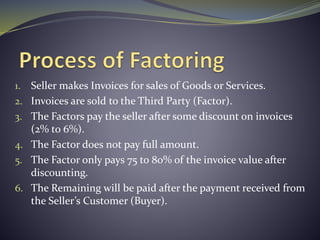

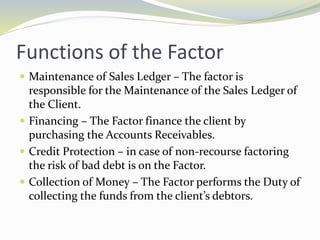

Factoring is a financial service where a business sells its accounts receivables to a third party called a factor at a discount in order to access cash flow. The factor pays the business upfront for the invoices less a discount fee, takes on the risk of unpaid invoices, and handles billing and collection from customers. There are different types of factoring arrangements like recourse, non-recourse, advance, and maturity factoring that determine who assumes credit risk and when payment is made. Factoring provides businesses with working capital and cash flow while transferring some credit and collection responsibilities to the factoring company.