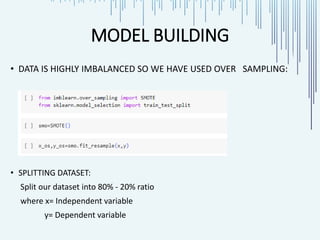

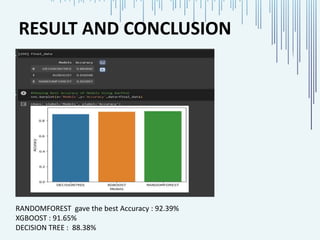

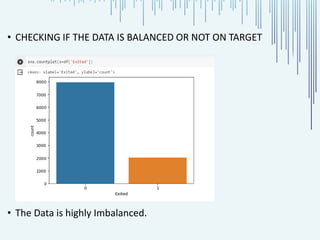

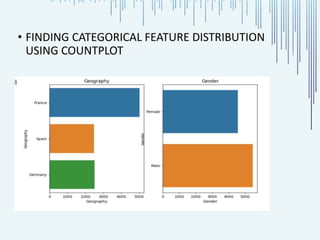

The document presents a project on customer churn analysis in the banking sector, emphasizing the importance of customer retention and data-driven strategies to mitigate churn. It outlines the steps taken, including data exploration, model building using decision tree, random forest, and XGBoost classifiers, and highlights that the random forest model achieved the highest accuracy of 92.39%. Overall, the analysis aims to provide insights for better resource allocation and personalized customer engagement.

![• DROP UNWANTED COLUMNS:

data=data.drop(['CustomerId','Surname','Exited','RowNumber'],axis=1)

we have dropped these columns because it does not have huge impact on

model building. And dropped Exited column because it is Target variable.

• STANDARDIZATION:

Standardization is a preprocessing method used to transform numerical

data by scaling it to have a mean of zero and a standard deviation of one.

This transformation is applied to all features ensuring that they have the

same scale, thus preventing features with larger magnitudes from

dominating the learning algorithm.

• LABEL ENCODER:

As we have Analyzed in EDA we have Total 3 categorical features. Including

the Target column. So before Model building we will convert those into

numerical features,With the help of label encode.](https://image.slidesharecdn.com/harshpakhare-employechurn-240424083421-f02566f5/85/Employee-Churn-Prediction-Artificial-Intelligence-Project-Presentation-12-320.jpg)