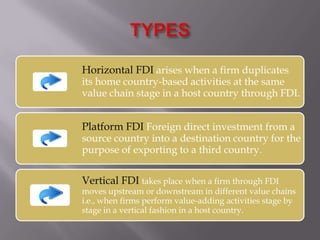

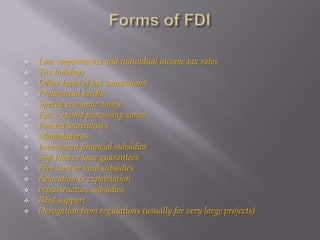

FDI refers to direct investment into a foreign country by buying an existing company or expanding operations. It contrasts with portfolio investment in public stock/bonds. Horizontal FDI duplicates home activities abroad. Platform FDI exports to third countries from a host. Vertical FDI moves through different value chain stages. FDI can bring equipment, technology, jobs, and contribute to exports, but may also crowd local industry and conflict with laws/culture. Investors acquire foreign companies through shares, mergers, joint ventures, or subsidiaries. Host countries use tax breaks, zones, loans to attract FDI based on profitability, costs, economic conditions, and policies.