The document discusses various aspects of technology mergers and acquisitions (M&A) including critical contract terms, market trends, and notable transactions. It highlights ten key elements that should be addressed in M&A contracts, presents a research report on the public markets, and lists significant deals made in 2015. The analysis covers valuation multiples in different sectors, recent mega deals, and the performance of the consumer technology market.

![20

$4.4B

$16.5B

$2.4B

$3.0B

$3.0B

$4.8B

$2.8B

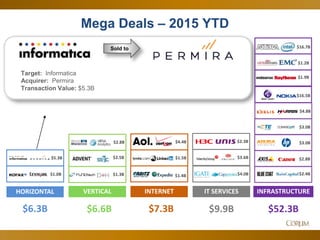

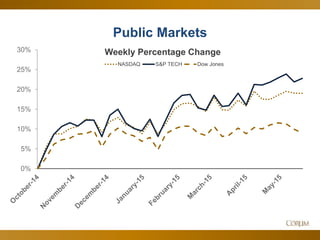

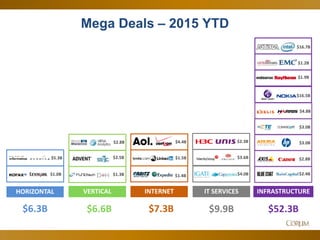

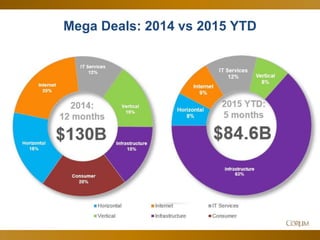

Mega Deals – 2015 YTD

$1.0B $1.4B $4.0B

$1.5B$5.3B $3.6B

$2.3B

$16.7B

$1.2B

Sold to

Target: TelecityGroup [United Kingdom]

Acquirer: Equinix

Transaction Value: $3.6B

HORIZONTAL INTERNET IT SERVICES INFRASTRUCTURE

$6.3B $7.3B $9.9B $52.3B

$1.9B

$2.8B

$1.3B

$2.5B

VERTICAL

$6.6B](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-20-320.jpg)

![21

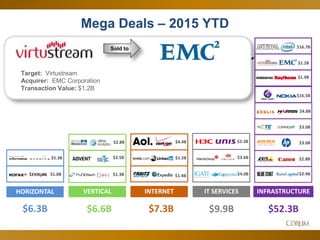

Mega Deals – 2015 YTD

Sold to

Target: H3C Technologies [China]

Acquirer: Unisplendour [China]

Transaction Value: $2.3B

$4.4B

$16.5B

$2.4B

$3.0B

$3.0B

$4.8B

$2.8B

$1.0B $1.4B $4.0B

$1.5B$5.3B $3.6B

$2.3B

$16.7B

$1.2B

HORIZONTAL INTERNET IT SERVICES INFRASTRUCTURE

$6.3B $7.3B $9.9B $52.3B

$1.9B

$2.8B

$1.3B

$2.5B

VERTICAL

$6.6B](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-21-320.jpg)

![28

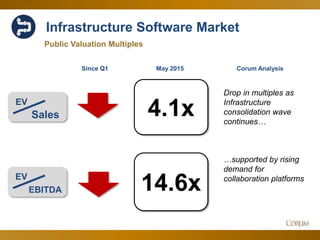

Infrastructure Software Market

Deal Spotlight

2.00 x

2.50 x

3.00 x

3.50 x

4.00 x

4.50 x

5.00 x

6.00 x

8.00 x

10.00 x

12.00 x

14.00 x

16.00 x

18.00 x

EV/SEV/EBITDA

Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15

EV/EBITDA 15.02 x 14.90 x 14.20 x 14.61 x 15.50 x 16.48 x 16.10 x 16.22 x 16.96 x 17.03 x 15.71 x 15.84 x 16.08 x

EV/S 3.60 x 3.57 x 3.41 x 3.89 x 4.07 x 4.27 x 4.37 x 4.73 x 4.34 x 4.16 x 4.12 x 4.03 x 4.23 x

Sold to

Target: Esna Technologies [Canada]

