Income and Wealth Inequality in the United States

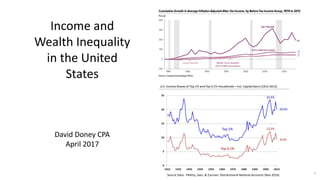

- 1. Income and Wealth Inequality in the United States David Doney CPA April 2017 1Source Data: Piketty, Saez, & Zucman: Distributional National Accounts (Nov 2016)

- 2. 2 Income and Wealth Inequality in the U.S. 1. Introduction 2. Causes of Income Inequality 3. Tax Policies 4. Wealth Inequality 5. Debating Inequality

- 3. Summary 1. Income inequality refers to a disproportionate share of the income going to relatively few. 2. Income and wealth inequality have steadily worsened since 1980, after a period of relative equality 1950-1979. 3. The top 1% of income earners had about 20% of the pre-tax income in 2014, versus 10% prior to 1980. 4. At 1979 levels of equality, the bottom 80% would be getting $11,000 more per year in pre-tax income. 5. The U.S. is roughly 30th percentile globally, meaning 70% of countries have a more equal income distribution. 6. Income inequality may slow economic growth, increase political polarization, and produce social unrest. 7. There are many causes of inequality; it is a by-product of our global economic system and policy choices. 8. An important differentiator between the middle-class and lower incomes is a college degree. 9. Tax policy choices since 1980 have reduced effective tax rates on higher income persons and corporations overall, although tax increases under Presidents Clinton and Obama offset some of the trend. 10. Solutions can be focused on making the distribution of income more equitable before- or after-tax. 11. Examples of pre-tax solutions include raising the minimum wage, stronger unions, protectionism, and reduced low-skill immigration. These affect market outcomes. 12. After-tax solutions include raising taxes on higher incomes, combined with transfers to lower income persons. For example, ACA/Obamacare raised taxes on the top 5% to fund subsidies and Medicaid for lower income persons. 13. U.S. household and non-profit wealth reached a record $93 trillion in 2016, yet recent gains go mainly to the wealthy. 14. Wealth is distributed more unequally than income, with the top 1% owning 42% of the wealth vs. 24% in the 1970’s. 15. Higher corporate profits relative to GDP combined with increasing levels of stock buybacks and dividends are major drivers of wealth inequality, as the top 5% wealthiest own about 70% of the financial assets. 16. Government action to reduce inequality is supported by a majority of Democrats but a minority of Republicans. 3

- 4. 4CBO: The Distribution of Household Income and Federal Taxes, 2013 +188% +63% +18% Since 1980, income growth has primarily gone to the top 1%

- 5. Source: Piketty, Saez, Zucman: Distributional National Accounts (Nov 2016) 5 20% 12% Share of pre-tax income by income group The top 1% now have about 20% of the pre-tax income, versus 10% in 1980. The bottom 50% now have 12% of the pre-tax income, versus 20% in 1980. Income inequality statistics tend to lag about 2 years, due to availability of source data.

- 6. What does this shift mean for families? If the United States shifted income away from the top 1% so that we had the 1979 income distribution: The bottom 99% of families would each get $7,000 more in annual pre-tax income (or) The bottom 80% of families would each get $11,000 more in annual pre-tax income Source: Larry Summers “Focus on growth for the middle class” Washington Post. ( January 2015) NYT: Eduardo Porter-Rethinking the Rise of Inequality (Nov 2013) 6

- 7. Economic & Political Impact of Inequality Slower economic growth Higher income households spend lower proportion of income Consumption might be 5% higher ($1 trillion/year) with 1979 inequality Higher household debt & risk of financial crises Indebted households spend less and are at greater risk of defaulting on debts Social Security financing / budget deficit More income above taxable threshold ($127,200 in 2017) not taxed Political Impact Polarization: Two electorates / Two economies Social unrest Reduced opportunity Higher inequality corresponds with reduced income mobility (“Great-Gatsby Curve”) Alan Krueger “Chairman Alan Krueger discusses the rise and consequences of inequality…” (January 2012) https://www.whitehouse.gov/blog/2012/01/12/chairman-alan-krueger-discusses-rise-and-consequences-inequality-center-american-pro 7

