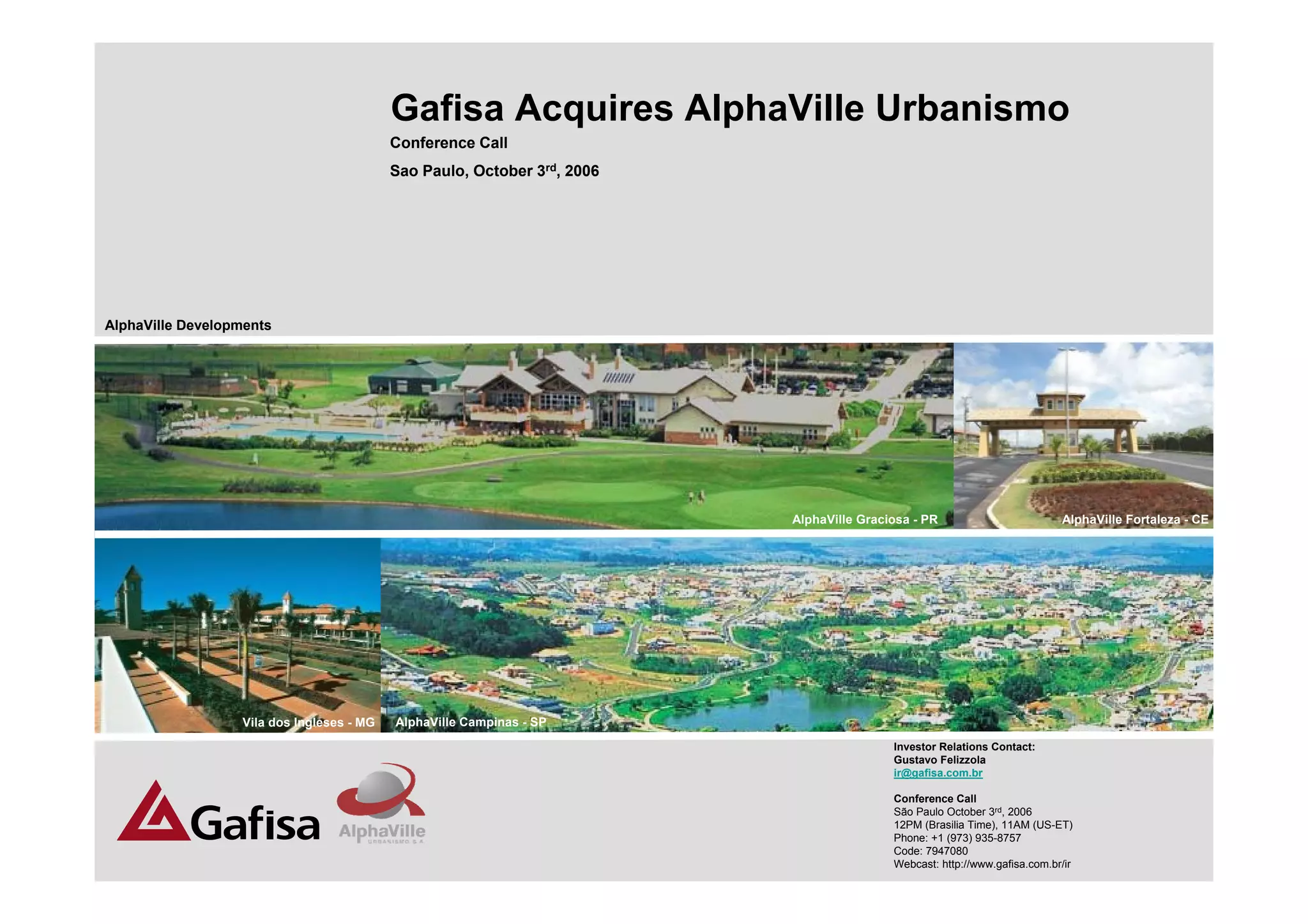

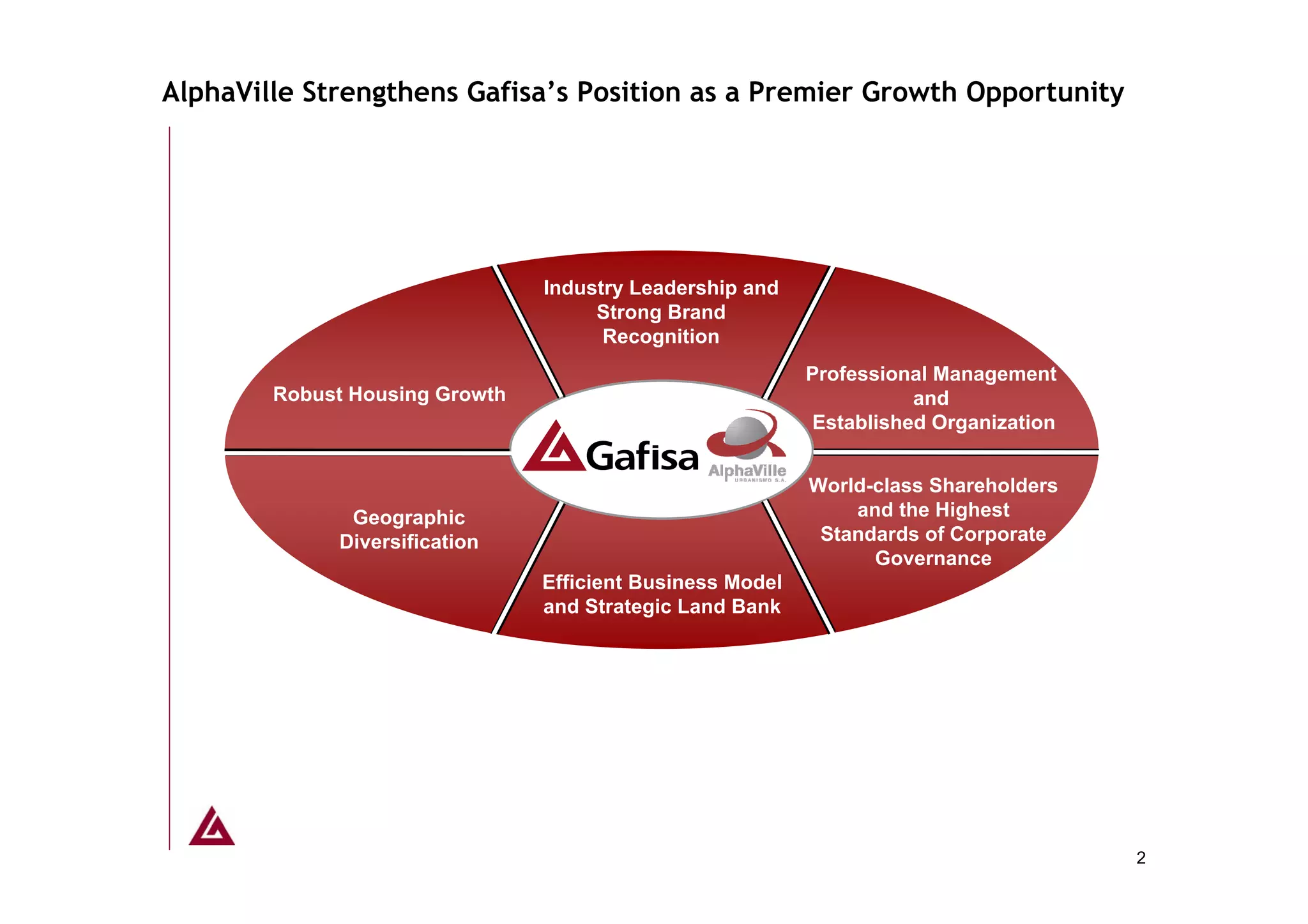

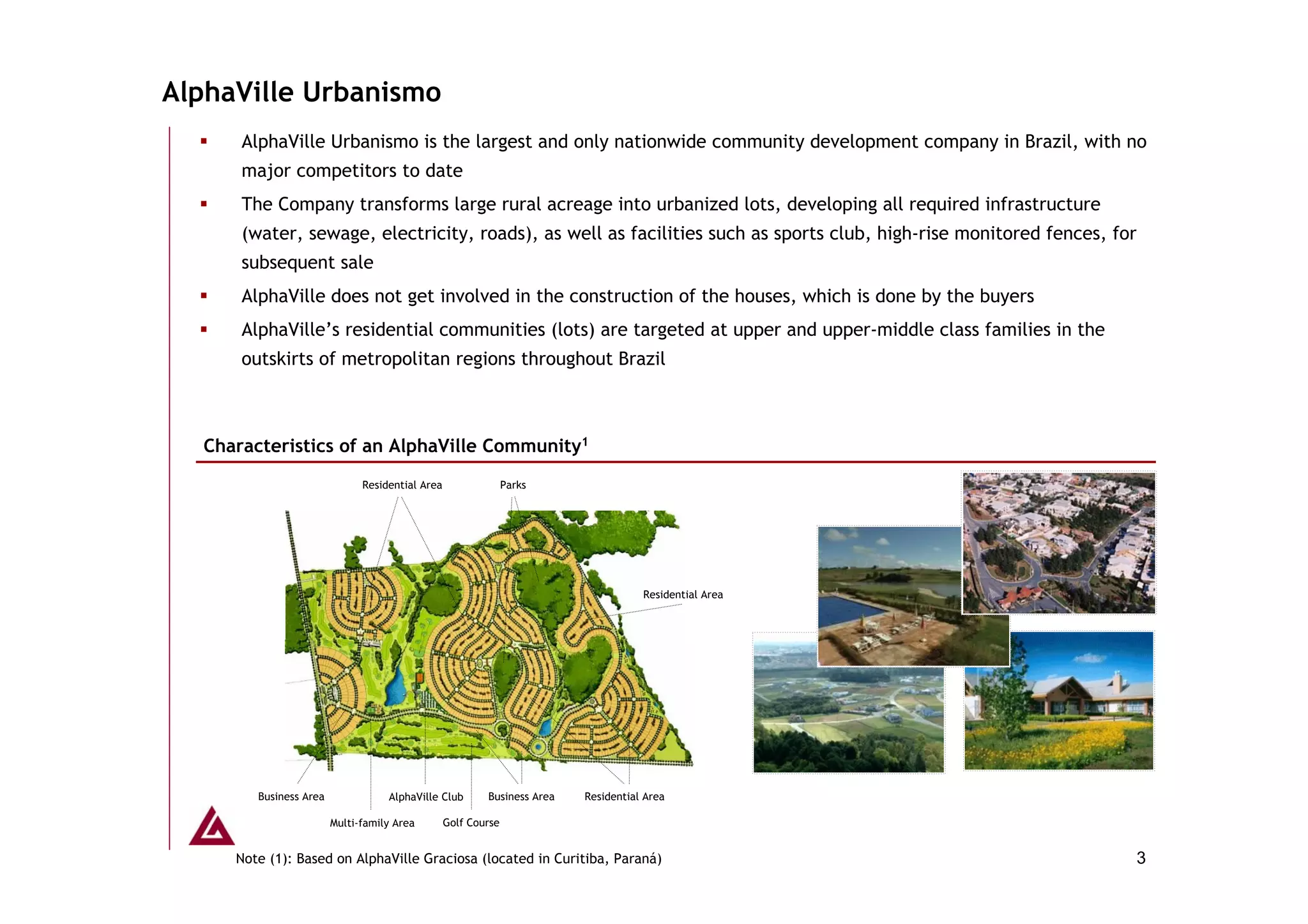

