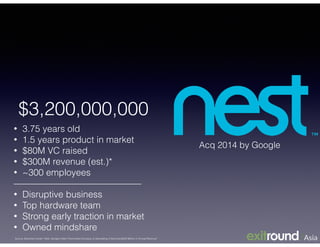

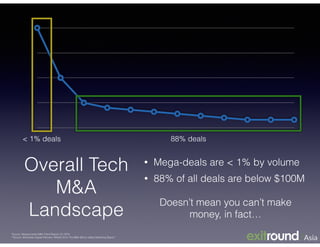

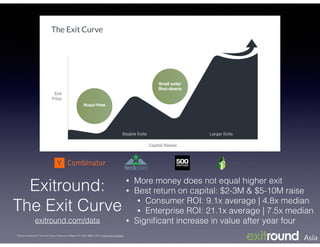

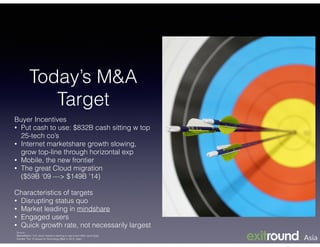

This document discusses trends in global and Asian technology M&A activity and provides advice for companies considering an acquisition or exit. It notes that global M&A reached record levels in 2014, with tech deals making up 35% of the total. Recent mega-deals are highlighted, with acquisitions valued between $2.5-19 billion. The document advises that while most deals are small, companies can still generate high returns, and the best returns typically come from companies that have raised $2-10 million. It also provides tips for companies to optimize their chances of a successful acquisition or exit.