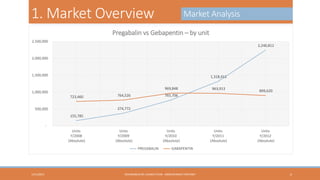

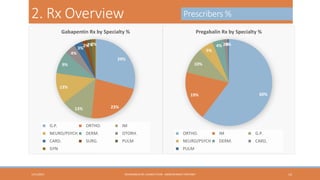

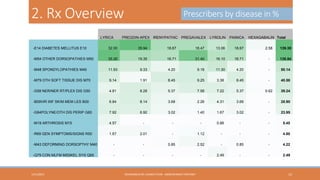

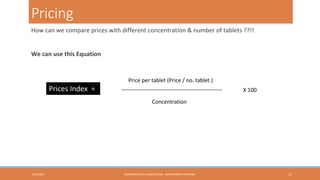

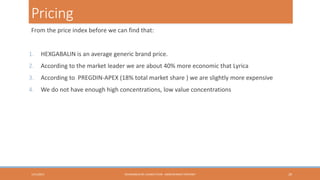

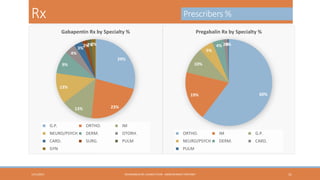

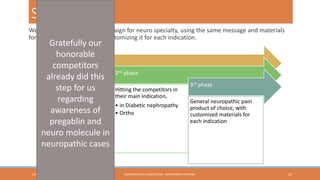

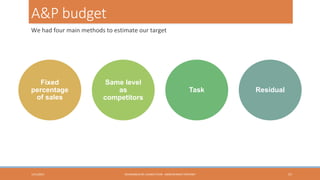

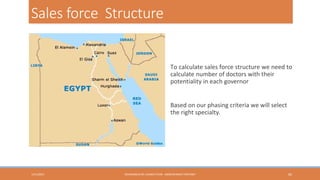

The document outlines the re-launch plan for Hexagablin, detailing market analysis, competitive landscape, pricing strategies, and promotional messaging. It includes a SWOT analysis highlighting key strengths, weaknesses, opportunities, and threats, accompanied by a sales forecast and strategic imperatives. The plan aims to position Hexagablin as a leading generic option in the neuropathic pain segment, focusing on building brand credibility among healthcare providers.