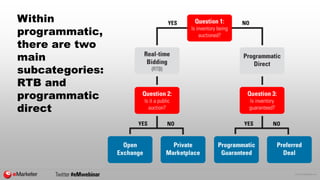

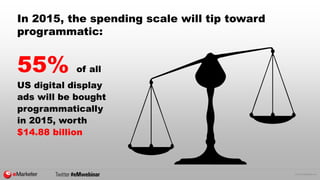

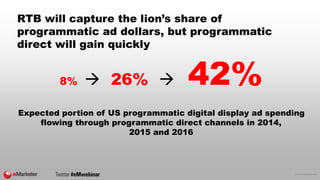

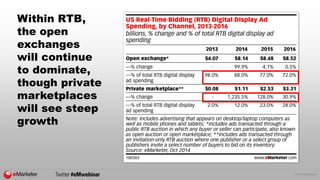

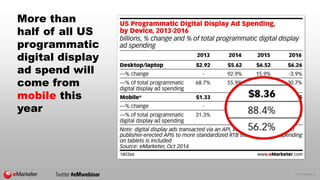

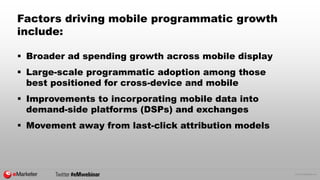

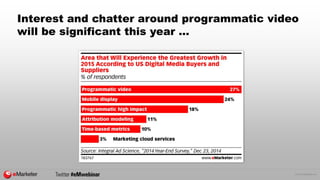

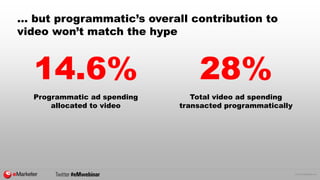

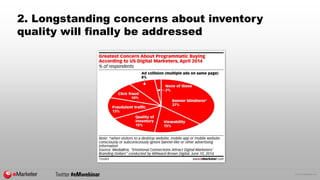

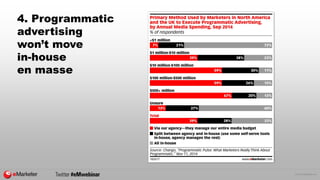

The document discusses the outlook for programmatic advertising in 2015, highlighting that 55% of U.S. digital display ads will be bought programmatically, with significant growth expected in mobile and programmatic direct channels. Key trends include the proliferation of private marketplaces and an increased focus on ad quality, while investment in programmatic TV is anticipated but won't see widespread adoption this year. Additionally, marketers are urged to explore data beyond third-party cookies as they continue adapting to programmatic models.