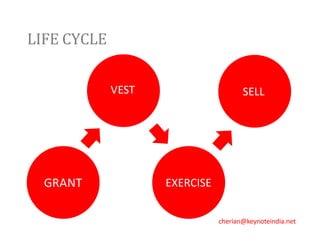

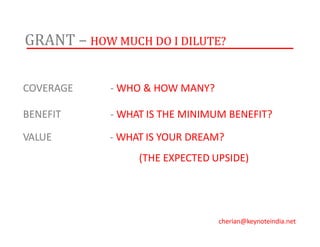

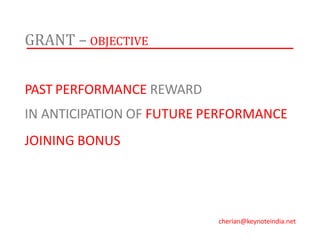

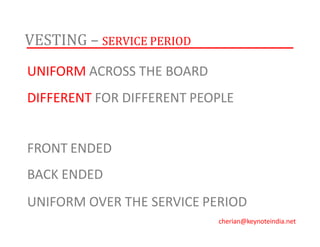

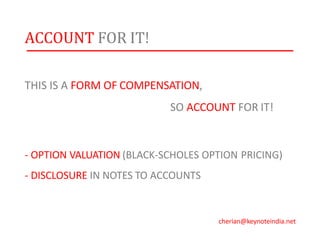

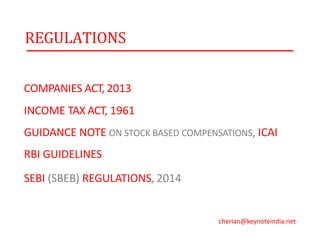

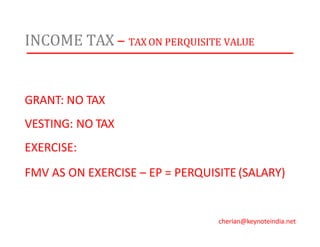

This document discusses stock-based compensation plans, including employee stock option plans, restricted stock units, stock appreciation rights, and employee stock purchase plans. It covers the lifecycle of these plans from grant to vesting to exercise and sale. Key aspects addressed include determining coverage and number of shares to grant, setting the grant price, vesting periods and conditions, liquidity options upon exercise, and accounting and regulatory requirements. The goal is to design and implement stock-based plans that attract and retain talent while meeting compliance standards.