Acquirer: Avaya [USA]

-Real-time collaboration and communications software

-Enables Avaya to integrate multivendor communications capabilities into cloud-

based applications](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-28-320.jpg)

![29

Infrastructure Software Market

Deal Spotlight

2.00 x

2.50 x

3.00 x

3.50 x

4.00 x

4.50 x

5.00 x

6.00 x

8.00 x

10.00 x

12.00 x

14.00 x

16.00 x

18.00 x

EV/SEV/EBITDA

Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15

EV/EBITDA 15.02 x 14.90 x 14.20 x 14.61 x 15.50 x 16.48 x 16.10 x 16.22 x 16.96 x 17.03 x 15.71 x 15.84 x 16.08 x

EV/S 3.60 x 3.57 x 3.41 x 3.89 x 4.07 x 4.27 x 4.37 x 4.73 x 4.34 x 4.16 x 4.12 x 4.03 x 4.23 x

Sold to

Target: Tropo [USA]

Acquirer: Cisco Systems [USA]

- Web-based collaboration API Platform-as-a-Service

- Extends Cisco’s collaboration technologies and enables it to reach out more

than 200,000 developers](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-29-320.jpg)

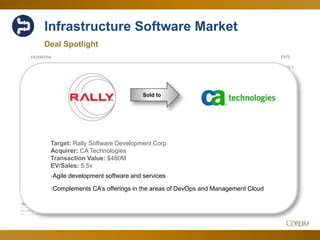

![32

Consumer Application Software Market

Deal Spotlight

1.00 x

1.20 x

1.40 x

1.60 x

1.80 x

2.00 x

2.20 x

2.40 x

2.60 x

2.80 x

5.00 x

6.00 x

7.00 x

8.00 x

9.00 x

10.00 x

11.00 x

12.00 x

13.00 x

14.00 x

EV/SEV/EBITDA

Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15

EV/EBITDA 10.82 x 7.99 x 7.42 x 9.70 x 9.44 x 10.37 x 11.60 x 12.33 x 11.64 x 12.26 x 12.19 x 12.47 x 12.76 x

EV/S 2.47 x 2.23 x 2.24 x 2.62 x 2.57 x 2.65 x 2.41 x 2.31 x 2.32 x 2.31 x 2.21 x 2.18 x 2.16 x

Sold to

Target: Wunderlist [Germany]

Acquirer: Microsoft

Transaction Value: $100-200 million

- Mobile task planning application

- 5th mobile acquisition in past half-year, complements the purchase of Sunrise

and Acompli](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-32-320.jpg)

![37

1.50 x

2.00 x

2.50 x

3.00 x

3.50 x

4.00 x

4.50 x

6.00 x

8.00 x

10.00 x

12.00 x

14.00 x

16.00 x

18.00 x

20.00 x

22.00 x

EV/SEV/EBITDA

Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15

EV/EBITDA 18.35 x 17.93 x 18.49 x 18.38 x 17.32 x 17.52 x 17.21 x 19.04 x 18.44 x 18.78 x 17.51 x 17.58 x 19.79 x

EV/S 3.71 x 3.57 x 3.57 x 3.96 x 3.57 x 3.66 x 3.33 x 3.33 x 3.31 x 3.43 x 3.57 x 3.57 x 3.67 x

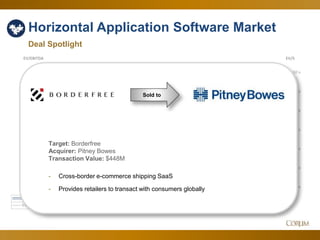

Horizontal Application Software Market

Deal Spotlights

Sold to

Target: Acclaris

Acquirer: Towers Watson

Transaction Value: $140M

- Employee health benefits administration SaaS

- Follow the acquisition of Saville for $64M in April

Sold to

Target: ACE Payroll [New Zealand]

Acquirer: MYOB [Australia]

Transaction Value: $10.2M

- Benefit & payroll management software](https://image.slidesharecdn.com/june11-slideshare-150615190126-lva1-app6892/85/2015-Tech-M-A-Monthly-M-A-Contract-Overview-37-320.jpg)