Embed presentation

Download to read offline

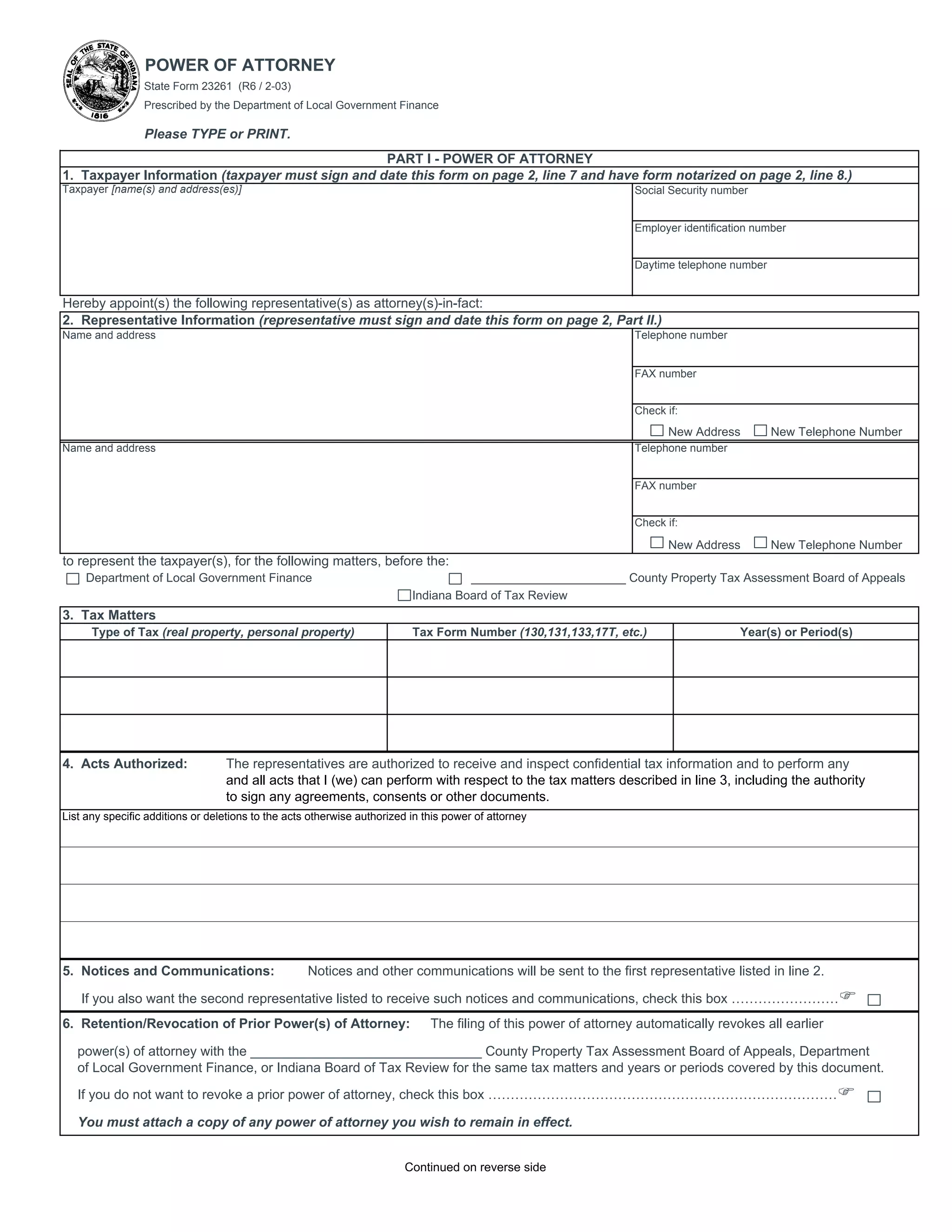

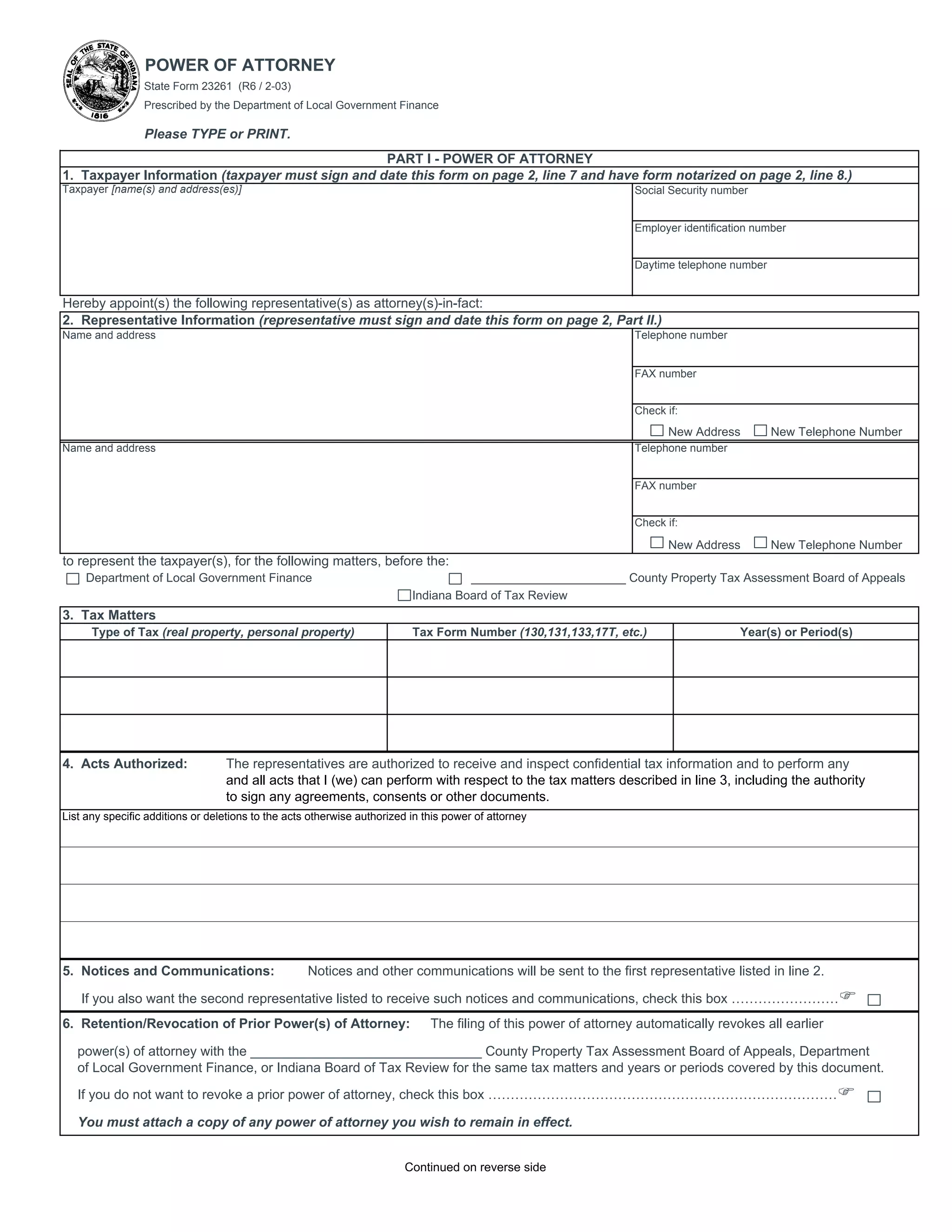

This document summarizes: 1) A power of attorney form appointing representatives to act on behalf of a taxpayer for certain tax matters before various Indiana tax authorities. 2) It provides spaces for taxpayer and representative contact information as well as details of the tax matters, years involved, and specific authorizations granted. 3) The taxpayer must sign and date the form which is also required to be notarized. Representatives must sign a declaration certifying their authority to represent the taxpayer.