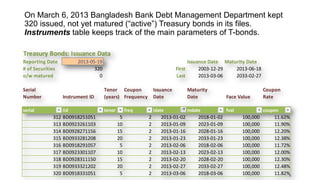

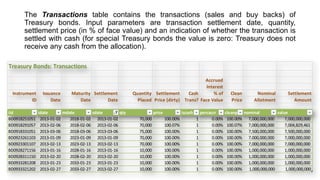

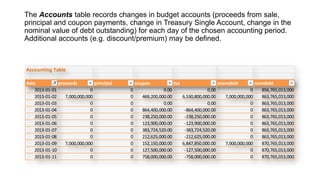

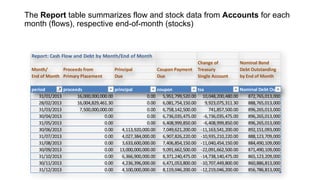

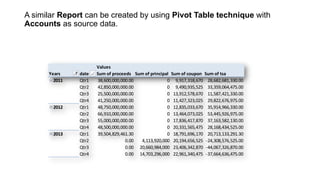

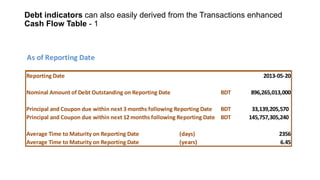

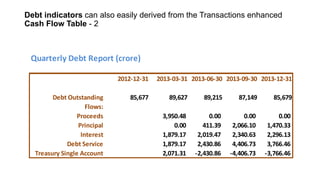

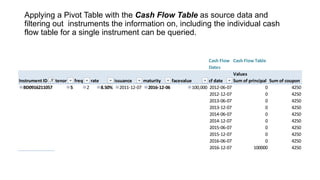

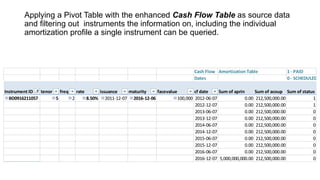

The document outlines an Excel workbook developed for managing a large treasury bond portfolio, detailing its structure which includes cash flow tables, transactions, accounts, and reports. It provides specific data on treasury bonds issued by the Bangladesh Bank, covering transactions and changes in budget accounts. Additionally, it summarizes flow and stock data regarding cash flows and outstanding debt over selected monthly periods.