- 8. Miles Corak https://milescorak.com/2012/01/12/here-is-the-source-for-the-great-gatsby-curve-in-the-alan-krueger-speech-at-the-center-for-american-progress/ “Great Gatsby” Curve As income inequality worsens, so does income mobility across generations (e.g., children tend to remain in same income group as parents) 8 Less Income Mobility More unequal

- 9. How Important is Solving the Problem? 9 “I believe this is the defining challenge of our time: Making sure our economy works for every working American. ” “But we know that people’s frustrations run deeper than these most recent political battles. Their frustration is rooted in their own daily battles -- to make ends meet, to pay for college, buy a home, save for retirement. It’s rooted in the nagging sense that no matter how hard they work, the deck is stacked against them. And it’s rooted in the fear that their kids won’t be better off than they were. They may not follow the constant back-and-forth in Washington or all the policy details, but they experience in a very personal way the relentless, decades-long trend that I want to spend some time talking about today. And that is a dangerous and growing inequality and lack of upward mobility that has jeopardized middle- class America’s basic bargain -- that if you work hard, you have a chance to get ahead.” President Barack Obama “Remarks by the President on Economic Mobility” December 4, 2013

- 10. Inequality is a Moral, Political and Economic Issue 10 Pope Francis denounces “trickle down” economic theories…” Washington Post. November 2013 / Pope Francis Evangelii Gaudium - November 2013 53. Just as the commandment “Thou shalt not kill” sets a clear limit in order to safeguard the value of human life, today we also have to say “thou shalt not” to an economy of exclusion and inequality. Such an economy kills. How can it be that it is not a news item when an elderly homeless person dies of exposure, but it is news when the stock market loses two points? This is a case of exclusion. Can we continue to stand by when food is thrown away while people are starving? This is a case of inequality. Today everything comes under the laws of competition and the survival of the fittest, where the powerful feed upon the powerless. As a consequence, masses of people find themselves excluded and marginalized: without work, without possibilities, without any means of escape. Human beings are themselves considered consumer goods to be used and then discarded. We have created a “throw away” culture which is now spreading. It is no longer simply about exploitation and oppression, but something new. Exclusion ultimately has to do with what it means to be a part of the society in which we live; those excluded are no longer society’s underside or its fringes or its disenfranchised – they are no longer even a part of it. The excluded are not the “exploited” but the outcast, the “leftovers”. 54. In this context, some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting. To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people’s pain, and feeling a need to help them, as though all this were someone else’s responsibility and not our own. The culture of prosperity deadens us; we are thrilled if the market offers us something new to purchase. In the meantime all those lives stunted for lack of opportunity seem a mere spectacle; they fail to move us.

- 11. 11 Income and Wealth Inequality in the U.S. 1. Introduction 2. Causes of Income Inequality 3. Tax Policies 4. Wealth Inequality 5. Debating Inequality

- 12. Source: Inequality for All - Graphics Package http://inequalityforall.com/resources/#/ 12 Income of Top 1% over Long-Run “Great Moderation” (1945-1980) Stronger unions Moderate executive pay norms Higher real minimum wage Limited immigration Less international competition Higher income tax rates on rich

