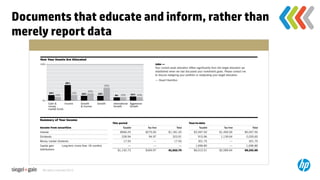

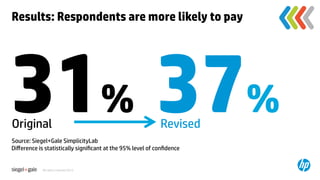

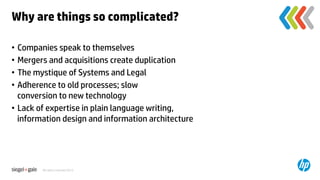

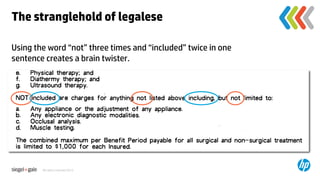

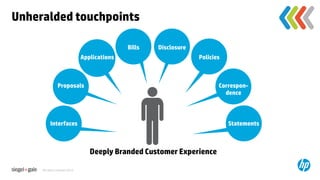

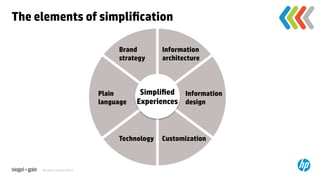

The document discusses the importance of simplifying customer experiences by addressing overlooked touchpoints and enhancing clarity in communication. It highlights how complexity in processes and legal language hinders customer understanding and suggests that simplification can serve as a competitive advantage. Examples of successful simplification strategies from various companies are provided, emphasizing the need for clear, straightforward communication in business practices.

![Insurance Score—clarifying a key concept across

multiple channels (After)

Call Center

Web

Printed Communications

“Allstate uses a number of factors to How do we determine your rates?

How we determine your premium

calculate insurance rates. The factors, To determine your premium we would In [State, Company] uses a secure computer program to pull information from

taken together, allow us to apply consider such factors as:

your credit history and produce an insurance score. Your insurance score is just

one component used in determining your auto tier. As the diagram show, Allstate

rates based on the likelihood that a • What type of car you drive: How old

considers your auto tier along with other information, such as [driving record/

loss may occur—similar to the way a is it? What safety features does it location of home/etc] to determine your premium group.

health questionnaire helps a life have?

insurance company predict losses and • Who drives the car: What is the age,

set rates. Over the years, we have driving record and gender of each

learned that certain credit driver?

information allows us to predict the • How you use the car: How far do you

likelihood of loss with great accuracy. drive? Do you use the car to commute

It is this group of loss-related factors or for pleasure? Where do you keep

that we consider from a credit report, (garage) your car?

Some of the items we consider in a typical customer’s credit history include the

not the credit score, nor a person’s We also consider your insurance score, number of credit accounts and the length of time you’ve maintained your credit

credit-worthiness.”

a calculation based on elements from accounts. We also consider your payment history and how often lenders have

your credit history. Over the years we’ve made inquiries into your credit report other than to make promotional offers.

found that including insurance scores These specific aspects of an individual’s credit history have been shown

helps us better predict the likelihood of by research and experience to indicate the likelihood of experiencing an

experiencing an insurance loss. This insurance loss.

helps us match our rates to the risk

we’re assuming.

All rights reserved 2012.](https://image.slidesharecdn.com/2012-hp-exstream-ietzkorn-bt-lg-120919140955-phpapp02/85/Best-Practices-in-Improving-Customer-Experience-by-Focusing-on-Overlooked-Touchpoints-18-320.jpg)