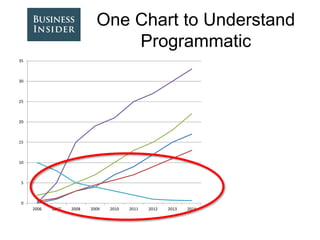

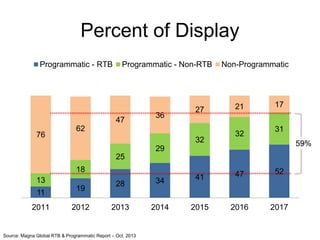

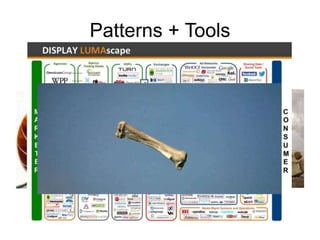

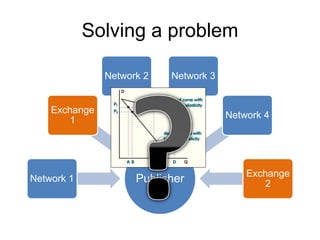

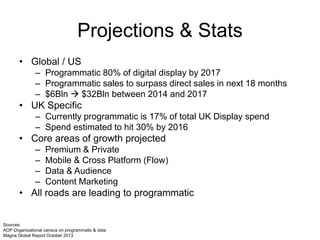

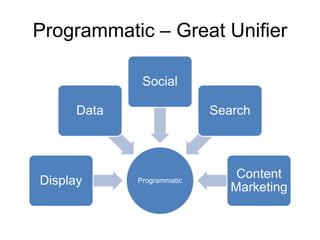

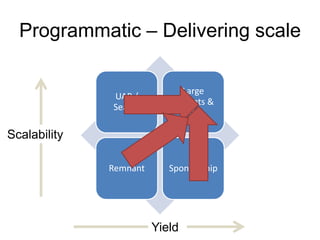

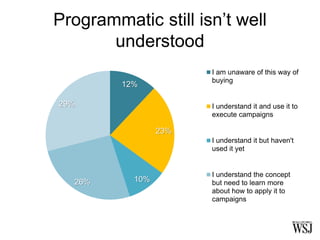

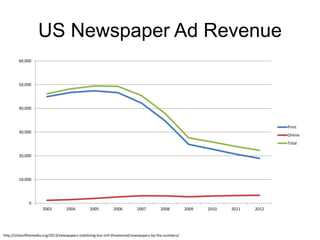

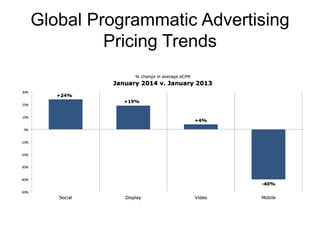

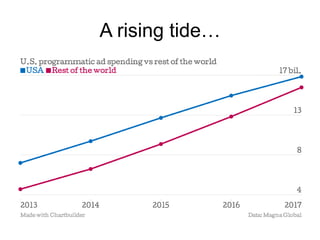

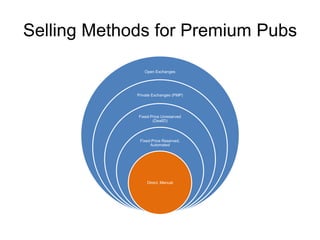

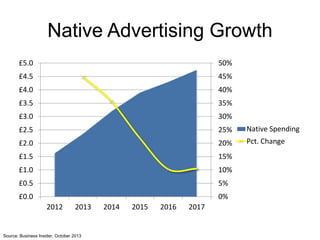

The document discusses the evolution and future of programmatic advertising as a vital component of the media landscape, with forecasts predicting it will comprise 80% of digital display by 2017. Key challenges include CMO adoption, fragmentation, and privacy concerns, while opportunities lie in market growth and advancements in mobile, video, and data-driven strategies. The integration of programmatic and native advertising is anticipated to drive industry evolution towards more standardized and regulated practices.