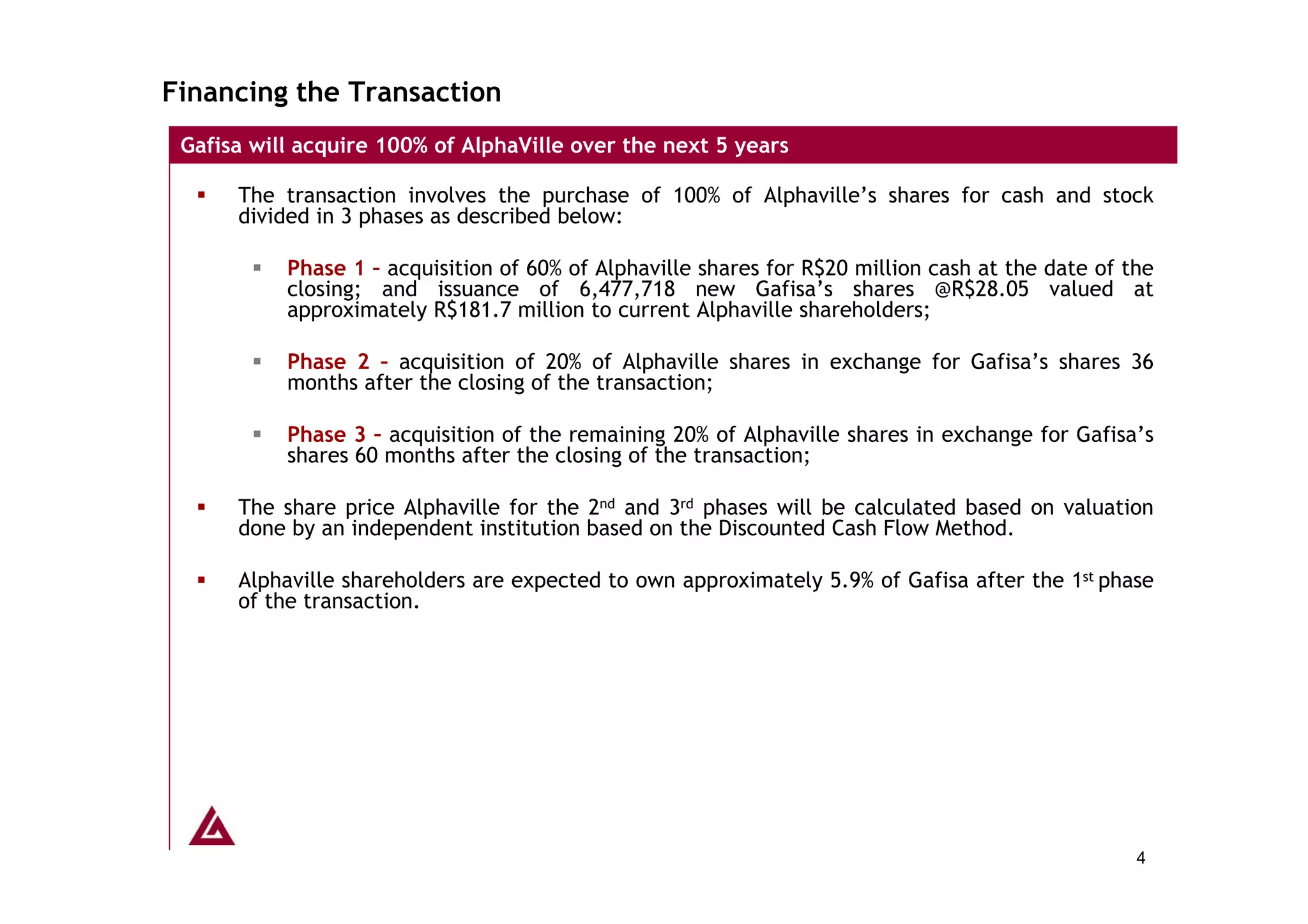

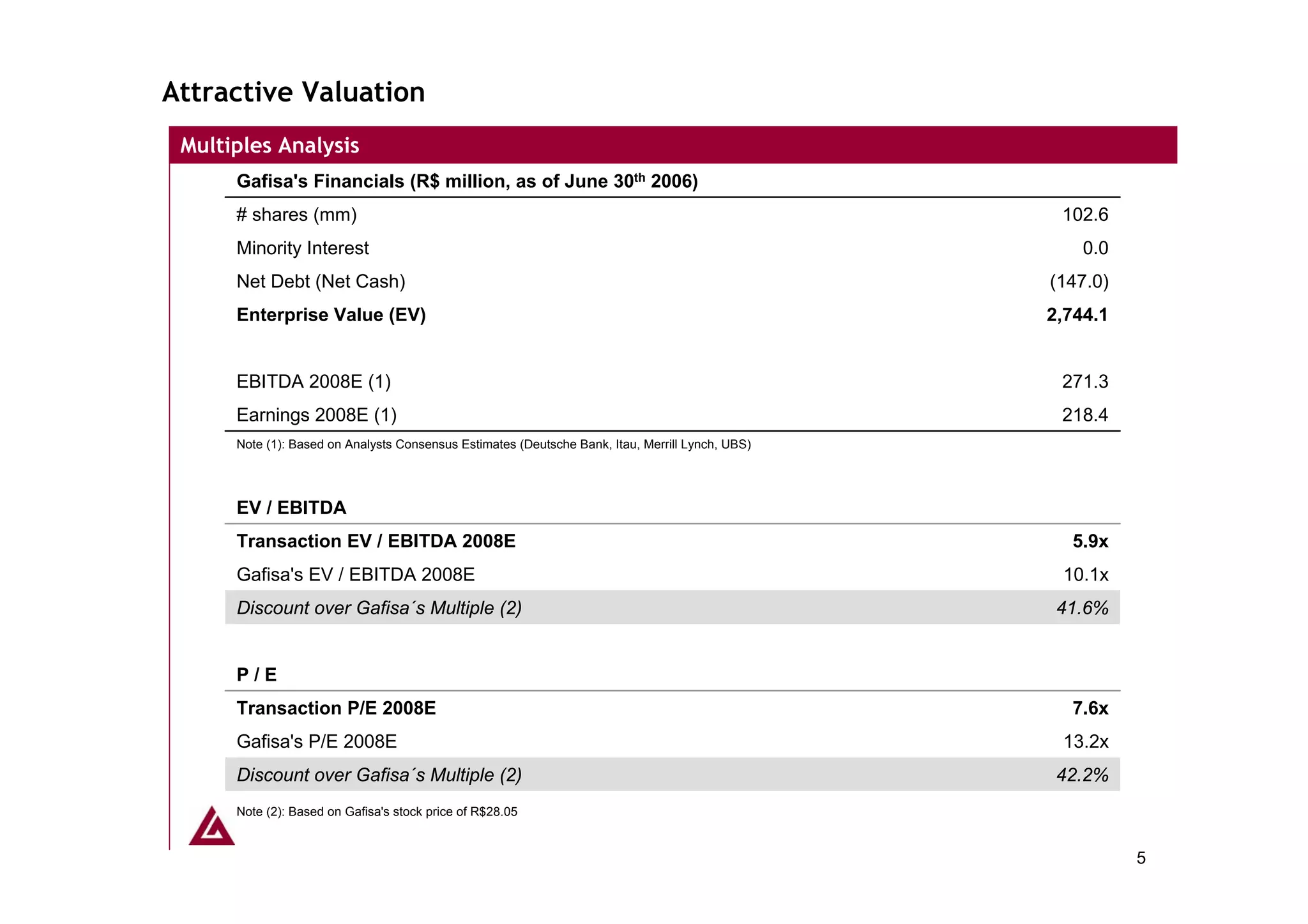

