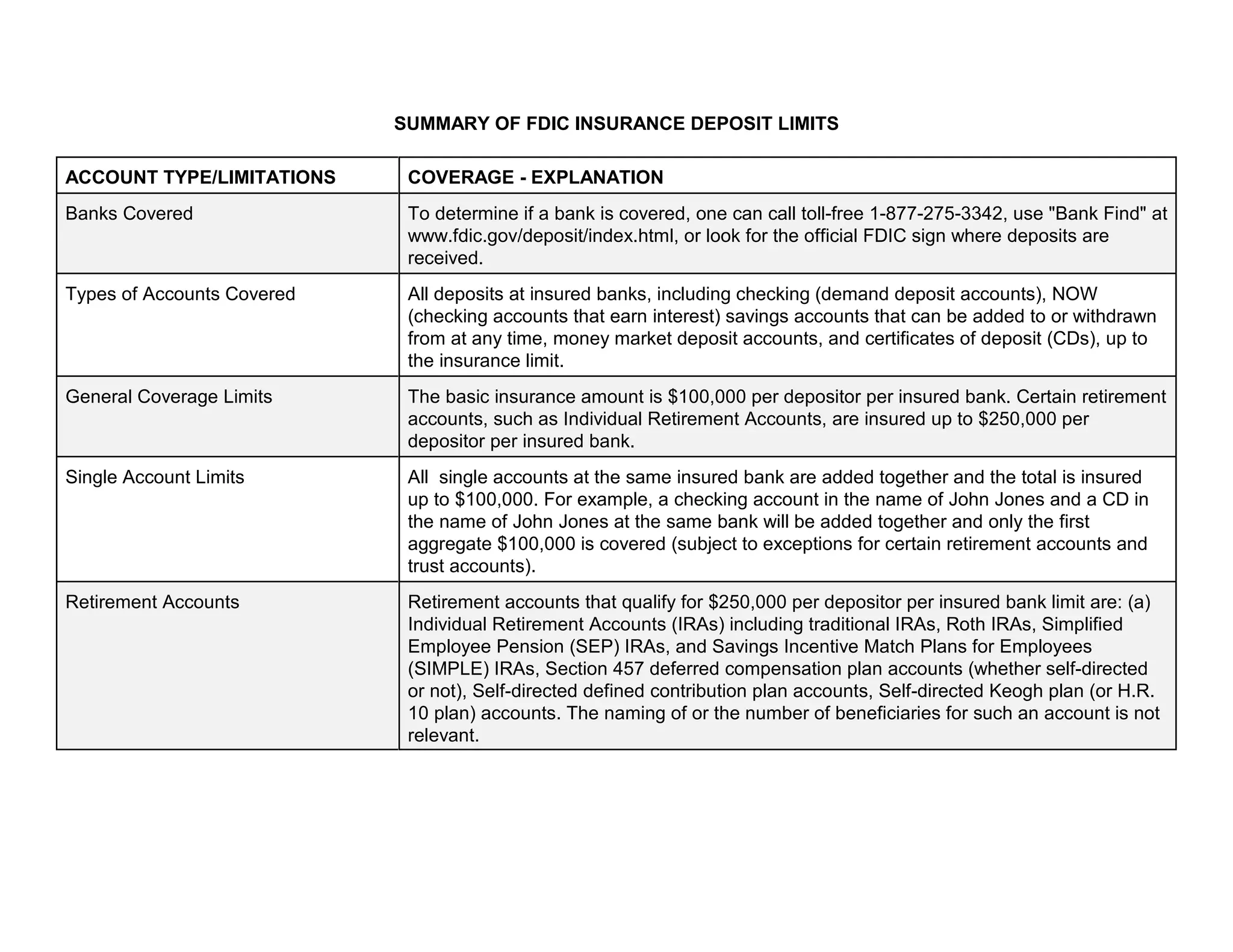

The FDIC insures bank deposits up to $100,000 per depositor per insured bank. Certain retirement accounts are insured up to $250,000. For joint accounts, the insurance is calculated by allocating equal shares to each owner, up to $100,000 per owner. Payable on death and revocable trust accounts provide $100,000 coverage per beneficiary. Irrevocable trust accounts are insured separately for each beneficiary, up to $100,000 per beneficiary. A depositor can receive insurance for single accounts, joint accounts, and trust/POD accounts, up to $100,000 in each category.