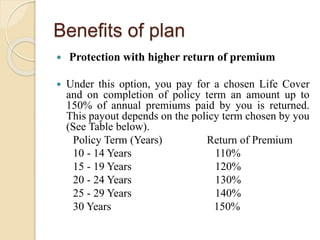

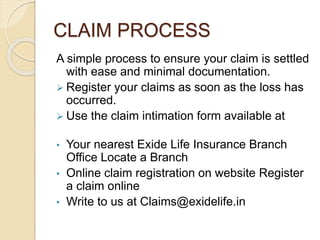

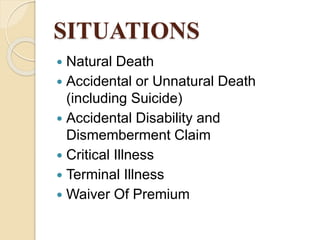

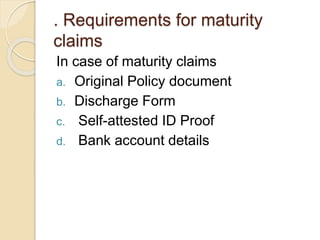

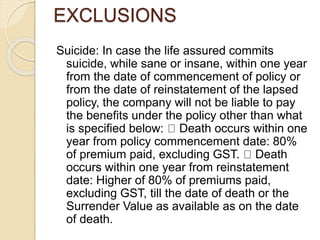

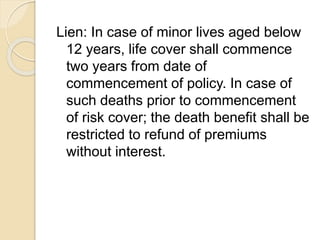

Exide Life Insurance provides various life insurance products like term plans, health plans, and riders. It has over 15 lakh customers and manages over 11,015 crores in assets. It sells products through multiple channels and offers benefits like protection, savings options, and return of premiums. Key products discussed include Exide Life Smart Term Plan, Exide Life Term Rider, and Exide Life Sanjeevani health plan. The document also outlines claim process, terms and conditions, exclusions, and requirements for maturity claims.