- 13. “Why is inequality rising? There is some disagreement about this and also some nuance as to exactly which aspect of inequality we're talking about and what kind. Some of the most prominent accounts: Skill-biased technological change. Technological improvements raise incomes, but they do so unevenly. Rewards disproportionately go to highly educated workers. On this view, rising inequality reflects slowing educational progress and better schooling is the key solution. This has been the traditionally dominant view in economics, but it doesn't explain the specific rise of the top 1 percent very well. Immigration. Importing low-skilled workers to do low-paid jobs tends to raise measured income inequality. David Card estimates immigration to be the cause of about 5 percent of the total rise in inequality. Decline of labor unions. Labor unions reduce inequality both by raising wages at the low end and constraining them at the high end. Bruce Western and Jake Rosenfeld estimate that the decline of labor unions as a force in the American economy is responsible for 20 to 33 percent of the overall rise in inequality. Trade. Growing international trade with lower-wage countries such as China seems to have reduced the wage share of overall national income, boosting the incomes of people with large stock holdings. Superstar effects. Because the world is bigger and richer in 2014 than it was in 1964, being a "star" performer — the most popular athlete, author, or singer — is more lucrative than it used to be. Executives and Wall Street. Increased incomes for CEOs and financial sector professionals account for 58 percent of the top 1 percent of the income distribution and 67 percent of the top 0.1 percent. So the specific dynamics of compensation in those areas are wielding a big influence. Minimum wage. David Autor, Alan Manning, and Christopher Smith find that about a third (or possibly as much as half) of the growth in inequality between the median and the bottom ten percent is due to the declining real value of the minimum wage. This is different from the issues about the top end pulling away that normally dominate political discussions of inequality, but it's a noteworthy finding nonetheless. The fundamental nature of capitalism. Thomas Piketty has made waves lately with his new book Capital in the 21st Century, which argues that very high levels of inequality are the natural state of market economies. In his view, it's the economic equality of the mid-twentieth century that needs explaining, not today's inequality.” 13 VOX: Why is Inequality Rising? Source: VOX-Everything You Need to Know About Income Inequality

- 14. Union membership rate fell from 20.1% in 1983 to 11.% in 2015. “Public-sector workers had a union membership rate (35.2 percent) more than five times higher than that of private- sector workers (6.7 percent).” “Median weekly earnings of nonunion workers ($776) were 79 percent of earnings for workers who were union members ($980).” 14 Source: BLS “Union Members Summary” (2015) Income Inequality and Union Membership (1918-2008) Economic Policy Institute (EPI) Newsletter: Unions and Shared Prosperity http://www.epi.org/news/union-membership-declines-inequality-rises/ Top 10% income share Union participation

- 15. “Superstar hypothesis” argues similar premium for very top performers in multiple fields. CEO Pay: http://www.epi.org/publication/ceo-and-worker-pay-in-2015/ The Economist, “Who Exactly are the 1%” (January 2012) 15

- 16. 16 Source: Wikipedia The real minimum wage has fallen relative to its peak during the Great Moderation

- 17. Source: 1997 Economic Report of the President 17 Labor Substitution: Immigration & Globalization Types of labor substitution Immigration Off-shoring / Sourcing overseas While immigrants increase the supply of labor, they also increase demand, leading to a variety of debates about impact Studies indicate low-skill immigrants may moderately reduce the wages of workers without high school educations, but do not increase native worker unemployment

- 18. Source: 1997 Economic Report of the President NYT Eduardo Porter “Rethinking the Rise of Inequality” (Nov 2013) 18 College Premium Through 1995 “In 1980 the median male college graduate earned roughly one-third more than the median male high school graduate, but this wage premium grew to over 70 percent by 1993.” “Since then that trend has slowed, and the ratio even declined slightly in 1995.” Separate study (Lemieux 2010) estimated that 60% of the change in wage inequality between 1973 and 2005 due to college premium. But does it explain the top 1%? 1.7 1.3

- 19. 19Source: NYT: Eduardo Porter-Rethinking the Rise of Inequality (Nov 2013) While the college premium contributed to worsening inequality 1970-2000, it leveled off and was not a major contributor to further increases thereafter. It does not explain why the 1% are leaving the other college- educated population behind. College Premium Through 2011

- 20. 20 Why is Inequality Rising? Source: VOX-Everything You Need to Know About Income Inequality •Lax anti-trust enforcement •Anti-union laws •Income tax cuts •Real minimum wage declines •Exec pay norms changed •Superstar effects •College premium •Labor force participation proportional to education •Trade / Offshoring •Low-skill immigration •Decline of unions Global Competition Education Policy / Deregulation Compensation Trends There are many theories about why inequality has worsened The reasons behind one income group separating from another vary For example, the college premium explains much of the difference in income between the middle and lower income groups Reasons for the 1% leaving others behind are a composite of nearly every factor, with executive pay a key element