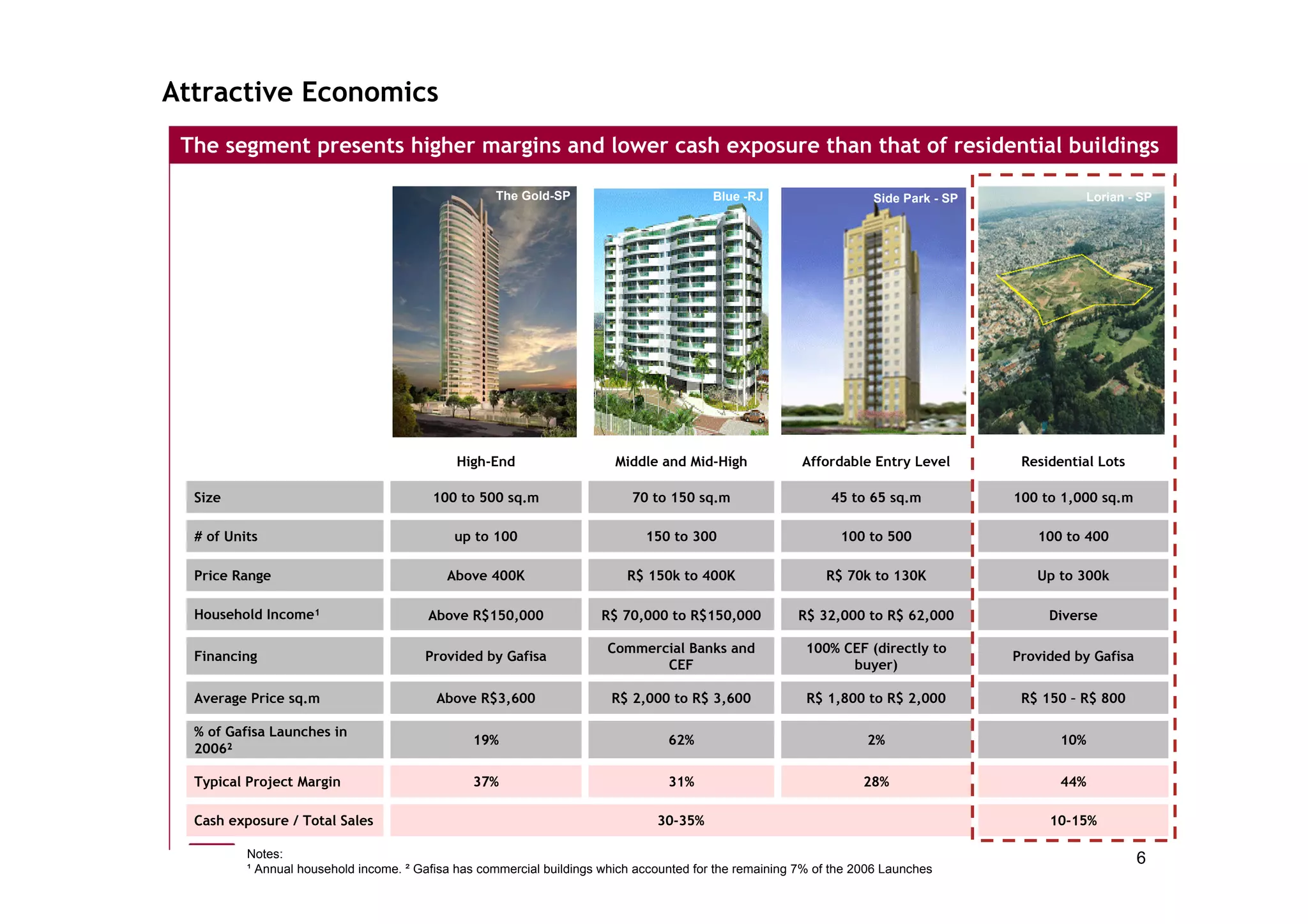

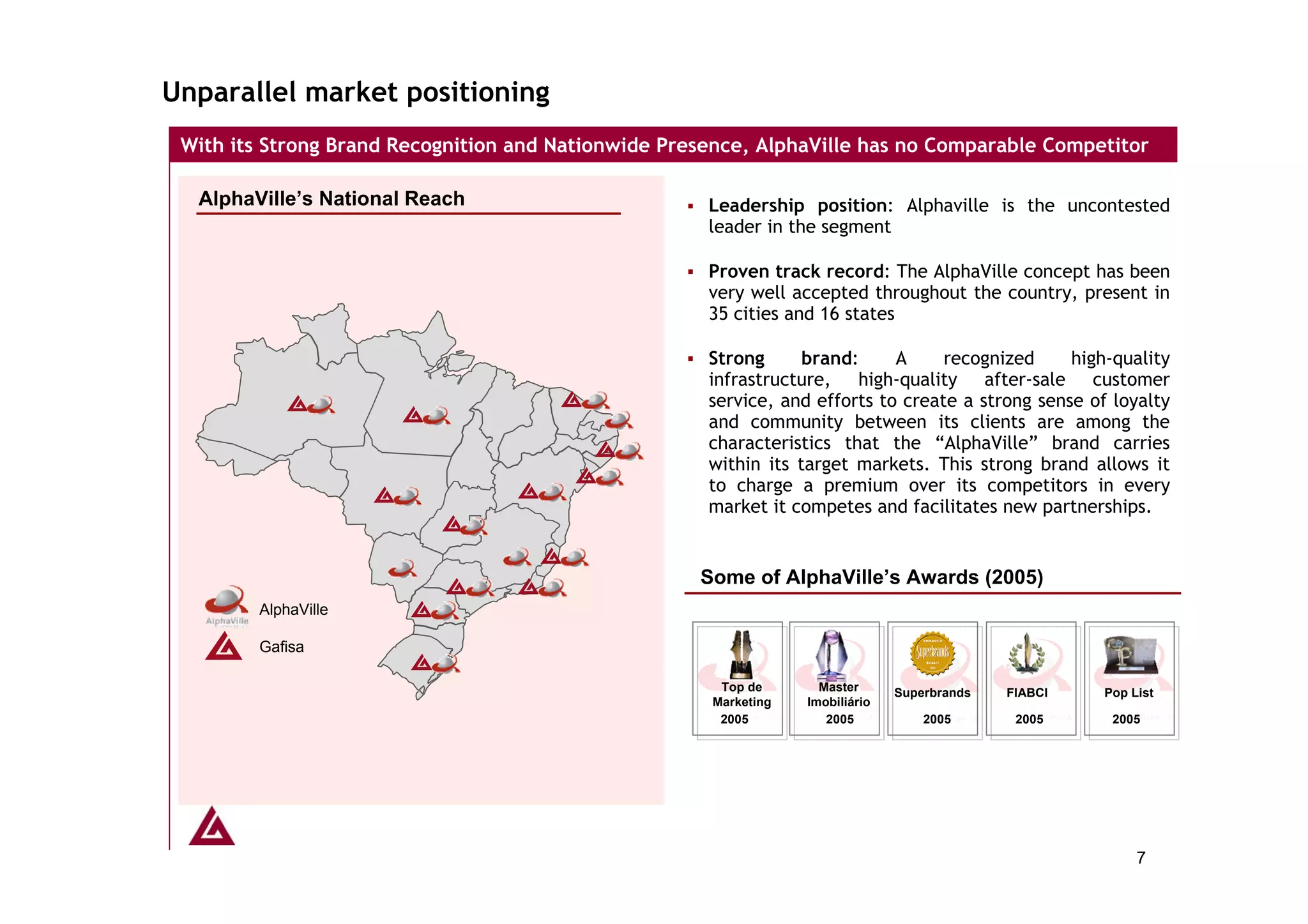

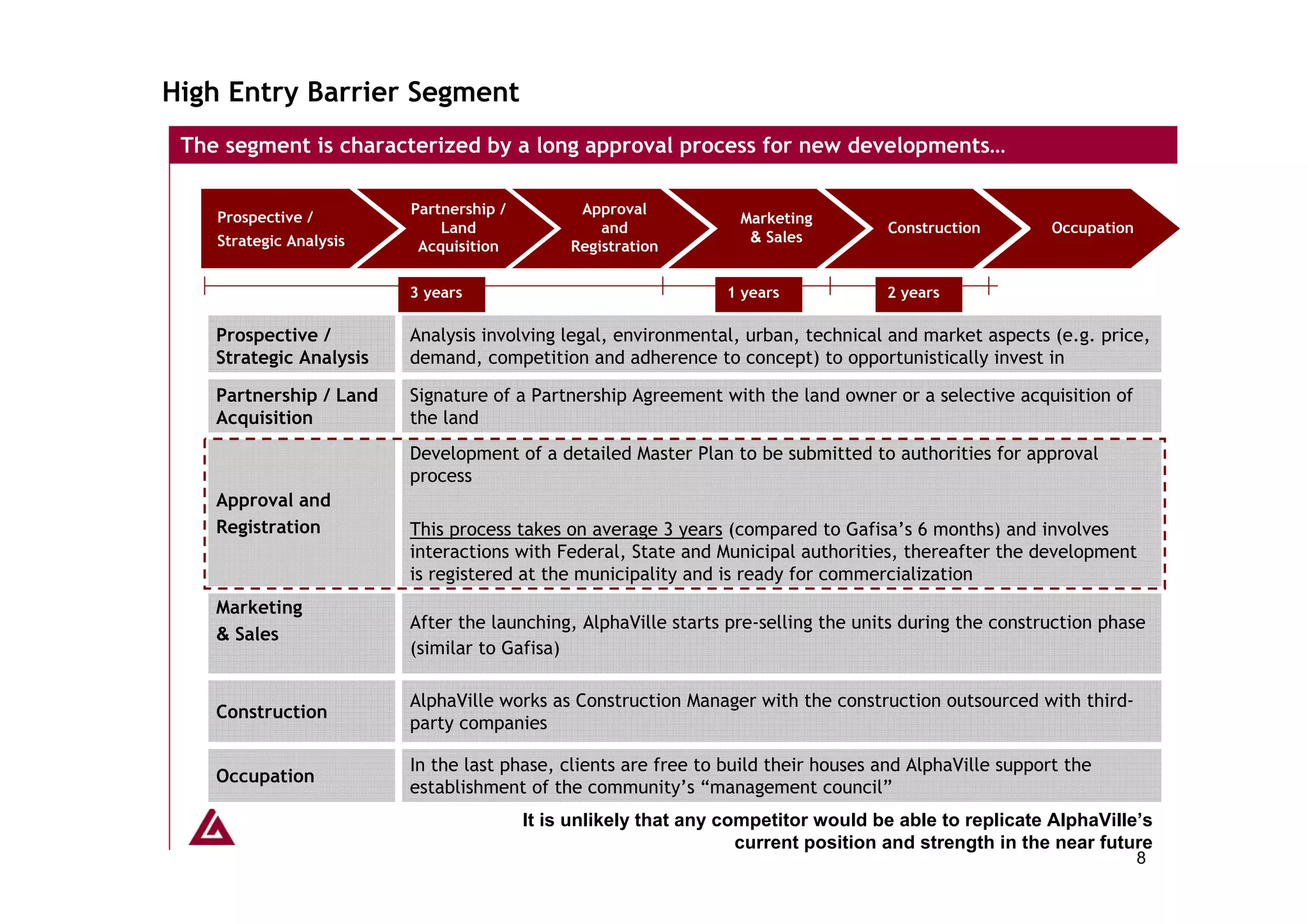

