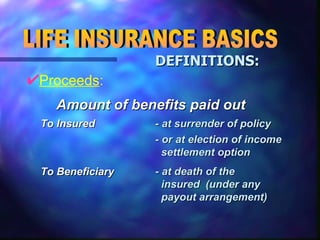

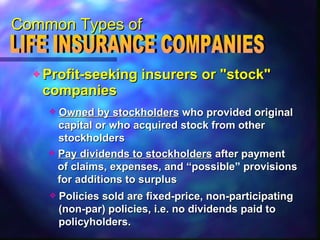

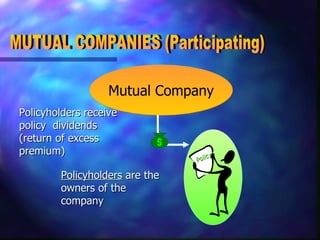

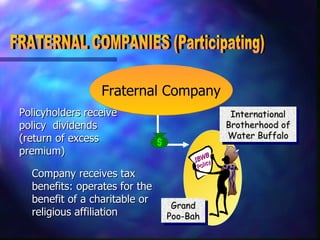

This document defines key terms related to life insurance. It explains that life insurance is a contract where one party agrees to compensate another for a specified loss, such as death. The beneficiary is the person named to receive life insurance proceeds. Premiums are the amounts paid for an insurance contract. The document also outlines the main types of life insurance companies, including stock companies that pay dividends to shareholders, mutual companies that return dividends to policyholders, and fraternal companies that receive tax benefits for charitable affiliations.