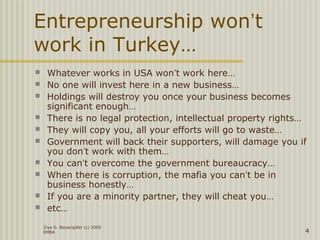

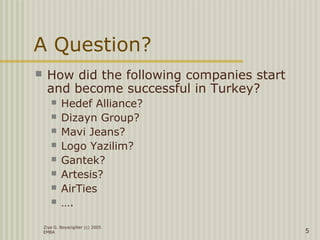

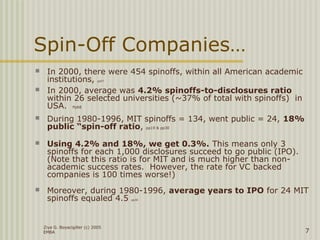

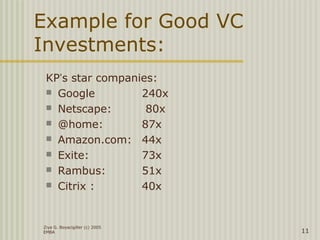

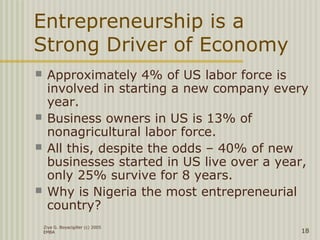

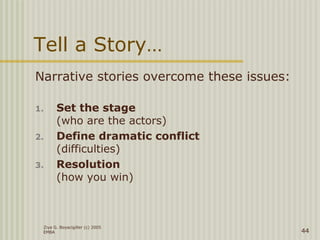

This document discusses entrepreneurship in Turkey according to Ziya G. Boyacigiller, a leading angel investor and mentor to entrepreneurs in Turkey. It provides an overview of common beliefs that entrepreneurship won't work in Turkey due to challenges like lack of investment, intellectual property issues, and corruption. However, it notes several successful Turkish companies and discusses factors changing in Turkey's environment like EU reforms that are encouraging entrepreneurship. The document is based on a presentation by Boyacigiller on his views of entrepreneurship in Turkey.