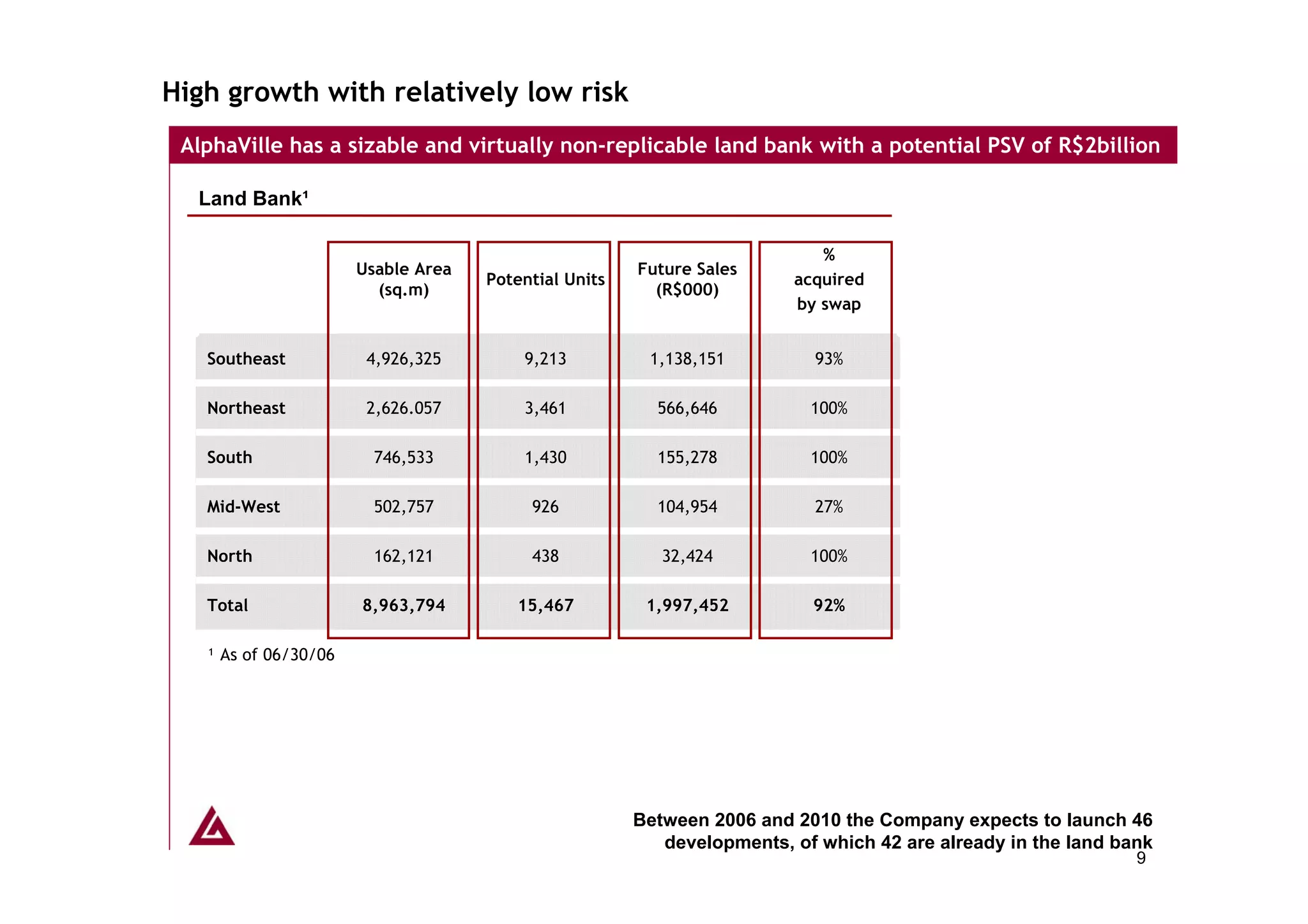

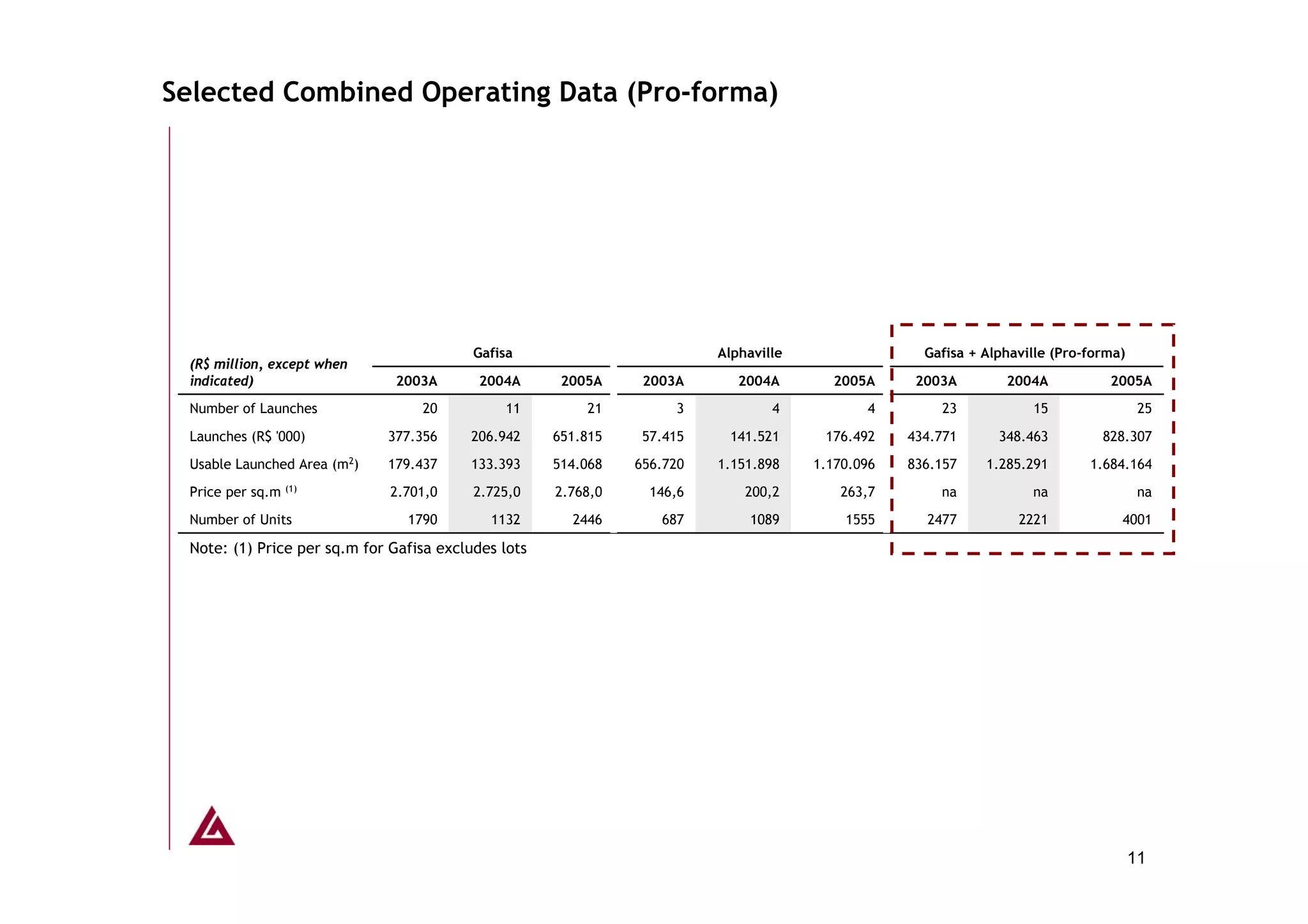

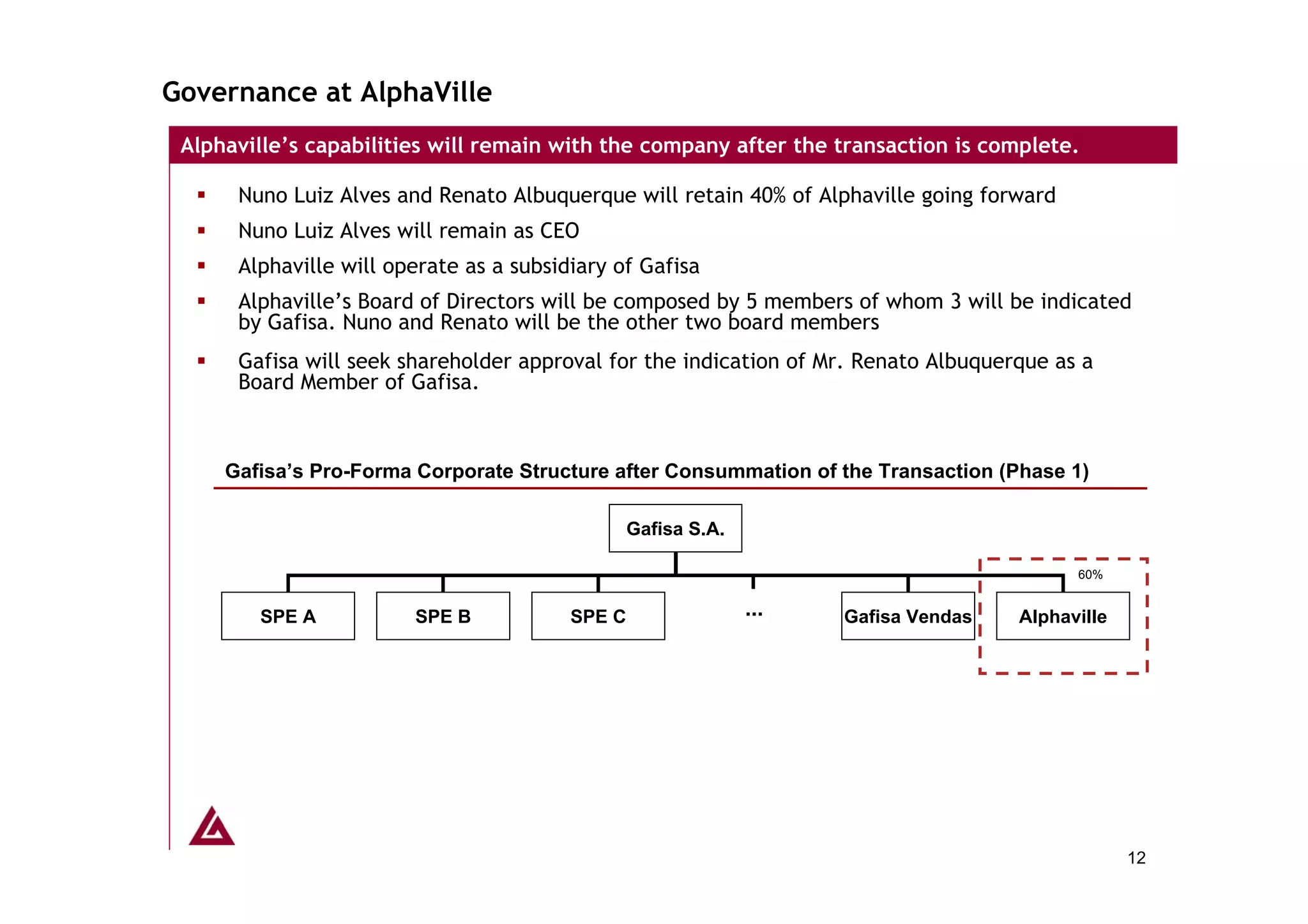

