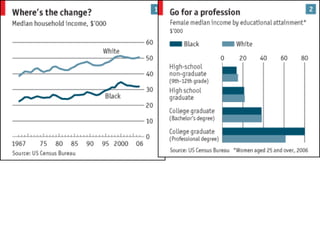

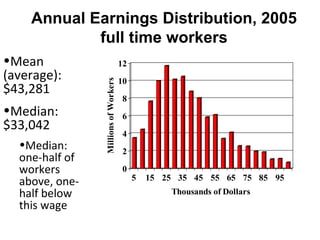

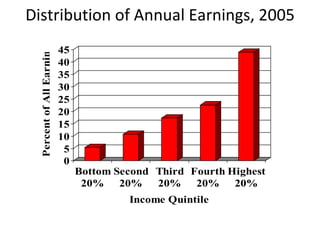

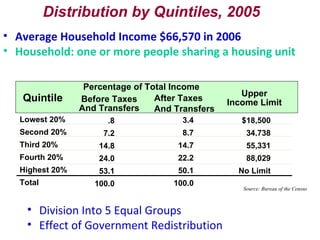

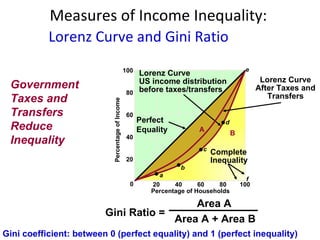

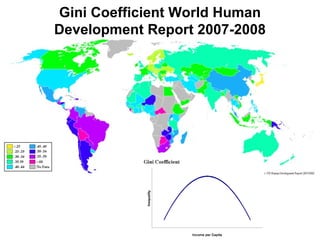

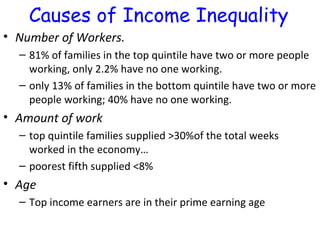

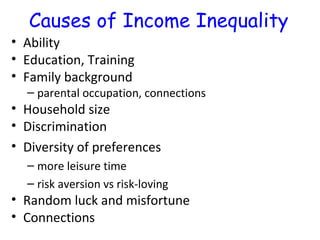

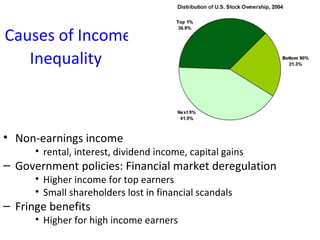

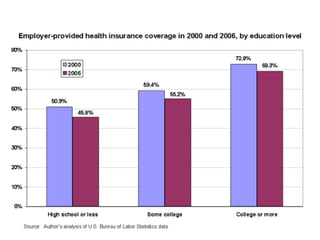

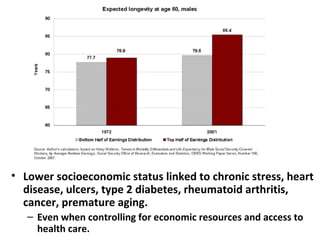

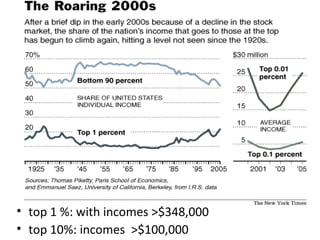

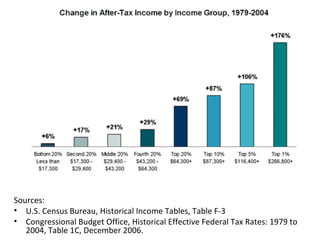

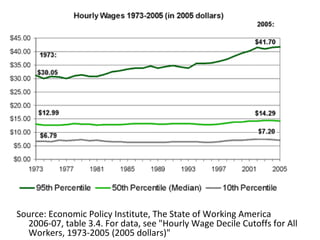

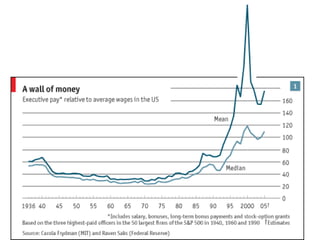

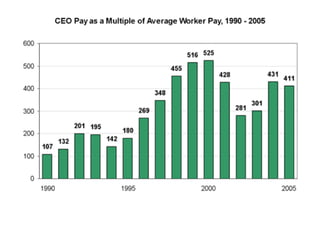

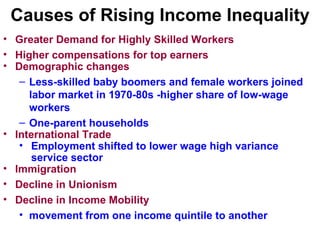

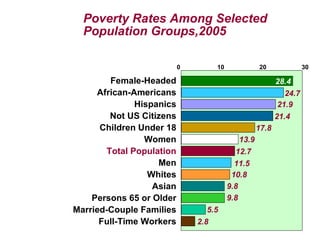

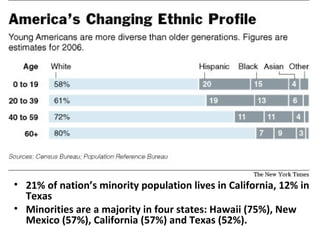

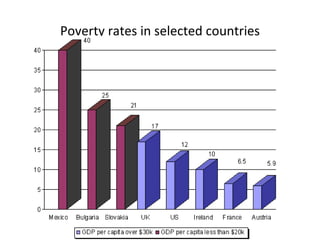

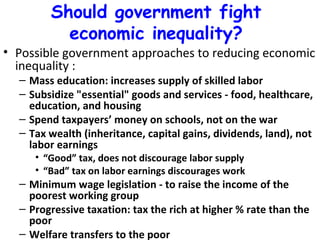

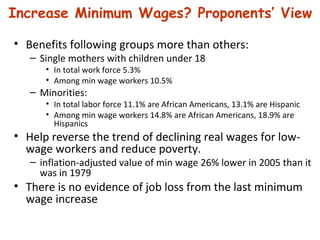

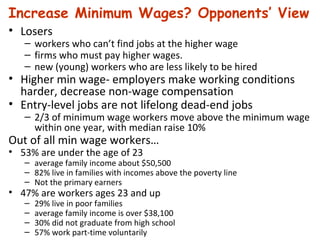

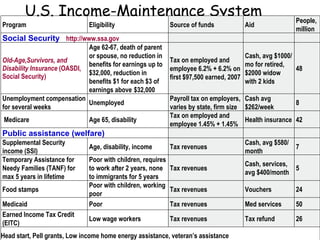

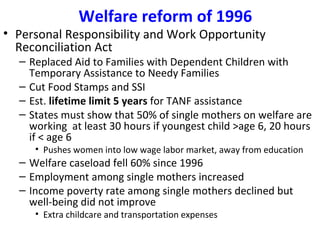

The document discusses income inequality and the government's role in addressing it. It provides data showing disparities in income distribution in the US and how government taxes and transfers help reduce inequality. It also examines causes of inequality like differences in skills, education and household size, and debates around minimum wage laws and welfare programs.