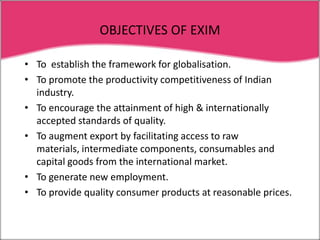

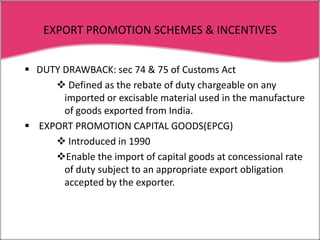

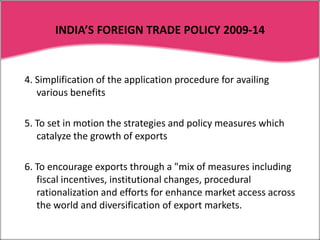

The document summarizes India's export-import (EXIM) policy. It discusses the objectives of EXIM policy as facilitating globalization and promoting productivity and competitiveness. It outlines various export promotion schemes like duty drawback, export promotion capital goods scheme, and duty exemption/remission schemes. It also discusses volumes of EXIM policy, foreign trade policy 2009-2014 which aimed to double India's exports and share in global trade, and highlights incentives introduced or extended like benefits for status holders, income tax exemptions, and enhanced export credit insurance coverage.