- 21. 21 Income and Wealth Inequality in the U.S. 1. Introduction 2. Causes of Income Inequality 3. Tax Policies 4. Wealth Inequality 5. Debating Inequality

- 22. 22

- 23. 23

- 24. CBO: Top 1% received 12.4% of after-tax income in 2013, versus 7.4% in 1979. Source: CBO “Distribution of Household Income and Federal Taxes 2013” 24

- 25. U.S. income inequality is high but comparable to other developed nations before taxes and transfers, but the worst after. That is, we redistribute less. We are roughly 30th percentile globally, meaning 70% of countries have a more equal income distribution (Source: CIA World Factbook) Gini index ranges from: 0 (equal) to 1 (unequal) 25 Gornick & Milanovic Income Inequality in Cross-National Perspective (May 2015)

- 26. Source: NYT Who’s tax rates rose or fell? (April 2012) http://www.nytimes.com/imagepages/2012/04/13/opinion/sunday/0415web-leonhardt.html? Average tax rates for highest incomes cut dramatically since the 1960’s. 26

- 27. 27CBO: The Distribution of Household Income and Federal Taxes, 2013 2013: Obama allows Bush tax cuts to expire for top 1%

- 28. 28 ACA/Obamacare raised taxes on the top 5% and used it to fund transfers (subsidies) to lower income groups. Obama also allowed the Bush tax cuts of 2001 and 2003 to expire for the top 1%. These are examples of after- tax solutions for addressing income inequality. Source: CEA Economic Report of the President 2017

- 29. 29 CBO “The Distribution of Major Tax Expenditures in the Individual Income Tax System” (May 2013) Tax Expenditures (Top 10) Exclusions from taxable income Employer-sponsored health insurance Net pension contributions and earnings (401k) Capital gains on assets transferred at death A portion of Social Security and Retirement benefits Itemized deductions Certain taxes paid to state and local governments Mortgage interest payments Charitable contributions Preferential tax rates on capital gains and dividends Tax credits The earned income tax credit, and The child tax credit. Top 10: About $1 trillion per year impact on federal budget

- 30. 30CBO “The Distribution of Major Tax Expenditures in the Individual Income Tax System” (May 2013) 17% 13% 9% 12% 51%

- 31. 31 CBO “The Distribution of Major Tax Expenditures in the Individual Income Tax System” (May 2013) Major Tax Expenditures for the 1% in 2013 ($ Billions)

- 32. 32 Income and Wealth Inequality in the U.S. 1. Introduction 2. Causes of Income Inequality 3. Tax Policies 4. Wealth Inequality 5. Debating Inequality

- 33. Household Net Worth 2000-2016 33 Our economy is a tremendous wealth engine…but the distribution is highly uneven. The top 1% had 42% of the wealth in 2015, vs. 36% in 2007 and 24% in 1979 $93 trillion is about $700,000 / household on average, but bottom 50% average $11,000

- 34. 34 42%

- 36. Janet Yellen speech “Perspectives on Inequality and Opportunity…” (October 17, 2014) https://www.federalreserve.gov/newsevents/speech/yellen20141017a.htm 36 The Great Recession damaged highly- leveraged homeowners in particular Bottom 50% of households have an average net worth of $11,000.

- 37. Janet Yellen speech “Perspectives on Inequality and Opportunity…” (October 17, 2014) https://www.federalreserve.gov/newsevents/speech/yellen20141017a.htm 37 CBO: Family average wealth [2013] Top 10% = $4 million 51st to 90th = $316,000 26th to 50th = $36,000 0 to 25th = $13,000 in debt. CBO Trends in Family Wealth, 1989 to 2013 76% of income gains 2009- 2013 went to top 1%.