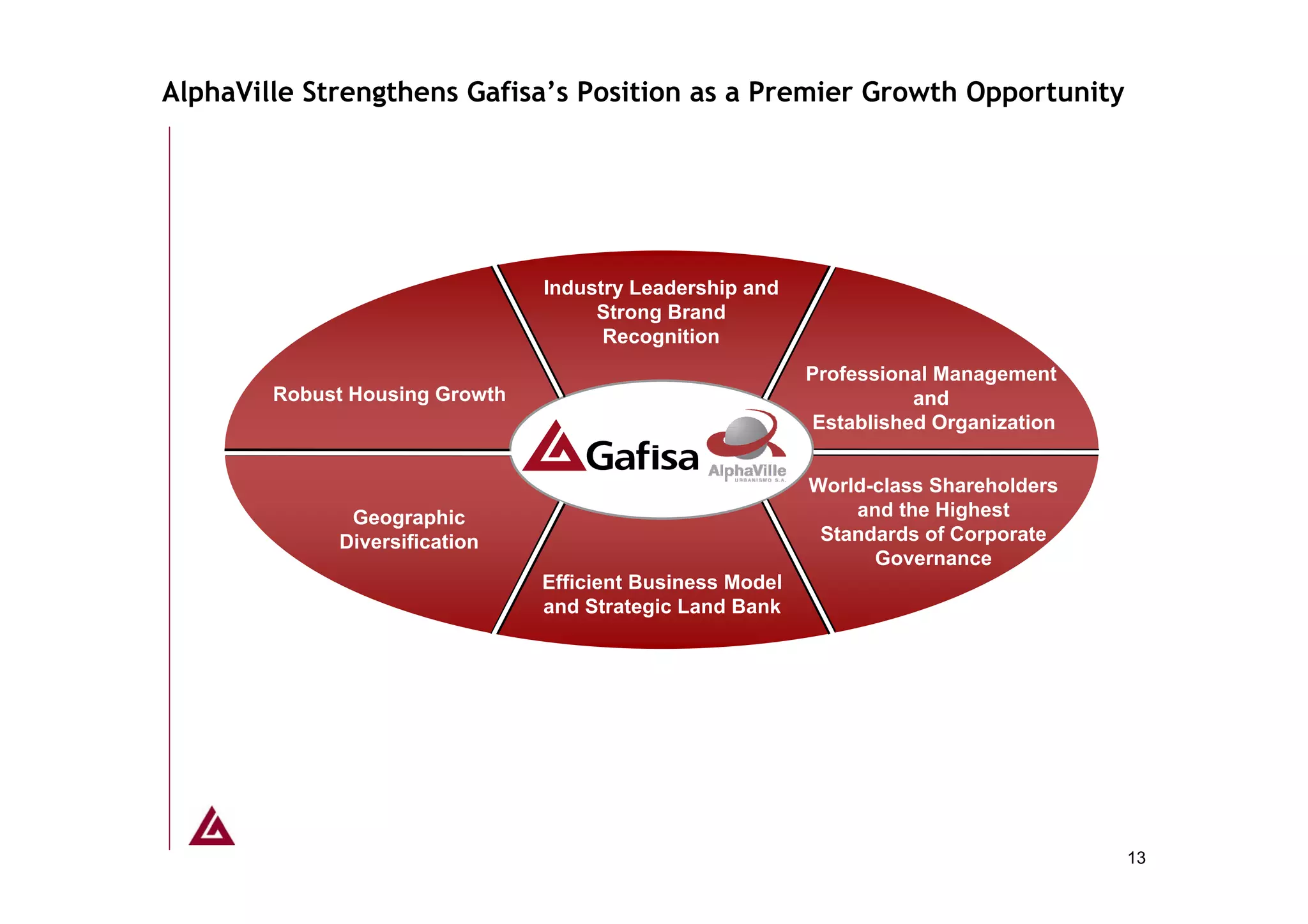

Gafisa acquired AlphaVille Urbanismo, Brazil's largest developer of planned communities. The acquisition was conducted over 5 years in 3 phases, with Gafisa paying cash and stock. AlphaVille strengthens Gafisa's position with its leadership in planned communities, strong brand, and large land bank. The companies expect future synergies through cross-selling, geographical expansion, and financial optimization.