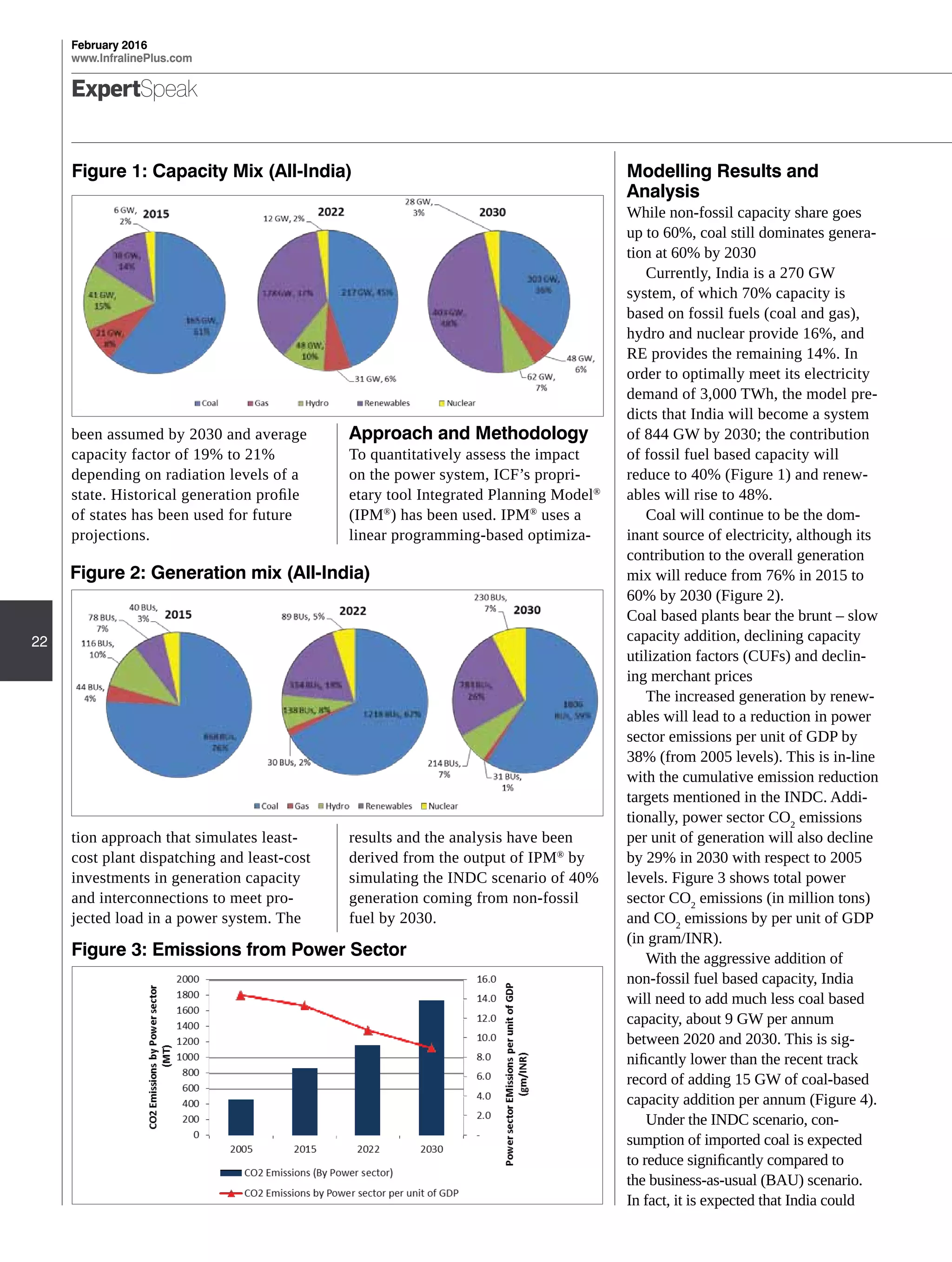

The document summarizes the key findings from modeling the impact of India's targets in its Intended Nationally Determined Contribution (INDC) on the country's power system out to 2030. The main results are:

1) Coal will continue to dominate electricity generation, though its share will fall from 76% today to 60% by 2030 as non-fossil fuel capacity rises to 48% of total capacity.

2) Aggressive renewable energy addition will require adding gas and hydro capacity to manage variability, and may make the system more expensive overall by INR 2,60,000 crores compared to a business-as-usual case.

3) Coal-fired plants will see reduced capacity factors