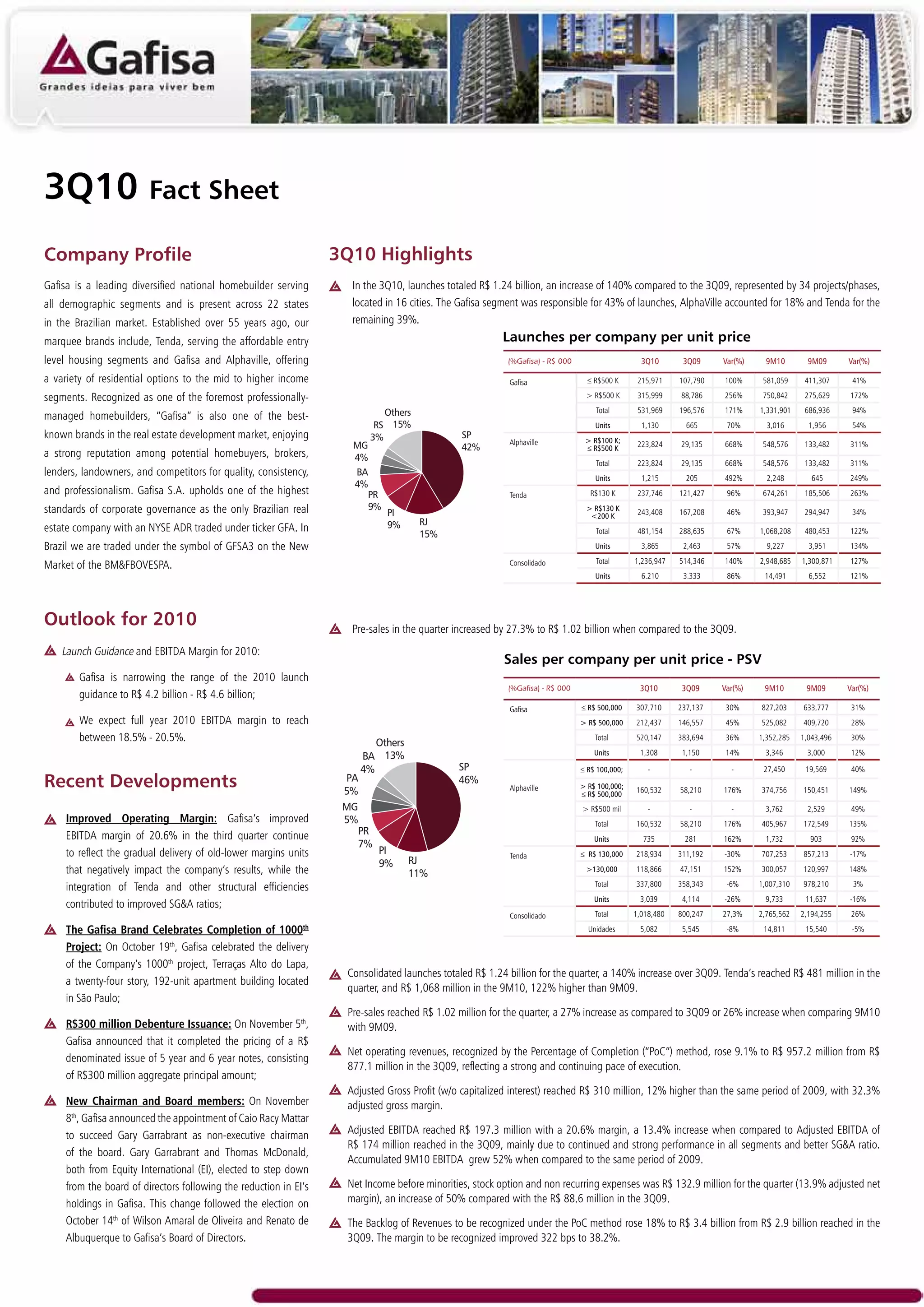

Gafisa reported strong financial results for 3Q10, with launches totaling R$1.24 billion, up 140% year-over-year. Pre-sales increased 27% to R$1.02 billion. Net income before minorities was R$132.9 million, up 50% from 3Q09. Gafisa delivered 16 projects representing R$300 million in PSV during the quarter. The company has a large national land bank of R$16.6 billion that will support continued growth.