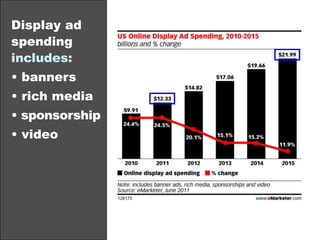

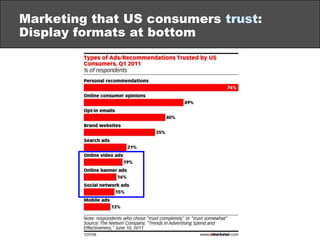

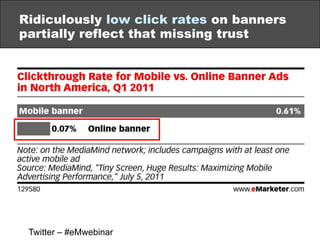

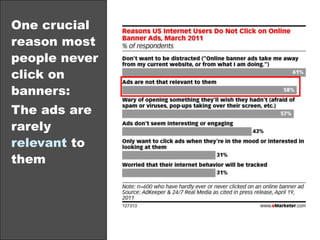

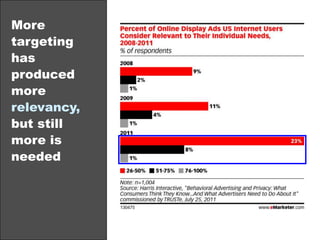

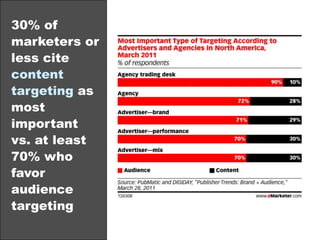

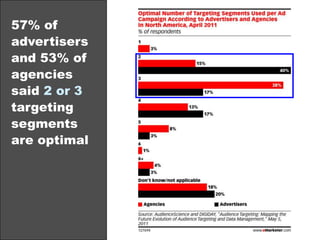

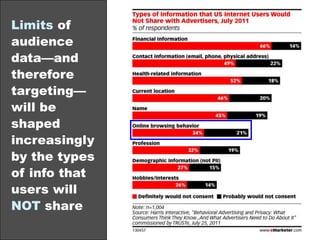

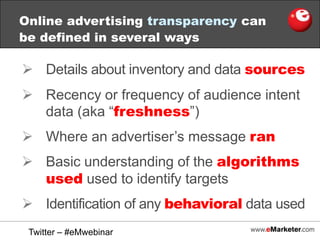

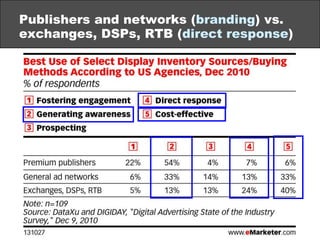

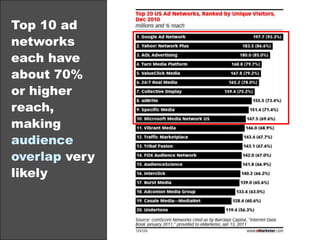

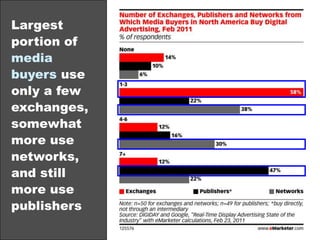

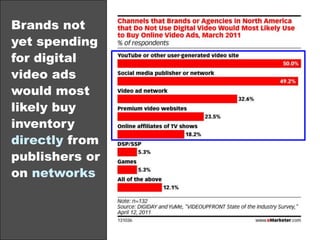

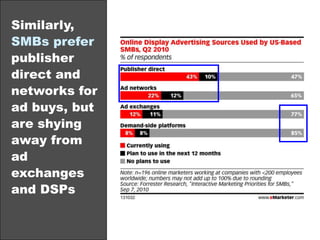

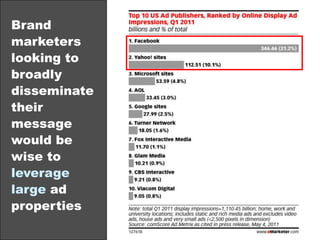

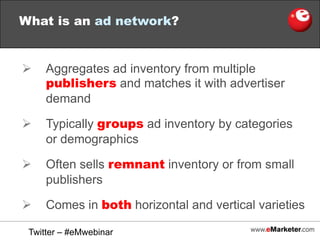

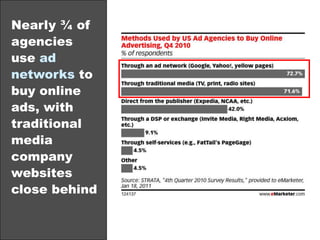

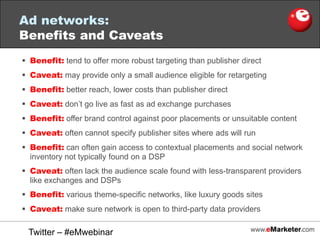

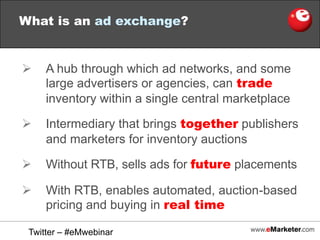

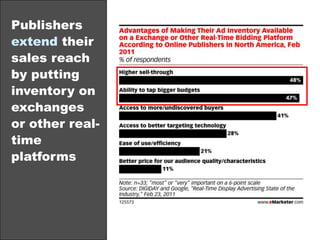

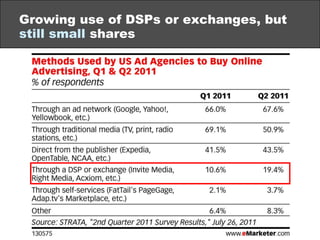

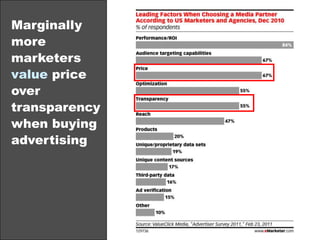

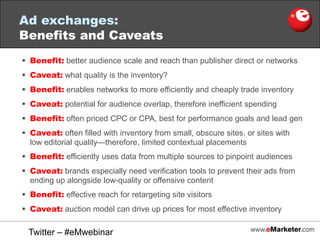

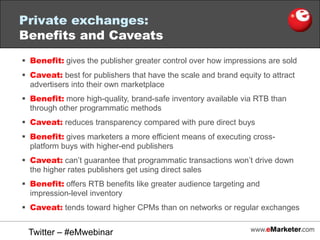

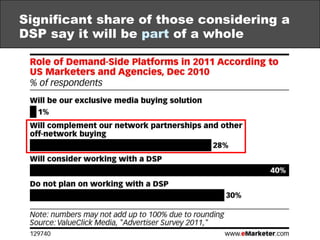

