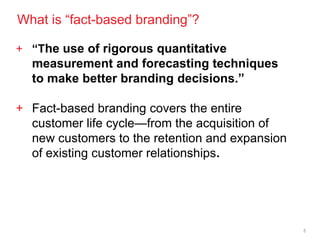

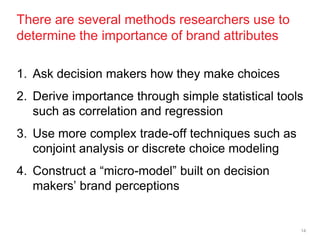

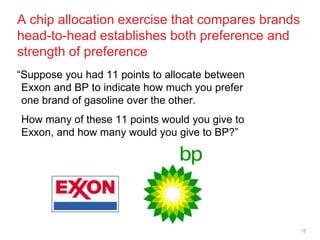

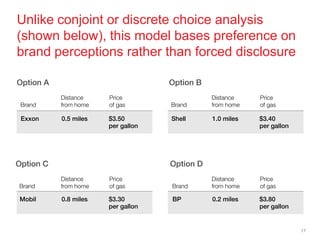

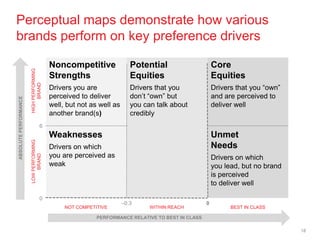

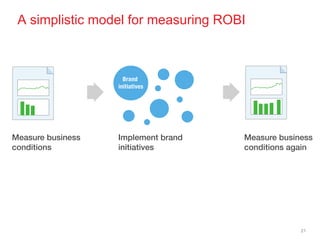

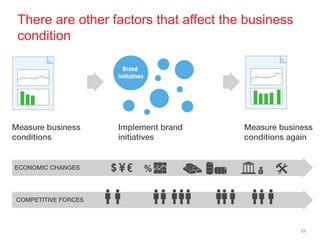

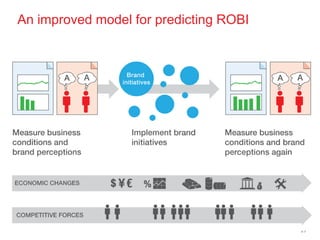

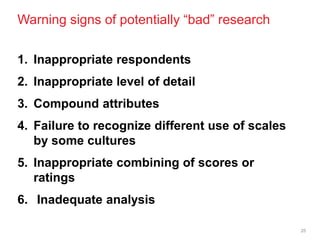

The document discusses fact-based branding, emphasizing the use of quantitative measurement to enhance branding decisions throughout the customer lifecycle. It outlines five key reasons to adopt this approach and explores methods to identify brand attributes and improve brand perception. Additionally, the document addresses potential pitfalls in research practices that may lead to flawed branding insights.