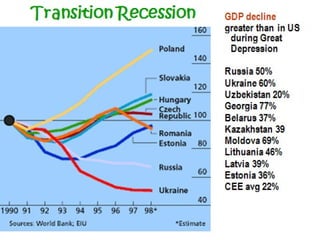

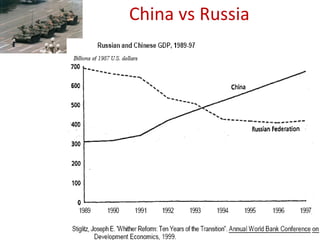

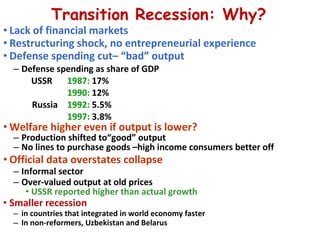

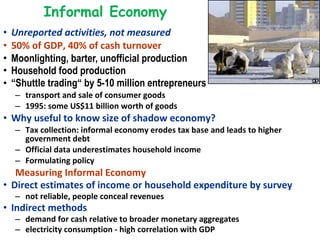

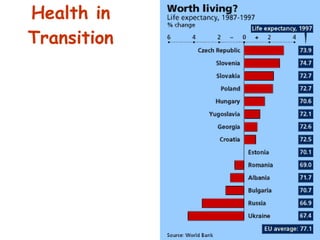

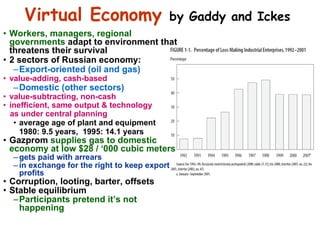

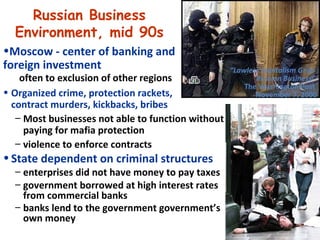

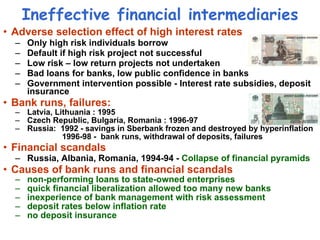

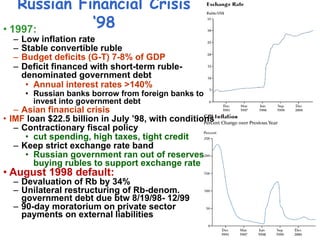

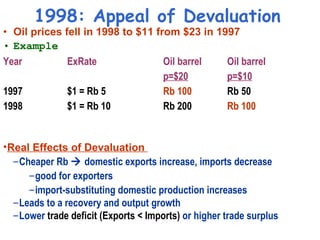

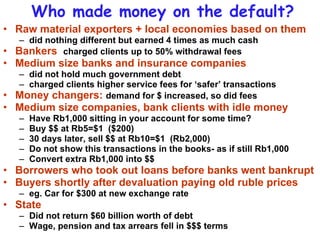

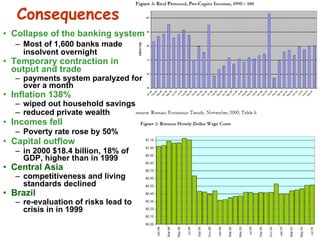

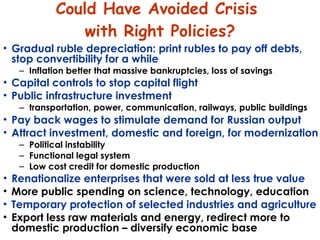

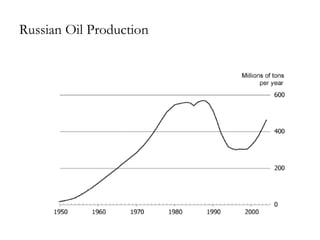

The document summarizes key economic challenges faced by post-Soviet states following the dissolution of the USSR in 1991. It discusses the recession in these countries due to factors like cuts to subsidies and declines in population income and trade. It also examines issues like high interest rates, lack of financial markets, monetary policy, defense spending cuts, and the shift from military to civilian production.