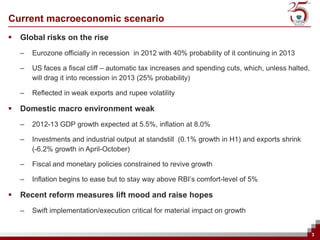

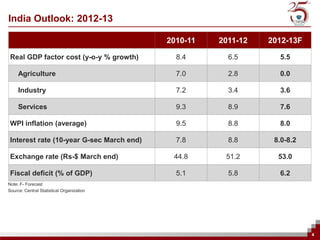

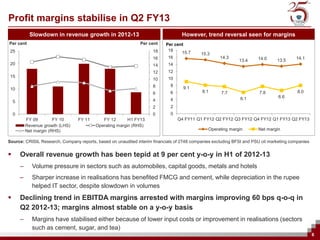

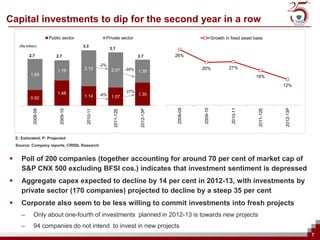

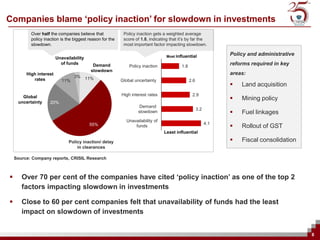

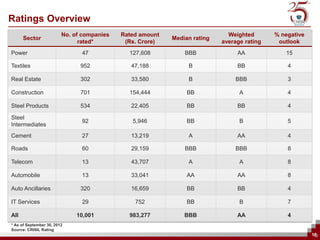

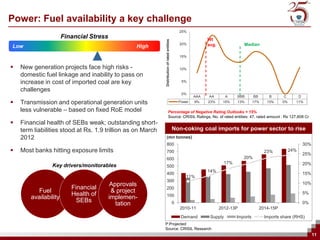

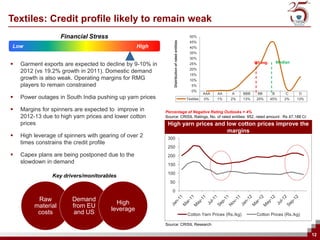

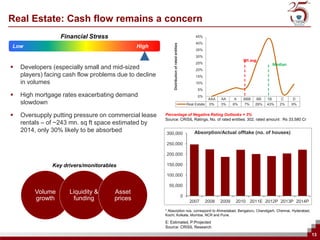

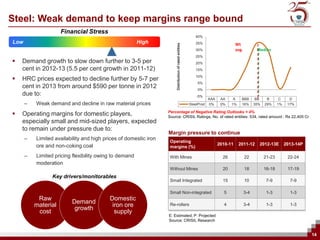

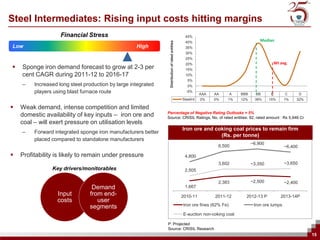

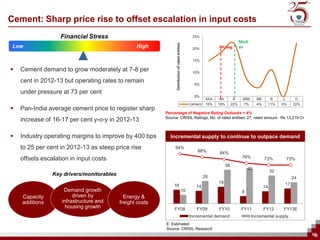

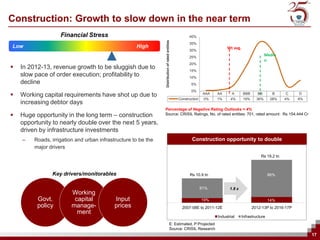

The document summarizes the current state of the Indian economy and key industries based on a presentation by the President of CRISIL Research. It finds that (1) domestic and global macroeconomic conditions remain weak, though recent reforms provide hope; (2) industry profit margins have stabilized after declining for several quarters; and (3) capital investments are expected to decline for the second straight year, especially among private sector companies, due to policy inaction on land acquisition, mining, and other issues according to a poll of companies.