- 38. 38 Pew Center “The many ways to measure inequality” (September 22, 2015) http://www.pewresearch.org/fact-tank/2015/09/22/the-many-ways-to-measure-economic-inequality/

- 39. 39 Top 5% have 72% of the financial wealth (stocks & bonds) So stock market appreciation, dividends, and stock buybacks disproportionally benefit them Source: Who Rules America? G. William Donhoff (UC Santa Cruz)

- 40. 40 Corporate Profits (% GDP)

- 41. Buybacks and dividends are a major upward redistribution method for wealth More companies are doing stock buybacks, and in greater amounts Buybacks & dividends around $900B annualized rate in 2015 & early 2016 For scale, non-residential (business) investment was ~$2.2T in 2016 Top 5% own 72% of the financial assets Chart: Yardeni Research (January 2017) http://www.yardeni.com/Pub/buybackdiv.pdf William Lazonic “Profits without Prosperity” / HBR September 2014. https://hbr.org/2014/09/profits-without-prosperity 41

- 42. Source: Krugman / Wells Microeconomics 3rd edition 42 Is the “Free Market” always right? Output is higher and prices lower in perfect competition, which is better for consumers (labor) but less advantageous to capital (owners). As industries concentrate and deregulation weakens anti-trust enforcement, outcomes look more like oligopoly and monopoly than perfect competition, meaning prices are higher and output lower. In other words, we have market failure; regulation is required to get the optimal market outcome! This worsens inequality, as corporate profits are distributed to higher-income and wealth households.

- 43. 43 Income and Wealth Inequality in the U.S. 1. Introduction 2. Causes of Income Inequality 3. Tax Policies 4. Wealth Inequality 5. Debating Inequality

- 44. Debating Income Inequality “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.” -- Warren Buffett (2006) Ben Stein “In Class Warfare, Guess which class is winning?” NYT, Nov 2006. http://www.nytimes.com/2006/11/26/business/yourmoney/26every.html 44

- 45. Polls 45 Pew Center: “Most Americans say U.S. economic system is unfair…” (Feb 2016) http://www.pewresearch.org/fact-tank/2016/02/10/most-americans-say-u-s-economic-system-is-unfair-but-high-income-republicans-disagree/

- 46. Market Income “Pre-Distribution” Education (all ages) Retraining / Life-long learning Minimum wage Unions / labor power Limit labor substitution Profit sharing / 401k match Restrict buybacks and dividends Cultural shifts and awareness Addressing Income & Wealth Inequality After-Tax Income “Redistribution” Raise income tax rates on high incomes Minimum effective tax rate / “Buffett Rule” Remove cap on payroll tax Treat all sources of income similarly Reduce “tax expenditures” for wealthy Minimum effective tax rates Transfers Increase earned income tax credit Expand healthcare subsidies & Medicaid Medicare for All For wealth inequality Raise estate taxes Sovereign wealth fund 46

- 48. Statistical Summary Table 48 Note: CBO income inequality numbers typically show the same trends, but are different than the Piketty, Saez, & Zucman figures. See example in table for after-tax income share of top 1%.

- 49. Source: Piketty, Saez, Zucman: Distributional National Accounts (Nov 2016) 49

- 50. Sources 50 CBO: The Distribution of Household Income and Federal Taxes, 2013 https://www.cbo.gov/publication/51361 CBO: Trends in Family Wealth, 1989-2013 https://www.cbo.gov/publication/51846 VOX: Everything you need to know about income inequality http://www.vox.com/cards/income-inequality

Editor's Notes

- If there are 100 families in the U.S., the richest 1 family has $20. The other 99 families have $80 spread among them.

- Note similar graph pattern to union participation and minimum wage relative to inequality.

- Media, sports

- Globalized supply chains / container management / more routine transaction work overseas

- Why those without college degrees left behind

- Diagram through 2004, so Bush tax cuts

- Clinton tax hikes in the 1990’s reversed by Bush tax cuts; which were allowed to expire.

- Counter-arguments: Class warfare, tax flight, dislike of welfare (self-esteem, helping minorities), denial of existence of inequality or denial

- Counter-arguments: Class warfare, tax flight, dislike of welfare (self-esteem, helping minorities), denial of existence of inequality or denial