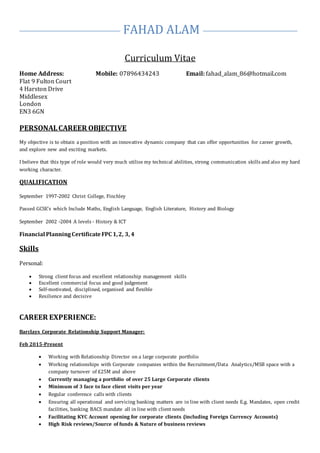

Fahad Alam has over 15 years of experience in banking, including his current role as a Corporate Relationship Support Manager at Barclays. He holds qualifications including GCSEs in various subjects and A Levels in History and ICT. Throughout his career, he has demonstrated strong client focus, relationship management skills, and a commercial focus. He has experience managing a large corporate client portfolio, facilitating account openings and reviews, and working cross-functionally within banks.