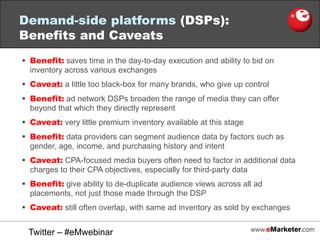

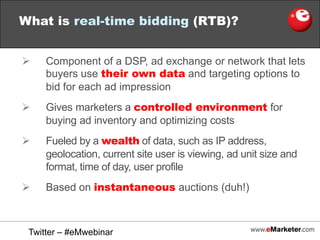

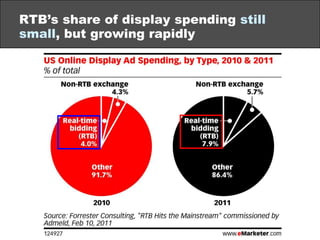

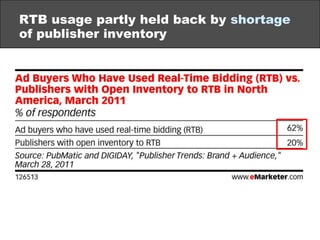

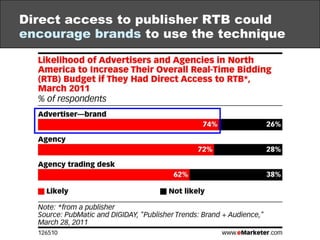

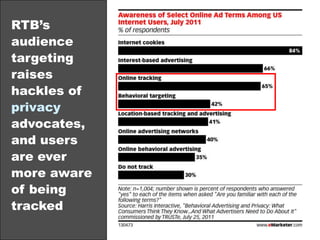

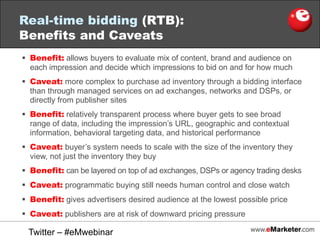

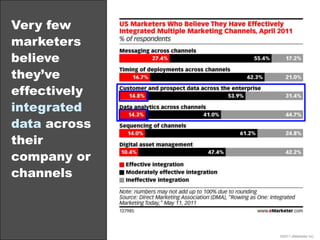

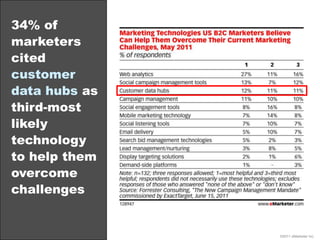

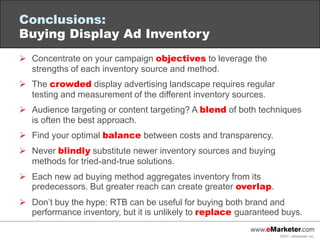

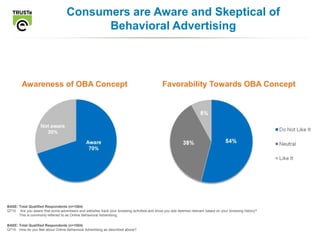

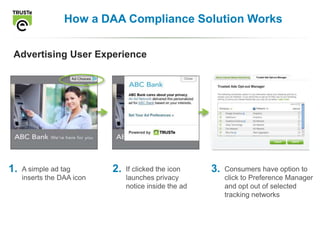

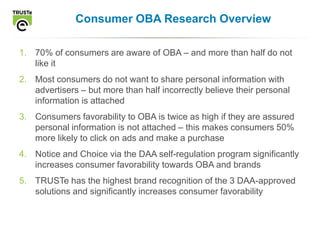

The document provides an overview of display advertising, focusing on market trends, targeting tactics, and various ad inventory sources, including publisher direct, ad networks, and exchanges. It underscores the importance of choosing the right inventory source for campaign objectives and highlights challenges such as audience overlap and data integration. Additionally, it addresses consumer attitudes towards online behavioral advertising and the significance of transparency in the advertising process.