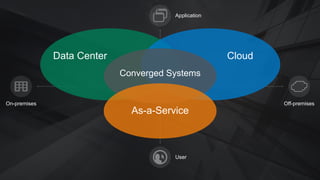

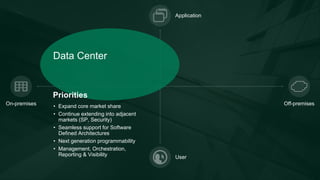

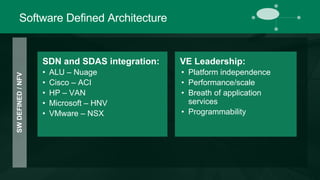

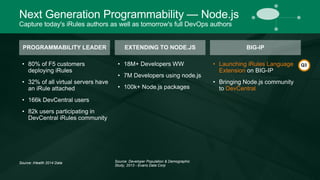

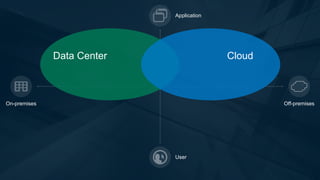

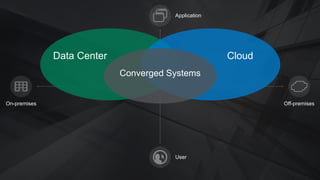

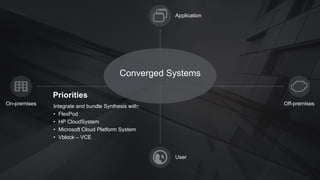

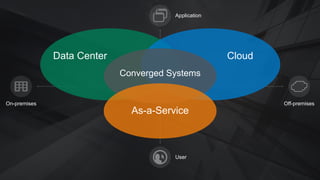

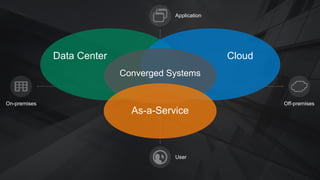

The document discusses F5's strategic vision and service offerings, emphasizing the importance of superior user-to-application experiences through their full-proxy technology and various application delivery services. It outlines the expansion into adjacent markets like security and service providers, highlighting hybrid cloud strategies and programmability enhancements, including an integration with Node.js. Additionally, it mentions partnerships with companies like Cisco and VMware to support service creation and management across private and public cloud environments.